Pro Trader’s Secret: Why Journaling Gives You the Real Edge

In a market obsessed with indicators, automation, and strategy stacking, the most transformative tool often gets ignored: the journal. Not a notes app. Not a…

In a market obsessed with indicators, automation, and strategy stacking, the most transformative tool often gets ignored: the journal.

Not a notes app. Not a spreadsheet graveyard. A true performance engine that gives you a structured, honest, and repeatable view into your own decision-making under pressure.

This is the tool the best traders at FXIFY rely on. The journal is where pattern becomes the edge. Where randomness becomes refinement.

In the long run, it’s not just the market you’re mastering. It’s yourself.

The Hidden Problem Most Traders Never Solve

Ask any underperforming trader what they’re working on:

“I need a better entry.”

“I keep overtrading.”

“I’m trying a new system.”

What you won’t hear – but what’s almost always true – is:

“I don’t have a real feedback loop.”

Without a journal, traders risk repeating errors they don’t realise they’re making. Markets change, but without tracking your process, it’s hard to tell if your strategy adapts or just drifts.

A proper trading journal gives you visibility into more than just entries and exits. It lets you review why you took a trade, what you saw, how confident you were, and whether the outcome aligned with your reasoning—not just your result.

This helps separate good trades with bad outcomes from bad trades that got lucky. Over time, it reveals patterns in your execution that you can learn to refine.

What a High-Performance Trading Journal Should Capture

This is not about collecting data for the sake of it. It is about transforming your decisions into a consistent, repeatable edge.

For each trade, your journal should capture:

Pre-Trade (Clarity Phase)

| What is the market context? (Trend, key levels, volatility) |

| What is the setup? |

| What specific signal or change would make you cancel or exit this trade? |

| What’s your emotional state right now? |

| Confirmation checklist: What factors do you need in order to enter a trade? |

Live Trade (Execution Phase)

| Entry, stop, and target prices |

| Note the position size, the dollar amount you’re risking, and the potential reward expressed in R-multiples (i.e. how many times your risk you’re aiming to make). |

| Time of day/session |

| Screenshot of the entry |

| Was this trade according to plan? |

Post-Trade (Reflection Phase)

| How much did you gain or lose and what was the RR (reward-to-risk)? |

| What went right? |

| What went wrong? |

| What was the emotional tone during the trade? |

| Screenshot of exit |

Optional Add-On: Trader Performance Score (TPS)

If you want a sharper view of how you are performing as a decision-maker – not just your trades – this simple scoring system adds a layer of accountability to each entry.

For every trade, score yourself on three dimensions (0–2 points each):

| Rule Adherence |

| 2 = Fully followed your trading plan 1 = Minor deviation 0 = Broke your rules |

| Execution Quality |

| 2 = Entered/exited cleanly, with no hesitation or slippage 1 = Slight delay or suboptimal entry 0 = Poor execution, e.g. chasing or misclicks |

| Emotional Control |

| 2 = Stayed calm and objective 1 = Felt pressure but managed it 0 = Made emotional decisions (revenge trade, fear exit, etc.) |

| Max score per trade: 6 points |

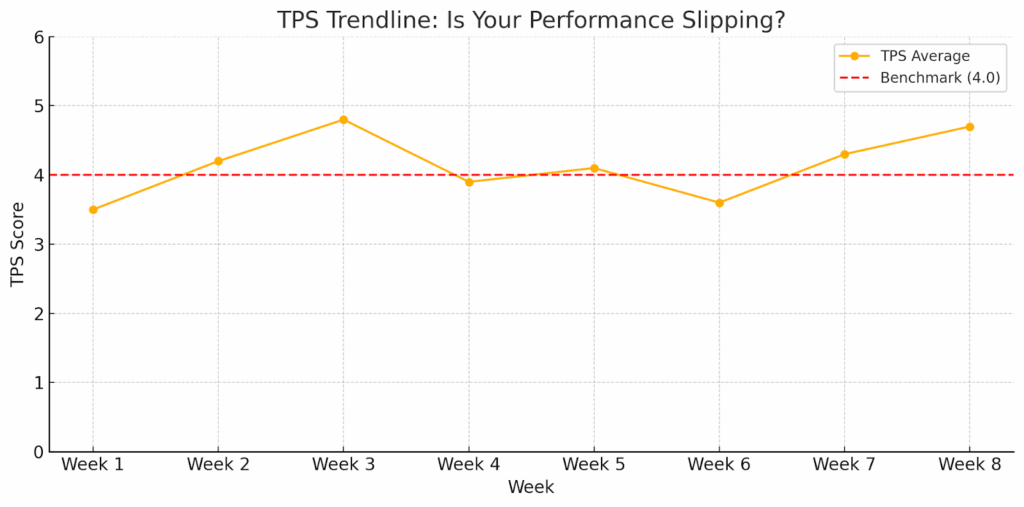

Track your weekly average TPS. If it drops below 4 consistently, it’s a signal to review your habits, stress levels, or trading environment.

Visualising your TPS trend helps identify performance drift before it costs you. Here’s how it might look in practice:

This isn’t about perfection. It’s about tracking personal precision – and improving what the market can’t measure for you.

Three Blind Spots That Kill Your Journaling’s Effectiveness

Even traders who journal can stay stuck. Why? Because they treat it like record-keeping, not performance tracking.

Here are the three biggest blind spots:

1. You’re Recording, Not Reviewing

Most traders log the trade and move on. But the edge isn’t in logging – it’s in looking back.

Block 30 minutes each week to ask:

| Which setups consistently perform? |

| What time of day do I trade best? |

| What emotional patterns are costing me money? |

Insight doesn’t come from more trades, but from honest reflection.

2. You’re Protecting Your Ego

You skip logging the trades that feel sloppy. You avoid reviewing the impulsive ones.

But those are the trades that teach the most.

The fastest improvement comes when you treat mistakes as data – not identity.

A losing trade can teach you. A hidden trade can’t.

3. You’re Not Closing the Loop

If the insights from your journal aren’t influencing your trading rules, what’s the point?

Every clear pattern you uncover should strengthen your playbook. Every recurring mistake should be engineered out of your system.

Journaling is only the first step. Integrating those insights into your strategy is where real growth happens.

Journaling reveals the truth. Integration turns it from theory to practice.

How FXIFY Traders Use Journaling as a Competitive Edge

At FXIFY, we’ve seen how the best traders operate—they rely on systems. And journaling is central to that edge. Here’s how they use it:

1. Spot What Works, Cut What Doesn’t

Top traders use their journal to identify which setups consistently perform. They track what times they trade best, which strategies deliver, and when to step back. It’s their roadmap to repeatable success.

2. Manage the Mind, Not Just the Market

You can’t control price action, but you can control your reactions. By logging emotions and stress triggers, our traders build routines that keep them calm and focused—even when markets get wild.

3. Build Confidence from Evidence

Conviction isn’t guesswork. It’s built by seeing a proven process work over hundreds of trades. Journals provide that feedback loop—turning experience into confidence you can scale.

Bottom Line: Self Reflection is Rewarded in Trading

New indicators and strategies come and go. But traders who excel focus inward. They refine execution, decision-making, and discipline—using the journal as a mirror and a sharpening tool.

At FXIFY, that’s how our traders separate from the crowd. They don’t just trade—they review, adapt, and improve. Every day.

Don’t just keep a journal. Build one that forges your strategy and edge–trade by trade, day after day.