FXIFY Trade of the Month: August Recap

Welcome back — August swung on Fed signals. Our traders rode the volatility with heavy volumes across majors and indices.

Top 5 Payouts of the Month

| Rank | Trader | Account (Plan) | Payout (USD) | Biggest Win (USD) |

|---|---|---|---|---|

| 1 | Anthony D. | $200K – One Phase – RAW | 11,944.13 | 2,583.00 |

| 2 | Tsvetomir V. | $75K – Instant Funding – RAW | 11,144.66 | 6,676.00 |

| 3 | Juan G. | $100K – Two Phase – RAW | 10,170.00 | 5,348.00 |

| 4 | Georgi G. | $200K – Two Phase – LIVE | 8,576.53 | 2,788.50 |

| 5 | Borislav T. | $200K – Two Phase – LIVE | 7,920.00 | 6,000.00 |

Note: One of August’s top payouts came from an Instant Funding account — a good fit for traders who want to skip evaluations and start trading funded capital right away.

Trade of the Month — Roland J. pockets $25,960 on NZDUSD (Short)

| $25,960 | NZDUSD | 14 HRS |

| Gain Realised | Pair Traded | Holding Time |

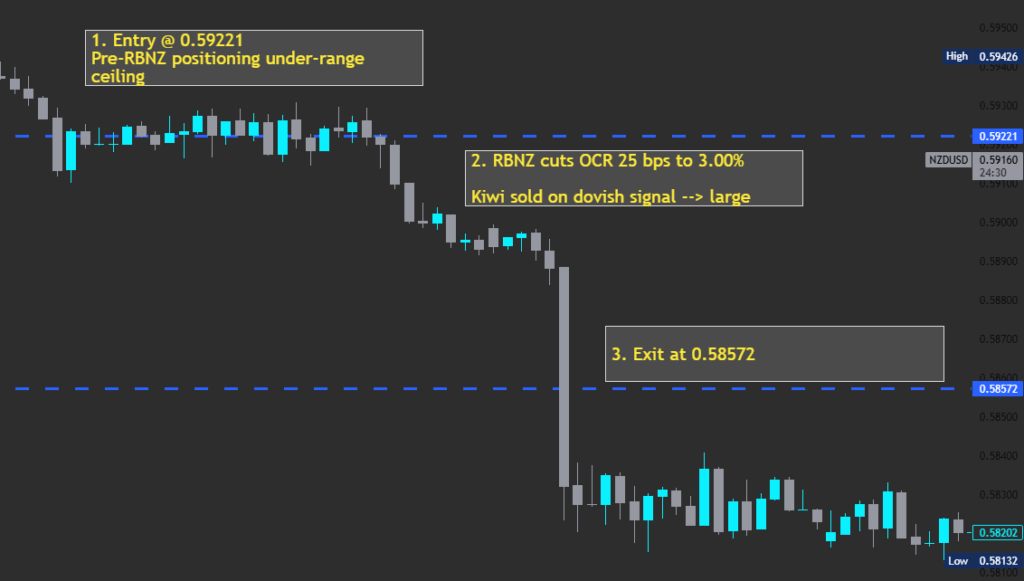

Setup: Event-driven short — central-bank window; pre-event range failing near 0.592x.

Entry: Short 0.59221 as price stalled beneath the prior-day range top; plan to hold through the announcement and into first support.

Exit: Take-profit 0.58572 at the first liquidity shelf after the impulse drop.

Risk: Invalidation = 15-min close back above the range top; stop sized by ATR(14); partial size pre-event, add on post-event retest only if structure holds.

Move of the Month: NASDAQ100

| Start Date | August 22, 2025 |

| End Date | August 29, 2025 |

| Starting Price | 21,550 |

| Ending Price | 20,800 |

| Point Change | -750 points |

| Percentage Change | -3.48% |

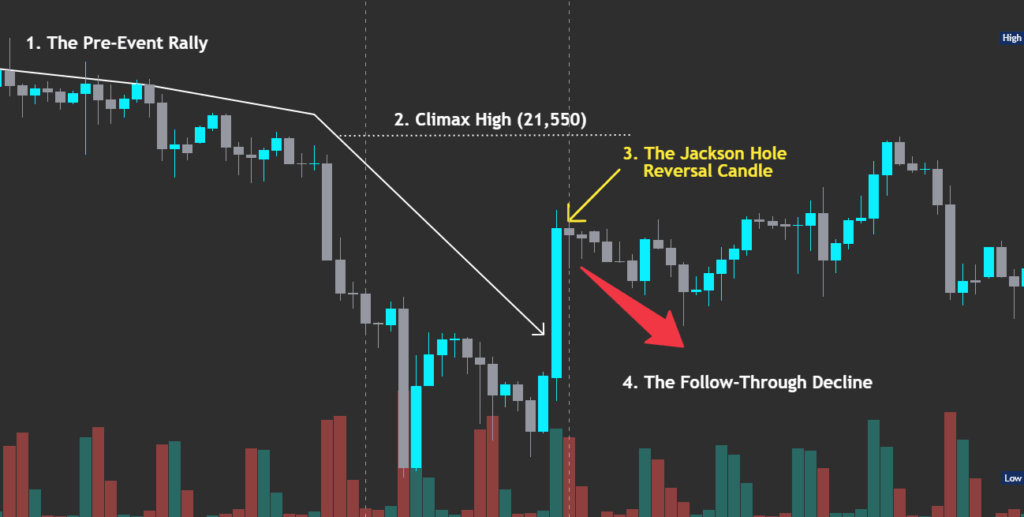

August saw the NASDAQ100 rally, driven by anticipated Fed rate cuts, peaking before the Jackson Hole symposium. However, Powell’s hawkish stance shocked markets, leading to a high-volume reversal at the “Climax High” and a “Jackson Hole Reversal Candle” .

Patient traders would have shorted after this confirmed reversal. This was followed by a week-long “Follow-Through Decline” , demonstrating the power of event-driven volatility and market reactions.

Top Traded Assets of August

| Symbol | Total Trade Volume (USD) | % Change M/M |

|---|---|---|

| XAUUSD | $35,611,489,747 | +4.59% |

| EURUSD | $8,303,561,754 | +2.32% |

| NASDAQ100 | $7,498,672,492 | –0.86% |

| DJ30 | $4,058,096,580 | -3.24% |

| GBPUSD | $3,291,071,025 | -2.26% |

GOLD

Gold’s August movements were driven by Fed expectations. It initially fell against a stronger dollar before rebounding as the dollar softened. This paired with 2.9% CPI, hinting at careful rate cuts. Intraday traders saw clear London breakouts into New York pullbacks, offering many breakout-and-fade chances with tight invalidation points.

EURUSD

EURUSD reflected a policy tug-of-war. Euro-area inflation at 2.1% kept the ECB on “hold and watch,” while US CPI at 2.9% and Jackson Hole comments suggested cuts “if needed.” This led to two-way flows: euro strength on softer USD days and quick reversals when US data firmed. Tactical traders used session structure, yielding multiple rotations.

NASDAQ100

Tech dominated August’s macro story—rates expectations vs. growth multiples. Nasdaq hit new records on cut hopes before swinging as desks squared risk. Intraday traders found a rich mix: opening momentum, midday VWAP reversion, and late-session squeezes. If-then plans were rewarded, and liquidity was ample with clear structure.

The Next Top Trader Could Be You!

This month, Roland J. showed what calm execution looks like—banking $25,960 on NZDUSD (short).

He waited for the post-news bounce to fail, then took the second move: a fade back toward pre-news balance with risk capped above the failure. That’s the habit we champion—map the players, plan the if-then, act when the market confirms.

Building on recent winners in the FXIFY™ community, Roland’s trade sets a clean benchmark for September. Every month brings fresh catalysts and fresh chances for disciplined traders. If you’re ready to level up, let this be your nudge: keep risk inside your daily limits, trade your plan, and let the edge compound.

| Account Type: | $400K Two-Phase |

|---|---|

| Top Asset | NZDUSD |

| Lot Size: | 40 |

| Biggest Win | $25,960 |

| Trading Time: | Intraday |