How to Trade Forex for Beginners: Market Basics and Strategies

Learn the fundamentals of Forex trading, including how the market works, understanding currency pairs like EUR/USD, the benefits of high liquidity and accessibility, and the risks involved, such as market volatility and leverage. Discover basic trading strategies like support/resistance, trendline pullbacks, and moving average crossovers to start your trading journey.

Forex trading for beginners might appear daunting, but with a few key concepts learned, anyone can become a trader. The forex market presents many opportunities as it is the world’s largest financial market, where national currencies are traded globally by retail traders and institutions. Whether you plan to trade part-time or pursue it as a career, understanding forex basics is crucial.

This guide will explain key concepts, market operations, and basic trading strategies, giving you a solid foundation for trading forex.

What is Forex Trading?

In simple terms, Forex trading refers to the act of buying and selling foreign currencies to make a profit.

Understanding Currency Pairs

Currencies are always traded in pairs, such as EUR/USD. This currency pair shows the exchange rate between the Euro (EUR) and the US Dollar (USD), indicating how many US dollars are needed to buy one Euro.

Capitalising on Fluctuating Exchange Rates

Exchange rates are always fluctuating, which provides many opportunities for forex traders to capitalise on these currency price movements. For example, if you think the Euro will go up in value compared to the dollar, you’d buy EUR/USD. If the Euro does rise, you make a profit. If you think the Euro will fall, you’d sell EUR/USD. Understanding how one currency relates to another is fundamental to forex trading.

Market Dynamics and Trading Opportunities

Because the foreign exchange market operates continuously across various time zones, it’s a dynamic and liquid environment. Major currency pairs like EUR/USD and USD/JPY are among the most actively traded currencies, providing many trading opportunities.

How Does the Forex Market Work?

Global Market Overview

The decentralised forex market operates 24 hours a day, five days a week, with massive daily trading volume exceeding $7.5 trillion (as of 2022). Trading occurs across four major sessions: Sydney, London, New York, and Tokyo, each contributing to the market’s around-the-clock activity.

Factors Influencing Currency Prices

The key factors influencing currency prices include economic data, geopolitics, and central bank policies, creating trading opportunities for market participants. Depending on the traders’ bias, they may either enter a buy (long) position or sell (short) position to speculate on these price movements.

Market Operating Hours

The FX Market typically opens at 5 p.m. EST on Sunday with the Sydney session and operates continuously until 5 p.m. EST on Friday when the New York session closes. However, the exact opening and closing times can vary depending on daylight saving time adjustments, regional holidays, and individual broker trading hours.

Regional Demand Dynamics

Regional demand plays a role in some pairs’ trading activity. For example, the USD/JPY pair typically sees significant price movements during the Tokyo session, reflecting high trading activity in the Japanese yen.

Benefits of Trading Forex

Accessible Market

The forex market operates 24 hours a day, five days a week, across major sessions like Sydney, London, New York, and Tokyo, allowing traders to enter and exit positions at any time.

With micro-lots and leverage, traders can start with as little as $10, though profits and losses scale with capital.

Alternatively, funded accounts offer access to larger capital with minimal upfront cost, allowing traders to manage a trading account with structured risk management. For example, FXIFY™ provides evaluations starting at $39, enabling traders to manage a $5,000 account without risking personal funds while following structured risk management.

High Liquidity

Forex is the world’s most liquid financial market, with over $7.5 trillion traded daily. It allows traders to easily enter and exit positions. This liquidity is largely driven by the interbank market, where banks and financial institutions continuously exchange large sums of currency. High liquidity ensures there is almost always a buyer or seller on the other side of a trade.

Transparency

The forex market is transparent, with real-time access to economic data and market information. Compared to stock markets, the risk of insider trading is minimal, creating a fairer trading environment.

Considerations When Trading Forex

Trading forex involves both opportunities and challenges. Risk management and an awareness of market volatility are essential to long-term success. Professional traders use strict risk management strategies, often limiting their risk to 1-2% of trading capital per trade.

Trading Can Be Risky

Forex trading is risky, especially when using leverage. For example, 30:1 leverage means a $100 account controls $3,000 in forex trading, amplifying both gains and losses. Without proper risk management, traders can quickly lose their entire balance. It is crucial to practise on a demo account first to develop these skills.

Prop firms like FXIFY help traders manage risk by providing funded accounts with drawdown limits and risk rules. Instead of risking their own funds, traders can access up to $400,000 with a FXIFY funded account, sharing the earnings while adhering to our trading rules.

Market Volatility

Exchange rates can be very volatile, reacting to economic data, central bank policies, and geopolitical events. For forex trading, the most important economic data to watch are interest rates.

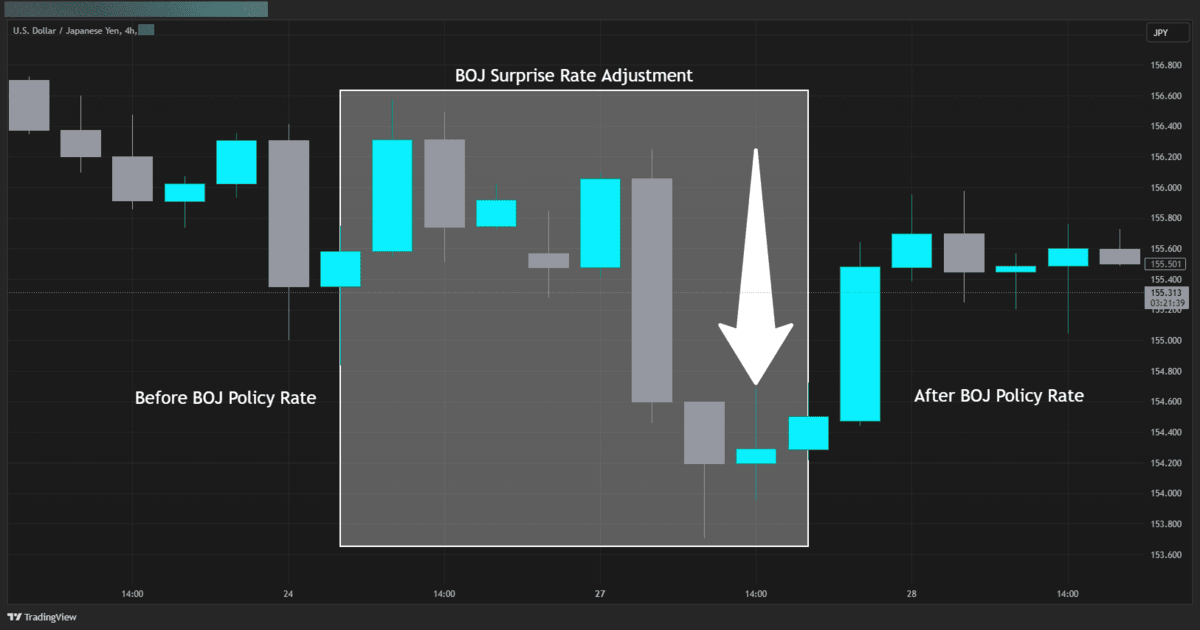

Bank interest rate decisions can cause major price swings in currency pairs, especially if the decision comes as a surprise. For example, when the Bank of Japan announced a policy rate adjustment on January 24, 2025, the USD/JPY pair experienced significant volatility. It initially traded near 156.50 before dropping sharply to below 154.00, as shown in the chart below.

Traders must adapt to changing market conditions by using economic calendars to anticipate news events and employing risk management strategies like stop-loss orders and hedging to minimise losses.

While the forex market is dynamic and liquid, trading involves significant risk. Success requires understanding market fundamentals and implementing effective risk management. Be aware of the potential for substantial losses and be prepared before trading.

Sign up to FXIFY™ and access these tools for free today

Forex Trading Strategies for Beginners

Basic forex trading strategies focus on simplicity and consistency, allowing beginners to build confidence in their trading plan. Technical analysis plays a key role in crafting a trading strategy.

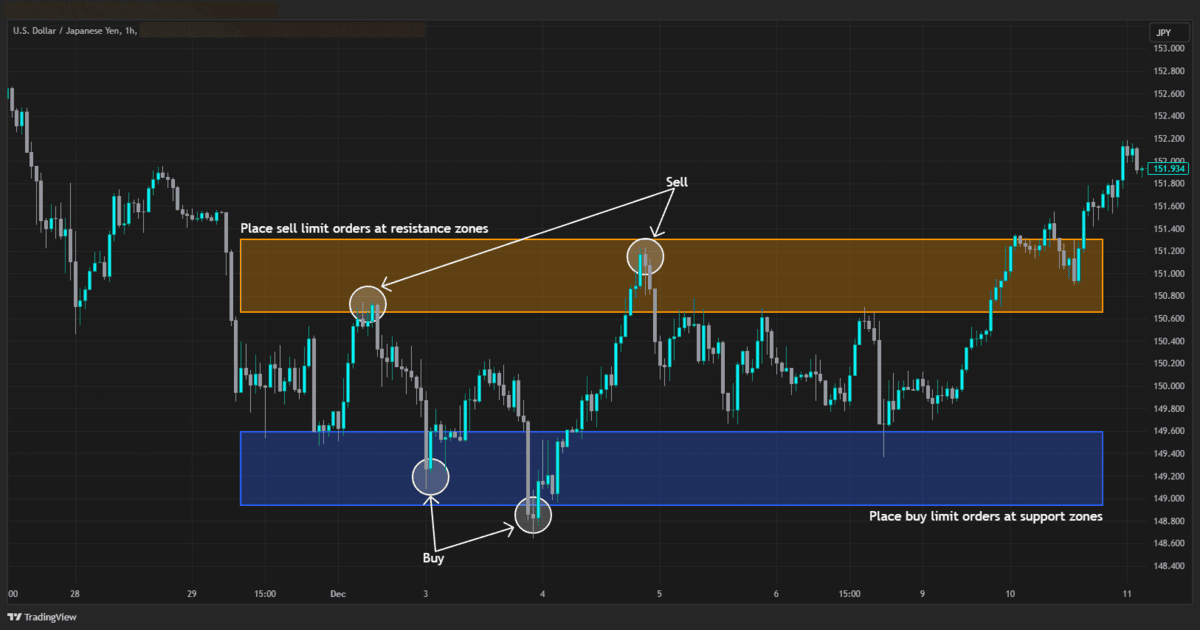

Support and Resistance Trading

Support and resistance are foundational concepts in technical analysis. Support is the price level where buying pressure tends to emerge, preventing the price from falling further. On the other hand, resistance is the level where selling pressure typically overcomes buying interest, causing the price to struggle to rise above it. By identifying these key levels, traders can strategically place orders near these zones, aiming to capitalise on the predictable behaviour of currency pair price movements.

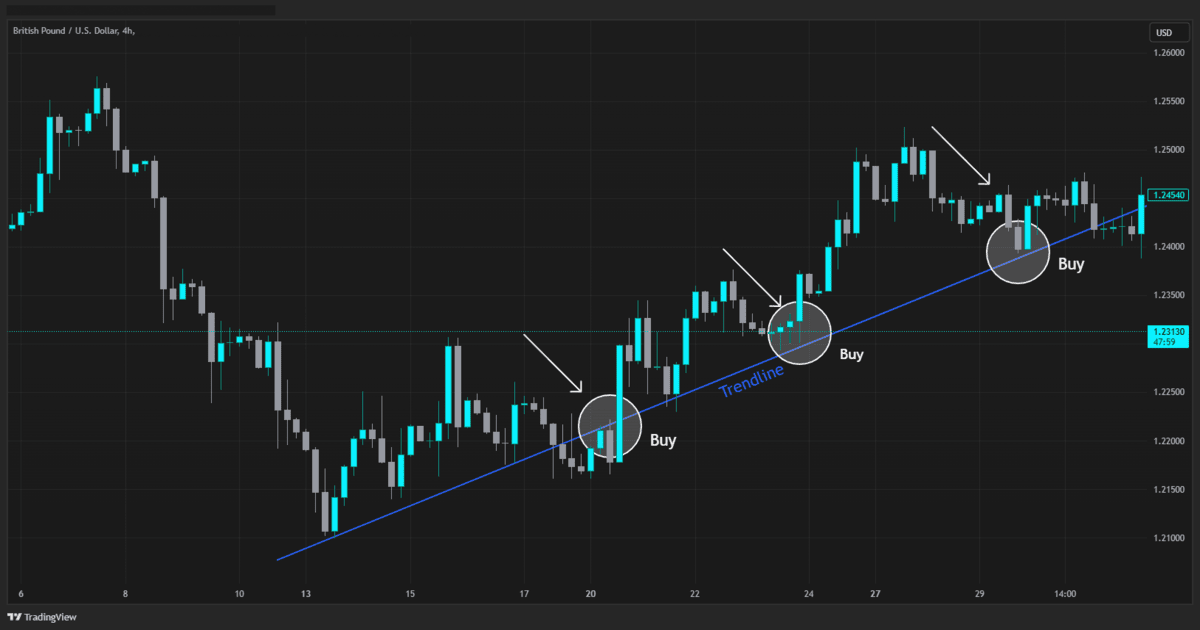

Trendline Pullback Strategy

This strategy focuses on identifying high-probability opportunities by entering trades during pullbacks within a clear trend. This approach aims to maximise potential gains while minimising risk.

For this strategy to work effectively, a clear trend must be present in the chart. In an uptrend, prices consistently form higher highs and higher lows, allowing traders to look for pullbacks before entering buy positions. Conversely, in a downtrend, prices make lower lows and lower highs, and traders may wait for an upward pullback before initiating sell positions. Drawing trendlines helps highlight these trends and retracement levels, enabling traders to determine optimal entry and exit points while aligning their trades with the prevailing market direction.

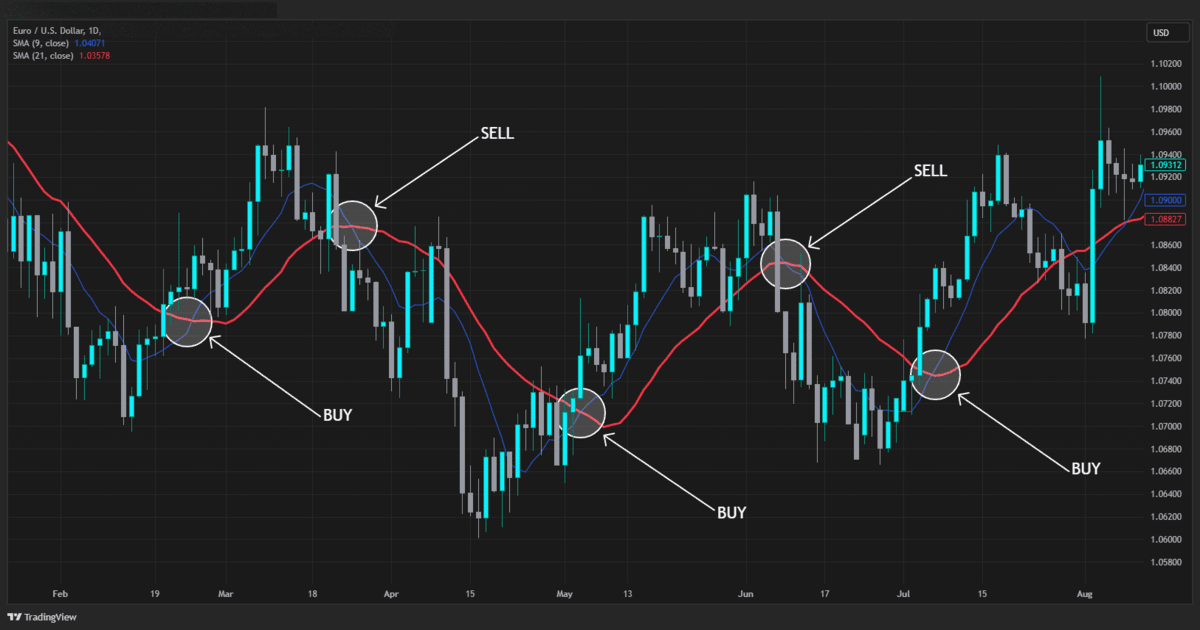

Moving Average Crossover

The moving average (MA) crossover strategy focuses on the interaction between two or more moving averages to signal potential trend changes. This involves using a shorter MA and a longer MA.

A Golden Cross occurs when a short-term moving average, such as the 9-day MA crosses above a long-term moving average, like the 21-day MA, which is generally interpreted as a bullish signal indicating rising momentum.

In contrast, a Death Cross happens when the short-term moving average crosses below the long-term moving average, often seen as a bearish signal suggesting that downward momentum is increasing. Monitoring these crossovers on pairs like EUR/USD can guide traders in making timely decisions in the forex market.

Key Forex Terms to Be Aware Of

Understanding forex basics, including currency pairs and pips, is essential for every trader’s success.

| Term | Definition |

| Pip | The smallest price movement in a currency pair. |

| Margin | The collateral required to open a leveraged trade. |

| Lot | Standardised trade size in forex. |

| Spread | Difference between bid and ask prices. |

| Leverage | Amplifies buying power but increases risk. |

| Scalping | Quick trades aiming for small profits. |

| Day Trading | Trading that opens and closes within one day. |

| Swing Trading | Holding trades for days to weeks. |

| Position Trading | Long-term trading where a position is held for months or years. |

FAQs: Your Forex Trading Questions Answered

Is $100 enough to start forex trading?

Yes, starting forex trading with $100 is possible by focusing on micro-lots and strict risk management. Alternatively, you can attempt a prop trading challenge for as low as $39, granting you a $5,000 funded account upon passing the evaluation.

What is the 5-3-1 rule?

The 5-3-1 rule emphasises mastering five currency pairs, three trading strategies, and one trading session.

Which currency pairs are best for beginners?

The best currency pairs for beginners depend on strategy, timezone, and trading plan. However, major pairs like EUR/USD and USD/JPY are often recommended due to their liquidity.