FXIFY Trade of the Month: May Recap

FXIFY’s May recap: $104K+ in payouts, top trade nets $46K on CHN50, and NAS100 shows a textbook Bollinger + RSI reversal. Are you next to top the charts?

As May wraps up, we’re proud to reflect on another month of strong performance and growth across the FXIFY trading community. Our traders showcased exceptional skill and strategy, navigating volatile markets with confidence.

XAUUSD remained the most traded asset, while CHN50U.x, USTEC.X, EURUSD.r, and GBPCAD.r led the way in gains—highlighting a wide range of successful strategies.

May also delivered real rewards. Our top traders earned over $104,941.39 in combined payouts, a testament to the dedication, opportunity, and support that defines the FXIFY experience.

Top 5 Payouts of the Month

| Rank | Trader | Account Size | Payout Amount | Biggest Win |

| 1 | Christian S. | $200K – Two Phase – RAW | $32,800.00 | $7,590.00 |

| 2 | Jarret J. | $200K – Two Phase – RAW | $30,001.69 | $18,163.00 |

| 3 | Ahtesham A. | $200K – Two Phase – RAW | $22,884.81 | $10,031.50 |

| 4 | Mubashir K. | $100K – Two Phase – RAW | $9,648.78 | $6,315.00 |

| 5 | Bilgudei K. | $100K – Two Phase – RAW | $9,606.11 | $3,977.60 |

Trade of the Month: A Classic Resistance Play Nets Trader $46,922

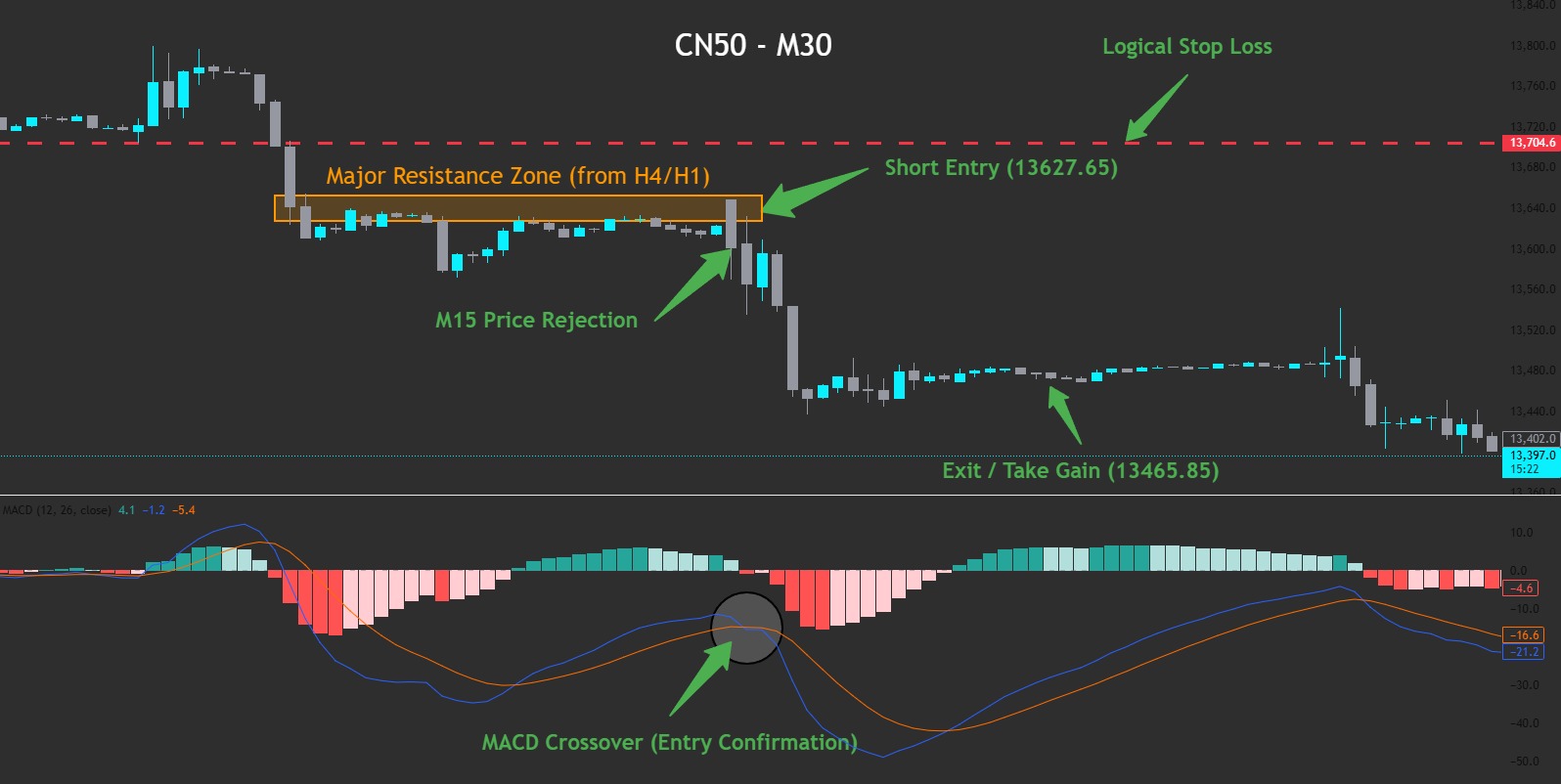

May’s top trade is a masterclass in technical precision, with Juan F. securing a $46,922 realised gain on the China A50 Index (CHN50). His trade perfectly illustrates a patient, top-down approach: likely identifying a key level on a high timeframe and then using a lower timeframe for a flawless entry and a disciplined exit.

| $46,922 GAIN REALISED | CHN50U.x PAIR TRADED | 11 HRS, 14 MINS HOLDING TIME |

|---|

Juan F. demonstrated exceptional patience by first identifying a major resistance zone on the 4-hour chart. Instead of trading in the ‘middle of the noise’, he appears to have waited for the price to rally up into this key zone of interest during the Asian session.

Switching to the 15-minute chart for execution, he would have watched as price action showed signs of faltering. A key signal was likely the clear price rejection just before 04:00 UTC+3, where the index failed to hold its highs. For final confirmation,

On the MACD indicator, a bearish crossover flashed. This confluence of (1) major resistance, (2) price rejection, and (3) a bearish momentum signal provided a high probability trigger for a short position.

- Entry: The entry at 13627.65 was executed after the price was rejected at a major H4 resistance zone. The trigger was likely confirmed on the M15 chart by a MACD bearish crossover at 04:00 UTC, signalling a definitive shift in momentum.

- Exit: The exit at 13465.85 appears to have been a discretionary decision based on prudent risk management. After a significant, high-momentum downward move, the MACD indicator showed that bearish momentum was fading. Rather than risk giving back gains to a potential reversal, Juan F. likely made the executive decision to secure his substantial realised gain.

Why This Trade Stands Out

This trade suggests a textbook example of a professional trading process that combines patience with precision across multiple timeframes.

Top-Down Analysis: The trader likely used higher timeframes (H4/H1) to identify a high-probability zone to trade from, giving them a clear strategic bias.

Pinpoint Execution: The execution points to the use of a lower timeframe (M15) to identify the exact moment of weakness through a combination of price action and indicator confirmation.

Disciplined Gain-Taking: Critically, Juan did not get greedy — the hallmark of a seasoned professional. They likely exited the short position based on weakening bearish momentum (consolidation at support, and MACD histogram flipping green).

Move of the Month: NAS100’s Textbook Bollinger + RSI Reversal

In May, NAS100 gave traders a classic textbook opportunity — and those who were sharp with their RSI and Bollinger Band playbooks capitalised in style. The index surged into overbought territory on May 29th, printing above the upper Bollinger Band while RSI clocked over 70 — flashing a prime short signal for reversal traders.

The trade set up beautifully: after entering just as the RSI tipped into overbought and the price breached the upper band, sellers took control. Over the next 48 hours, the price unwound in dramatic fashion. The exit confirmation came swiftly as price dipped below the lower Bollinger Band with RSI diving under 30 — locking in what could only be described as one of the cleanest technical plays of the month.

This wasn’t just a pretty chart — it was a textbook case of timing, patience, and trusting the signals. With zero ambiguity in the indicators, it was a dream short for traders to tune in to technical flow.

NAS100 June Price Action Overview

| Start Date: | 29th May 2025 |

| End Date: | 31st May 2025 |

| Starting Price: | 21,870 |

| Ending Price: | 21,050 |

| Pip Change: | 8,200 |

| Percentage Change: | 3.75% |

Top Traded Assets of May

Our traders demonstrated incredible engagement across various markets in May. It’s no surprise that certain instruments captivated their attention, driven by compelling opportunities. Here’s a look at the assets that saw the most significant trading volume within the FXIFY community last month:

| Symbol | Total Trade Volume ($) | M/M Price Change (%) |

| XAUUSD | $46,135,144,279.28 | 0.08 |

| EURUSD | $10,616,106,321.61 | 0.16 |

| US30 | $6,679,703,070.95 | 3.72 |

🪙 XAUUSD — Gold: Euphoria Hits a Temporary Peak

Gold’s steady rally gave traders room to lean into trend setups—especially after key breakout levels cleared early in the month. But into June, the pace is slowing and yields are ticking higher, so gold bulls will need to be selective. Still a solid volatility play for disciplined risk-takers.

💶 EURUSD — Euro: Crosswinds Ahead

EURUSD stayed on the radar as the ECB softened its tone and U.S. resilience kept the pair range-bound. FXIFY traders who managed the chop with tactical bias changes found solid opportunities. Two-way setups remain in play.

💻 USTEC — Nasdaq: AI Still Driving Demands

NASDAQ lit up the scoreboard in May, fueled by AI hype and clean tech momentum. NVIDIA’s positive earnings in late May kept the rally humming into June. But with valuations stretched, this rally’s starting to feel overheated — stay ready for surprises and be selective with your trades in June.

🏆 The Next Top Trader Could Be You!

Seeing these incredible results is inspiring, and it all starts with a single step. Every top trader, including May’s champions, began with a challenge. Take Christian S., our #1 trader this month—he turned his strategy into a $32,800 payout on his $200K account.

Think it’s out of reach? Think again. Here’s a look at how a top-tier trade could be constructed.

| Account Type: | $200K Two-Phase |

| Top Asset | XAUUSD (Gold) |

| Lot Size: | 5-10 lots |

| Biggest Win | $7,590.00 |

| Trading Time: | Intraday |

The opportunity is waiting. With FXIFY, you get access to the capital, tools, and flexibility you need to perform at your best. All that’s missing is you.