Month Forward: August 2025 Key Events Watchlist

August tends to have lower trading activity, but don’t expect a dull month. From U.S. inflation data to global central bank commentary and the high-stakes Jackson Hole Symposium, here’s what traders need to know to stay ahead.

August may be a quieter month in terms of volume, but it’s rarely quiet when it comes to market impact. From high-stakes Fed commentary to UK inflation data and another round of big tech earnings, the coming weeks are stacked with catalysts that could shape positioning into Q4.

As August unfolds, traders face a familiar seasonal pattern: thinner liquidity, but no shortage of volatility drivers. Key CPI and PPI reports out of the U.S. are expected to shape the Federal Reserve’s next steps, while the highly anticipated Jackson Hole Symposium could provide a clearer signal on monetary policy direction into Q4.

Meanwhile, the UK labour market and CPI data will continue to shape expectations for the Bank of England, while eurozone PMI figures and inflation updates are likely to keep EUR pairs reactive. In the background, ongoing geopolitical developments and commodity price movements add further complexity to sentiment and positioning.

August 2025 Economic Calendar

Taking a look at our FXIFY™ economic calendar, here are our top picks for economic news to look out for in August.

| Date | Asset | Events |

| Week One: August 4 – 10 | CHF USD NZD GBP CAD | CPI m/m ISM Services PMI Unemployment Rate BOE Monetary Policy Report Unemployment Rate |

| Week Two: August 11 – 17 | AUD USD AUD USD USD | RBA Monetary Policy Statement CPI m/m, y/y Unemployment Rate PPI m/m Unemployment Claims |

| Week Three: August 18 – 24 | CAD NZD GBP USD | CPI m/m RBNZ Monetary Policy Statement CPI y/y Unemployment Claims |

| Week Four: August 25 – 31 | EUR GBP USD | French Flash Manufacturing PMI Flash Manufacturing PMI Flash Manufacturing PMI |

| Week Five: July 27 – 31 | AUD USD CAD USD | CPI y/y Unemployment Claims GDP m/m Core PCE Price Index m/m |

August brings a packed schedule of important economic events. Early in the month, traders will be watching the BOE Monetary Policy Report and U.S. inflation data — both key to shaping interest rate expectations.

The second week features the RBA rate decision and U.S. CPI, which will be closely watched for signs of progress on inflation. Labour data from the UK and CPI from New Zealand and Canada in week three add to the list of impactful releases.

By the end of the month, attention will shift to the Jackson Hole Symposium, where Fed Chair Powell may signal the direction of policy going into the final quarter of the year. The month wraps with the Core PCE release — a key measure for the Fed — and GDP figures from Canada.

Traders should stay alert to these events, as many could cause sharp moves in major pairs. Remember: news trading is restricted 5 minutes before and after major releases on FXIFY accounts.

1. GBP – BOE Monetary Policy Report (Aug 7)

The Bank of England’s Monetary Policy Report is one of the most important GBP events of the month. Alongside updated projections, this report typically sets the tone for the Bank’s forward guidance.

With inflation still elevated and the labour market tight, traders will be looking for clues on future interest rate direction. A hawkish tone could lift GBP pairs, while any signs of policy easing could spark downside.

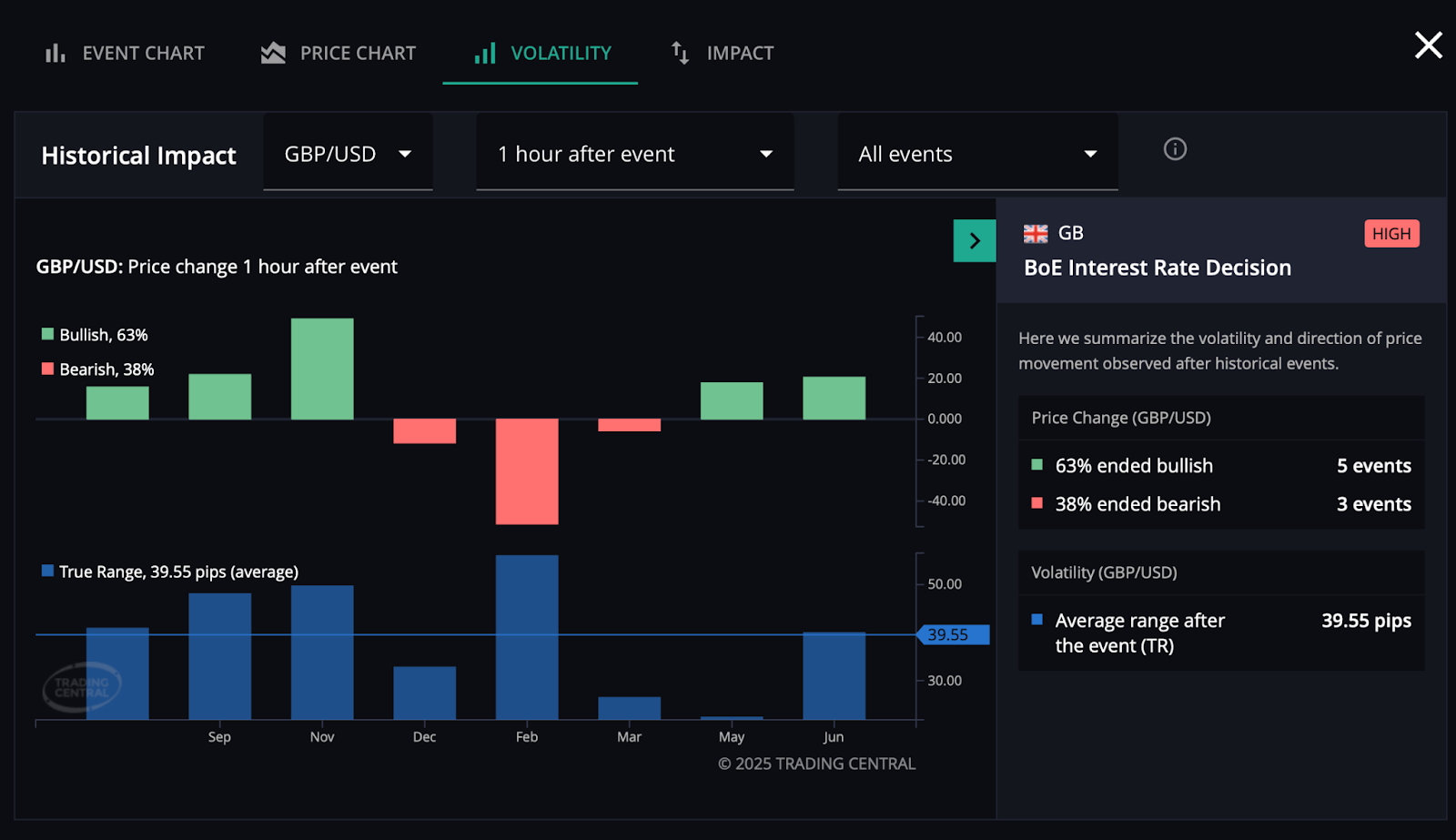

According to the Trading Central Economic Calendar (available in your FXIFY dashboard), the average one-hour move in GBP/USD following recent BoE interest rate decisions is 39.55 pips.

The historical reaction has been 63% bullish, suggesting a slight upside bias — but volatility remains high around this event.

2. USD – CPI m/m (Aug 12)

The monthly U.S. Consumer Price Index release remains one of the most important events for USD pairs. CPI surprises regularly impact Fed rate expectations, especially with inflation still running above target.

CPI reveals inflation trends in consumer goods and shapes expectations for U.S. rate cuts. But after the Fed’s surprisingly hawkish tone in July, the expectations for a rate cut in September has plummeted significantly.

This makes August’s CPI a key event to watch – in case of surprises.

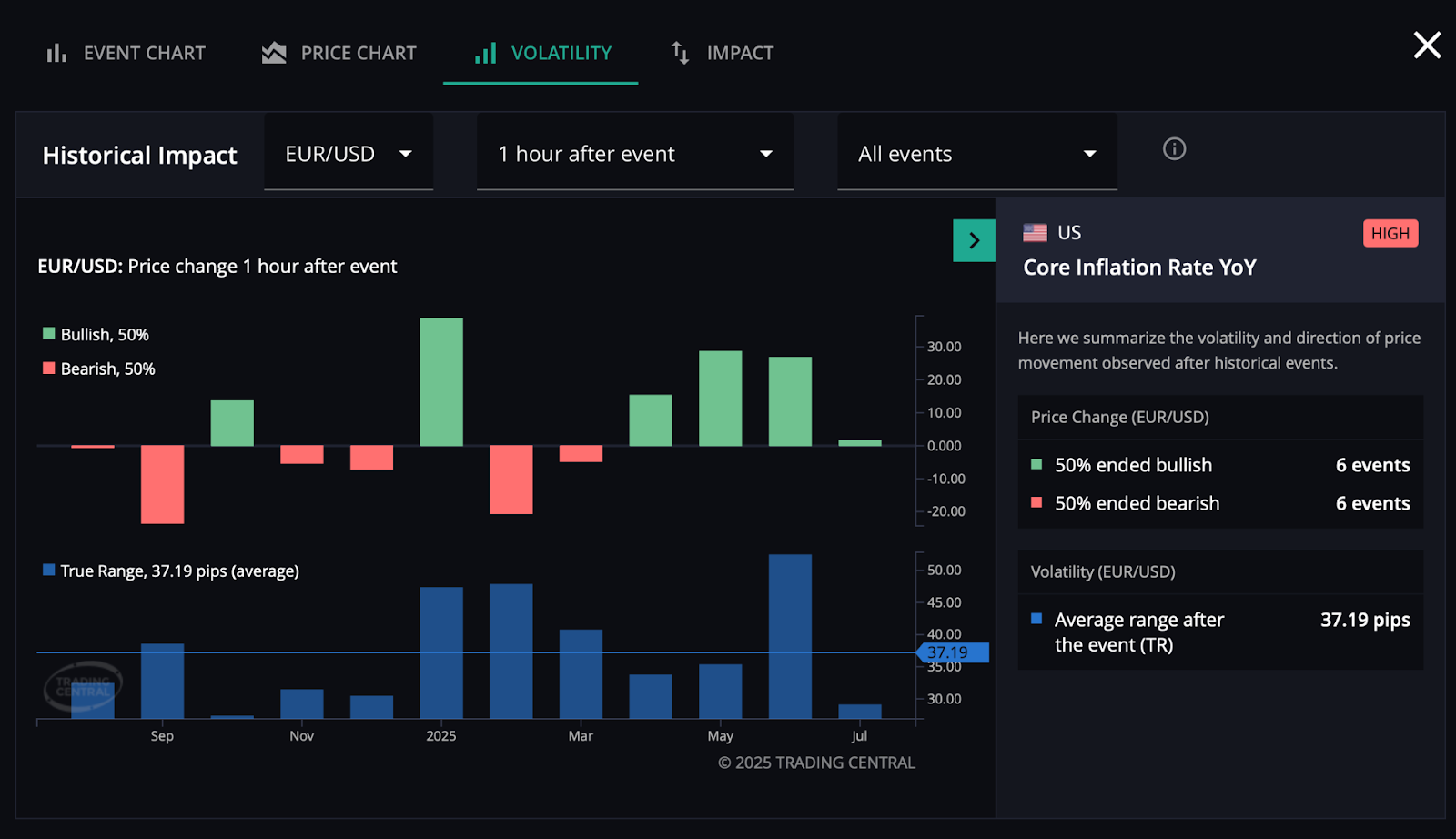

According to Trading Central data, the average one-hour move in EUR/USD following recent U.S. Core CPI releases is 37.19 pips. Historical data shows a 50/50 split between bullish and bearish outcomes, meaning direction is highly dependent on the surprise factor. With markets sensitive to even slight deviations, expect elevated volatility around this event.

3. USD – Core PCE Price Index (Aug 29)

The Fed’s preferred inflation gauge, the Core PCE Price Index, comes just days after the Jackson Hole Symposium and could reinforce or challenge any tone set by Powell’s remarks.

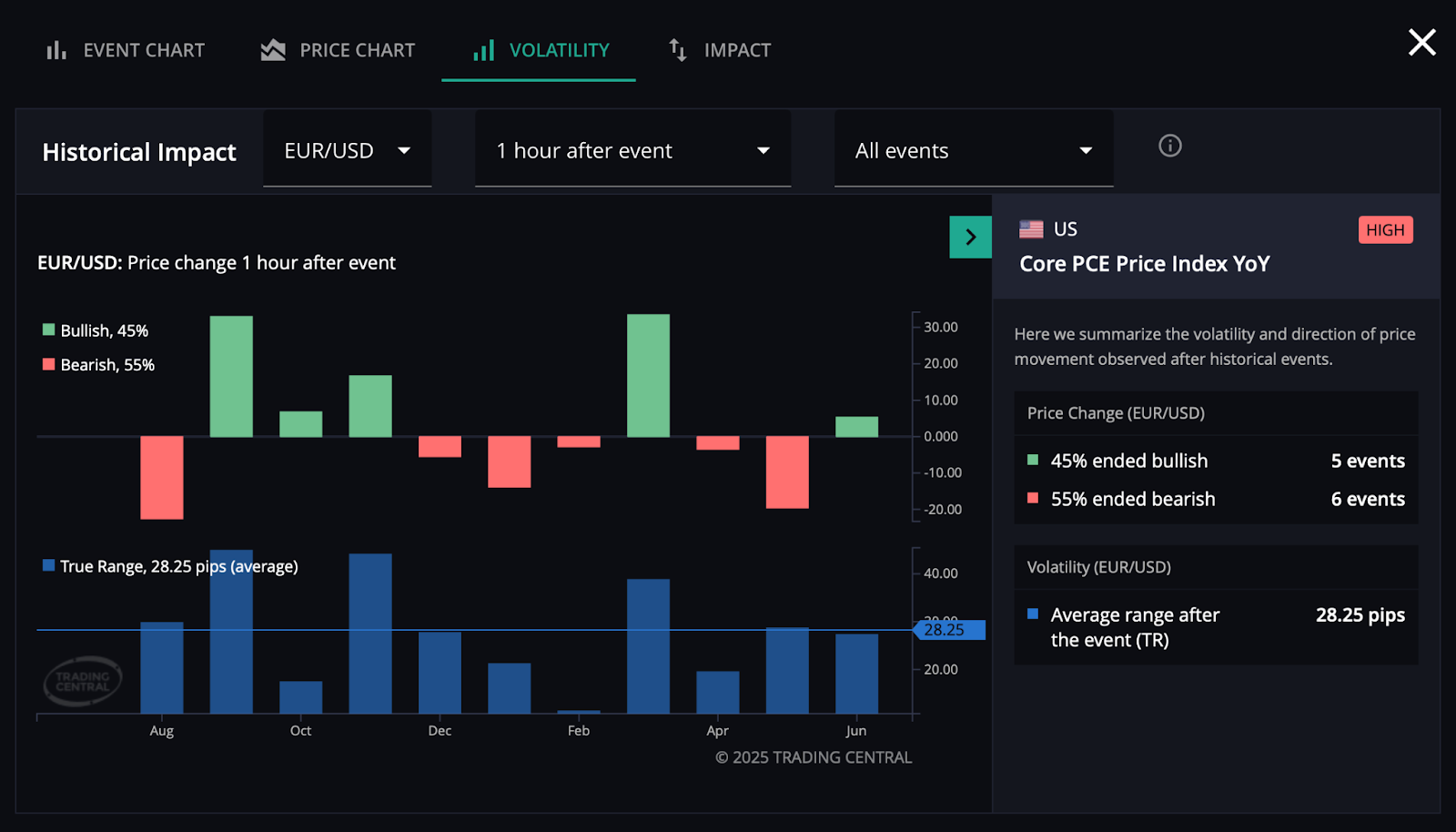

Trading Central data shows that EUR/USD has moved an average of 28.25 pips one hour after this release. Historically, 55% of reactions were bearish and 45% bullish, indicating a slight downside skew. While the average range is lower than CPI, this event remains pivotal for Fed-watchers — especially if inflation shows signs of re-accelerating.

August 2025 Earnings Calendar

After a strong earnings wave in July from Tesla, Netflix, and Apple, the focus now shifts to names like NVIDIA and Amazon — which are expected to be key players in the S&P 500 and Nasdaq. These companies’ results can affect overall market direction, especially in tech.

With inflation still high and economic growth slowing in some areas, markets will react strongly to any surprises in these earnings reports.

📅 Earnings Calendar – August 2025

| Date | Company | Ticker | Time | Sector |

| Aug 1 | Apple Inc. | AAPL | After Market Close | Technology |

| Aug 1 | Amazon.com Inc. | AMZN | After Market Close | Consumer/Tech |

| Aug 14 | Alibaba Group | BABA | Pre-Market | Consumer Tech / China |

| Aug 21 | NVIDIA Corp. | NVDA | After Market Close | Semiconductors / AI |

| Aug 29 | Dell Technologies | DELL | After Market Close | Tech / Hardware |

These earnings also give traders a closer look at how major businesses are handling challenges like rising costs, slowing demand, and global uncertainty. Strong results could boost confidence in the economy, while weak numbers may raise concerns about future growth.

For newer traders, these reports are a good opportunity to learn how earnings season can affect stock indices, tech sentiment, and even currencies tied to risk appetite.

Key Story: Bitcoin & DXY

This month’s key story focuses on the US Dollar and Bitcoin — two high-volatility assets sitting at pivotal levels. Bitcoin is consolidating at all-time highs, while DXY is breaking out of a multi-month downtrend. With August stacked with key macro data, both markets could provide early signals for broader risk sentiment heading into Q4.

Bitcoin (BTC/USD) After a breakout above multi-month resistance, Bitcoin is now consolidating just below the all-time high region between ~$120,150 and ~$116,300. Price is holding in a tight range, following a strong impulsive move to the upside.

Should this range break, we could see a move of about $4,000 (size of the range). A break higher could see us visit psychological levels near $125K, however, a confirmed breakdown could shift the short-term narrative and invite a pullback towards $112K.

US Dollar Index (DXY) broke above a clean descending trendline in late July and has since retested the breakout zone — a textbook break-and-retest structure now acting as support. This price action suggests momentum may be shifting in favour of the bulls, especially with price now trading above prior structure resistance.

With multiple high-impact US events on the calendar — including CPI (Aug 12), Jackson Hole (Aug 21–23), and Core PCE (Aug 29) — the dollar’s direction could hinge on how these releases shape expectations for future Fed policy.

A stronger dollar scenario could unfold if inflation data surprises to the upside or if Powell maintains a hawkish tone at Jackson Hole. On the other hand, signs of slowing inflation or dovish signals could stall the current breakout. Traders should monitor how DXY reacts around the previous resistance-turned-support zone heading into these key events.

This USD price action sits at the centre of this month’s broader market drivers — from inflation data to tech earnings and geopolitical risks. DXY direction could influence everything from EUR/USD and GBP/USD to gold and equity indices. With macro catalysts stacked toward the end of the month, August could set the tone for Q4 positioning.

Wrapping Up August’s Outlook

August is shaping up to be a critical month for traders. With U.S. inflation updates, Fed commentary from Jackson Hole, and key earnings reports from tech leaders, market momentum could shift quickly. The recent DXY breakout and Bitcoin’s price action near all-time highs highlight how structure and sentiment are aligning with major macro events.

Whether you’re trading indices, FX, crypto, or commodities, staying updated on the evolving narrative will be key to staying prepared. As always, approach high-impact weeks with a plan. With your FXIFY account, be sure to track these key events using the Economic Calendar. Trading Central’s Featured Ideas and Technical Views can support trade planning and identify setups around news catalysts.