Month Forward: July 2025 Key Events Watchlist

As summer heats up, July brings pivotal inflation data, central bank commentary, and major tech earnings. Here are the catalysts traders are watching, and what they mean for market momentum.

As July begins, traders are shifting their focus to policy pivots, Q2 earnings, and global inflation. With central banks signalling diverging paths and tech giants preparing to report, the month is shaping up to be a key test of risk sentiment.

While June offered mixed signals from major central banks, July is expected to offer more clarity on the timing of rate cuts — especially from the Fed and ECB. Meanwhile, CPI releases in the US and Eurozone will be watched closely for confirmation that inflation is continuing to ease. Equity traders will also be tracking earnings from major tech names including Apple and Tesla.

July 2025 Economic Calendar

Taking a look at our FXIFY™ economic calendar, here are our top picks for economic news to look out for in July.

| Date | Asset | Events |

| Week One: July 1 – 5 | USD USD USD GBP | Fed Chair Powell Speaks ISM Manufacturing PMI JOLTS Job Openings BOE Gov Bailey Speaks |

| Week Two: July 6 – 12 | USD USD CAD | FOMC Meeting Minutes Unemployment Claims Unemployment Rate |

| Week Three: July 13 – 19 | GBP USD AUD USD | CPI y/y PPI m/m Unemployment Rate Unemployment Claims |

| Week Four: July 20 – 26 | EUR GBP USD | French Flash Manufacturing PMI Flash Manufacturing PMI Flash Manufacturing PMI |

| Week Five: July 27 – 31 | AUD USD JPY | CPI y/y FOMC Statement BOJ Policy Rate |

The first half of July is packed with key U.S. data releases, including ISM Manufacturing PMI, JOLTS job openings, and the Consumer Price Index. With Non-Farm Payrolls pushed to July 3rd this month due to the Independence Day holiday, CPI and Fed Chair Powell’s upcoming testimony have taken centre stage as the most impactful events for dollar direction.

Meanwhile, traders will also be watching updates from the Bank of Japan, Australian jobs data, and inflation releases from the UK and Canada — all of which will help shape expectations for global monetary policy moving forward.

As traders move through July, it’s important to stay aware of heightened volatility around these releases. Keep in mind that news trading is prohibited 5 minutes before and after the announcement on Instant Funding and Lightning Challenge accounts.

1. GBP – BOE Gov Bailey Speaks

Kicking off the first week of July, Bank of England Governor Andrew Bailey is set to speak on July 5. While not an official rate-setting event, Bailey’s remarks can heavily influence GBP pairs — especially in the context of persistent inflation and speculation over the Bank’s next move.

Traders will be watching closely for any clues about the future path of interest rates or the BoE’s view on economic resilience. Although not always high volatility by default, speeches from central bank heads can generate sharp reactions if they contain unexpected commentary or signal policy shifts.

2. GBP – Core CPI

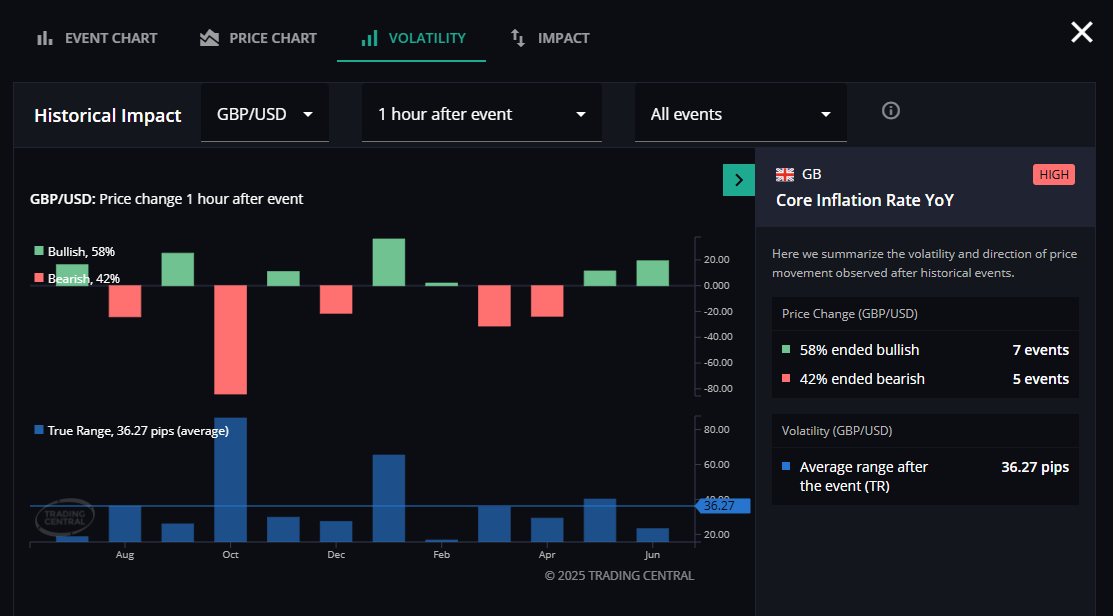

Releasing on July 16, UK inflation data will be a major market mover for GBP pairs. As the Bank of England weighs its next move, a surprise in the CPI reading could push GBP/USD directionally.

Trading Central data shows an average move of 36.27 pips in GBP/USD one hour after this event. Historical bias has been 58% bullish and 42% bearish, indicating a slightly positive skew — but volatility remains elevated.

3. JPY – Bank of Japan Policy Decision

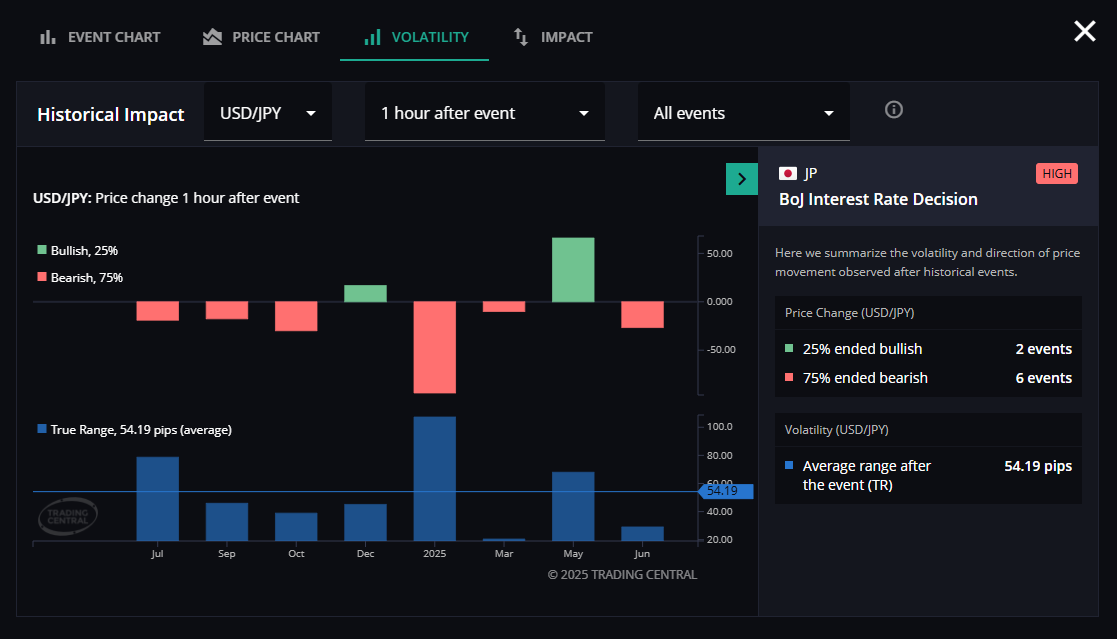

The Bank of Japan’s policy announcement on July 31 will be key for yen pairs. While many expect policy to stay steady, a growing minority anticipates tweaks to bond purchase language or guidance, particularly if yen weakness persists.

USD/JPY has historically moved an average of 54.19 pips in the hour following this event. Notably, 75% of past reactions were bearish — underscoring the risk of downside pressure if the BoJ disappoints hawkish expectations.

July 2025 Earnings Calendar

Earnings season kicks off in earnest this month. After a strong showing from Nvidia in Q2, attention now turns to Apple, Tesla, and key players in finance and retail. These results could shift tech sentiment and influence broader equity trends.

📅 Earnings Calendar – July 2025

| Date | Company | Ticker | Time | Sector |

| July 15 | JPMorgan Chase | JPM | Pre-Market | Financials |

| July 17 | Netflix Inc. | NFLX | After Market Close | Technology |

| July 23 | Tesla Inc. | TSLA | After Market Close | Consumer/Tech |

| July 31 | Apple Inc. | AAPL | After Market Close | Technology |

| July 31 | Intel Corp. | INTC | After Market Close | Technology |

Tech results will set the tone for indices like the Nasdaq 100. Disappointments may trigger risk-off pullbacks, while upbeat outlooks could drive breakout continuation.

Key Story: Gold vs WTI Crude Oil

This month’s narrative focuses on the contrast between Gold (XAU/USD) and Oil (WTI Crude) — two commodities reflecting differing technical outlooks and sensitivity to global developments.

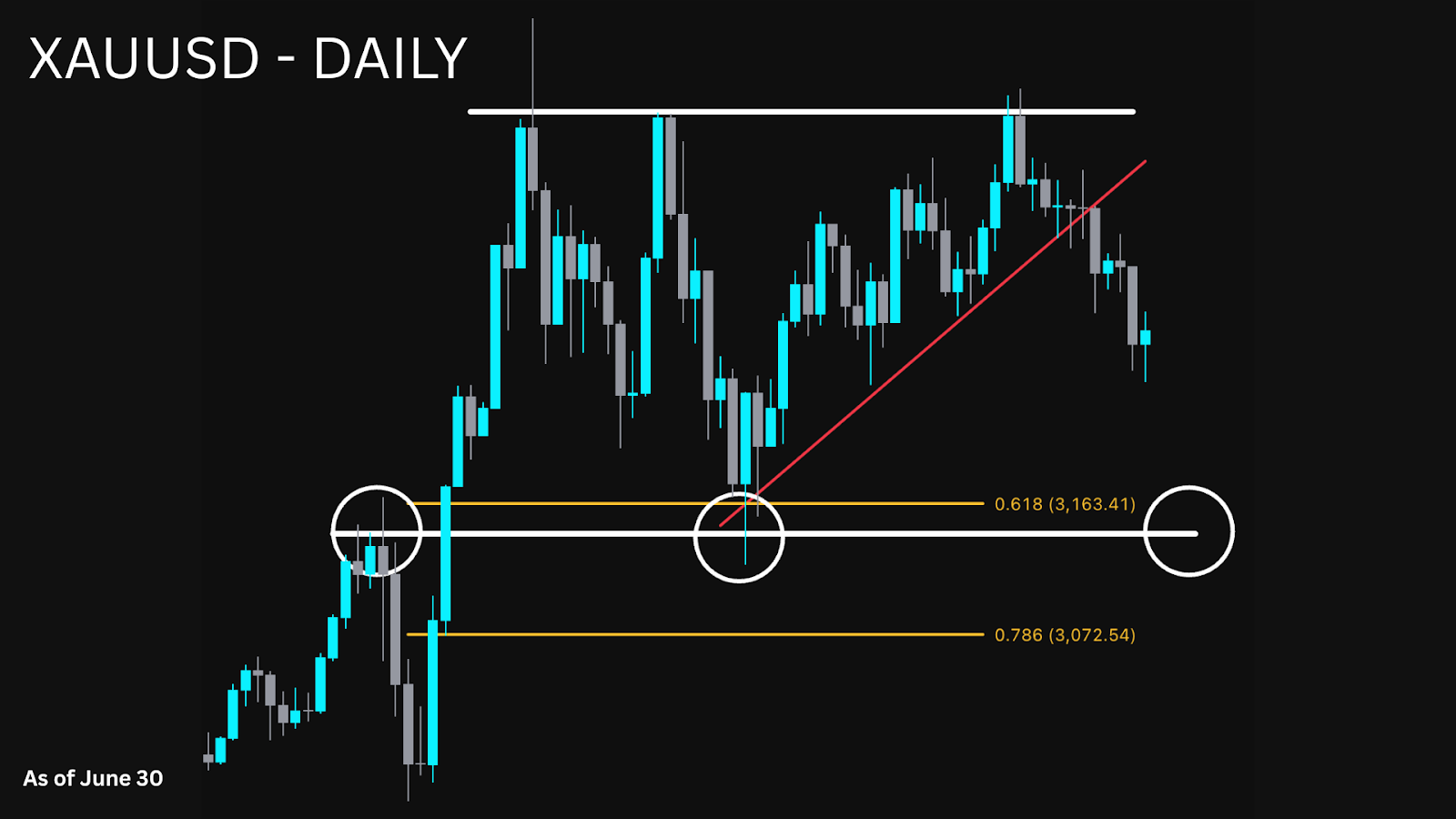

Gold (XAU/USD) Gold is currently trading well above the key support zone, having recently broken below a short-term trendline. This breakout suggests bearish momentum could continue in the short term, increasing the likelihood of price revisiting the 0.618–0.786 Fibonacci retracement area — a region that aligns with support.

This zone remains a potential high-probability long area if price reacts with bullish confirmation. The upside target remains at the resistance level formed at the all-time highs. Traders should watch for how price interacts with the fib region first.

This structure may be supported by any pickup in geopolitical tensions or fresh USD weakness following CPI or Fed commentary — both of which historically drive demand for safe-haven assets like gold.

Oil (WTI) Crude oil has retraced aggressively from its June highs and is now sitting just above a major horizontal support level. The market is now watching closely to see whether this level holds or breaks. A confirmed breakdown could open the door to further downside, especially if demand outlook weakens.

On the other hand, a bounce could signal renewed strength — particularly if OPEC+ surprises markets or geopolitical flare-ups impact supply expectations.

This gold–oil divergence highlights two core themes this month: risk sentiment and energy demand. Traders should monitor how each reacts to macro catalysts and whether technical support levels hold.

July delivers a blend of macro, earnings, and monetary policy catalysts. With inflation and rate expectations driving FX and indices, and tech earnings guiding equities, it’s a crucial month for positioning.

Wrapping Up June’s Outlook

July brings a diverse set of market-moving catalysts — from high-impact inflation prints and central bank speeches to a wave of tech earnings. While the absence of the NFP report shifted early-month volatility expectations, focus has quickly turned to CPI and Fed commentary to set the tone for the dollar and risk sentiment.

Commodities like gold and oil are providing technical clarity amid macro uncertainty, while FX markets remain sensitive to central bank outlooks — particularly from the BoE, BoJ, and ECB.

With your FXIFY account, you can use Trading Central’s tools to support your trading decisions. The Economic Calendar helps you track upcoming events, Technical Views provide clear chart analysis, and Featured Ideas highlight potential setups based on technical and macro factors — all designed to keep your trading process informed and consistent.