Month Forward: May 2025 Key Events Watchlist

From inflation updates to Nvidia earnings, May’s packed with market-moving events. Here’s what traders are watching—and why it matters.

April ended on a more optimistic note than expected. China quietly rolled back some tariffs on key US imports, signalling a potential de-escalation in the long-running trade tensions. This unexpected move has opened the door for the US to reciprocate—a shift that could have wide-reaching implications across commodities, tech, and global risk appetite.

As we step into the second half of May, attention turns to inflation data, central bank signals, and how key assets react.

May 2025 Economic Calendar

Taking a look at our FXIFY™ economic calendar, here are our top picks for economic news to look out for in May.

| Date | Asset | Events |

|---|---|---|

| Week One (May 1 – 4) | JPY USD USD EUR USD AUD | BOJ Press Conference U.S. Unemployment Claims U.S. ISM Manufacturing PMI ECB CPI Flash Estimate y/y U.S. Non-Farm Employment Change Australia Parliamentary Elections |

| Week Two (May 5 – 11) | USD NZD GBP USD GBP | U.S. ISM Services PMI New Zealand Unemployment Rate UK Construction PMI U.S. Federal Funds Rate BOE Monetary Policy Report |

| Week Three (May 12 – 18) | USD AUD GBP USD | U.S. Core CPI Australia Unemployment Rate UK GDP m/m U.S. Core PPI m/m |

| Week Four (May 19 – 25) | CAD EUR EUR EUR USD | Canada CPI ECB Financial Stability Review French PMI German PMI Flash Services PMI |

| Week Five (May 26 – 31) | NZD USOIL/UKOIL USD | RBNZ Monetary Policy Statement OPEC Meetings Core PCE Price Index m/m |

The first two weeks of May were front-loaded with major events. The FOMC held rates steady on May 1 but hinted at caution around inflation, tempering market expectations for summer cuts. Non-Farm Payrolls came in slightly below forecast, softening the dollar while lifting equities and gold. The BoE also held rates but was more dovish in tone, nudging GBP lower across the board.

FXIFY™ permits news trading on evaluations, but it’s important to note that volatility around key economic releases can increase slippage, spreads, and execution risk.

1. USD – Federal Funds Rate

As expected, the Federal Reserve kept interest rates unchanged at its May 1 meeting. Markets were less focused on the decision itself and more on Powell’s tone during the press conference. While he acknowledged some signs of economic softening—particularly in labour data—his overall messaging leaned cautious, with little urgency around cuts. This resulted in a muted reaction in EUR/USD, with the pair initially spiking higher before retracing as the dollar found support on reaffirmed inflation concerns.

According to Trading Central’s Volatility Tab, historical Fed rate decisions have caused an average move of 46.39 pips in EUR/USD within the first hour. In this case, the move aligned with the historical pattern: initial volatility followed by a fade, as traders digested the Fed’s data-dependent stance.

2. US Core CPI

The upcoming US Core CPI release will be one of the most closely watched data points this month. Core inflation remains a key factor in the Fed’s rate path, and another firm reading would reduce the chances of cuts in the near term, likely supporting the US dollar. On the flip side, if inflation shows signs of easing, it could trigger USD weakness and lift risk assets like EUR/USD and equities.

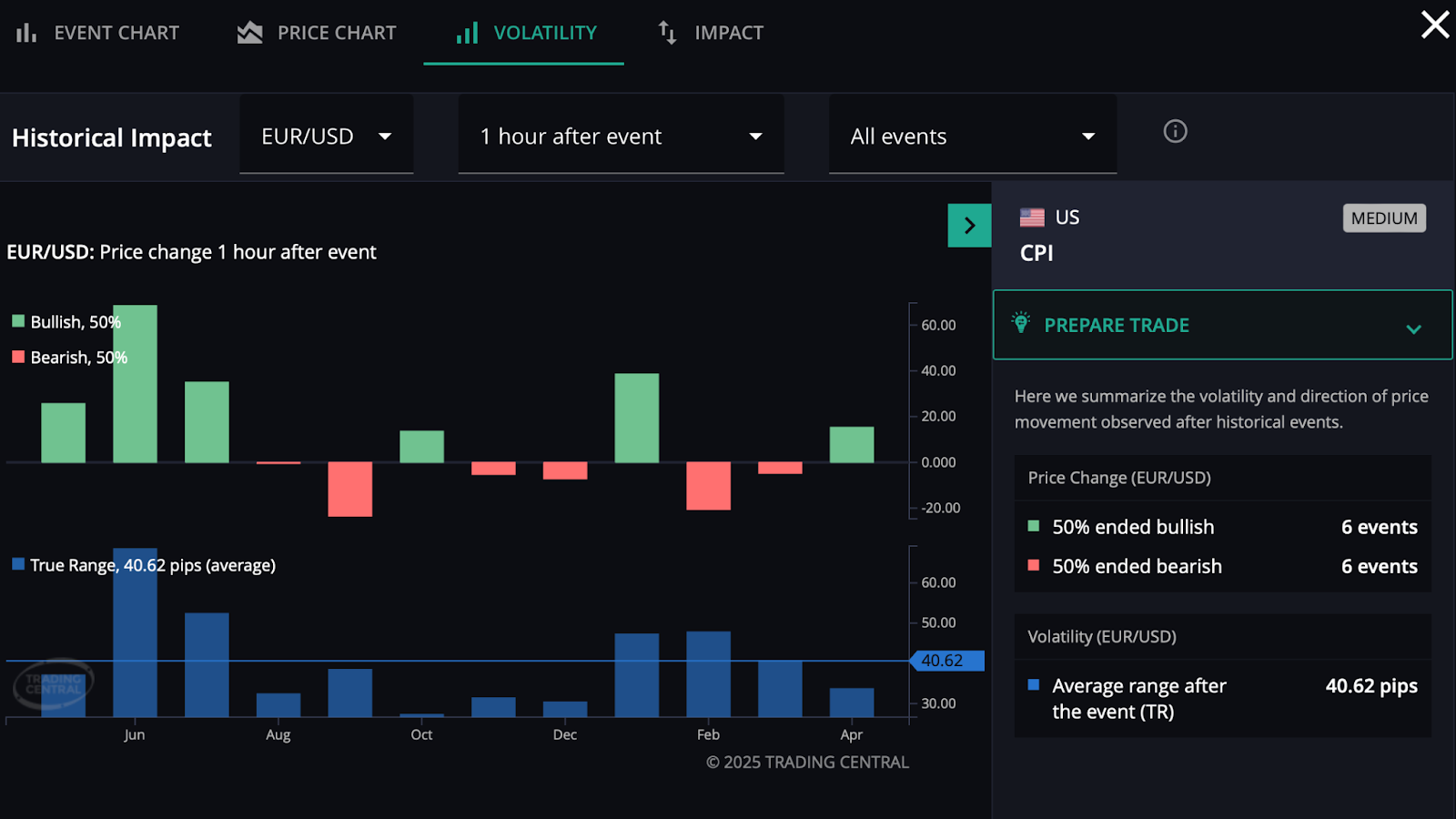

Historically, CPI releases tend to generate sharp reactions. According to Trading Central’s Volatility Tab, EUR/USD moves an average of 40.62 pips within one hour after the event, with a 50/50 split between bullish and bearish outcomes. Traders should be ready for immediate volatility as markets recalibrate expectations around Fed policy.

3. Bank of England Monetary Policy Report

As expected, the Bank of England held interest rates steady, but the tone of the statement and press conference leaned slightly more dovish than prior meetings. Policymakers acknowledged slowing growth and hinted that the next move could be a cut—possibly as soon as this summer. This led to broad GBP weakness, especially against USD and EUR, as traders adjusted their rate expectations.

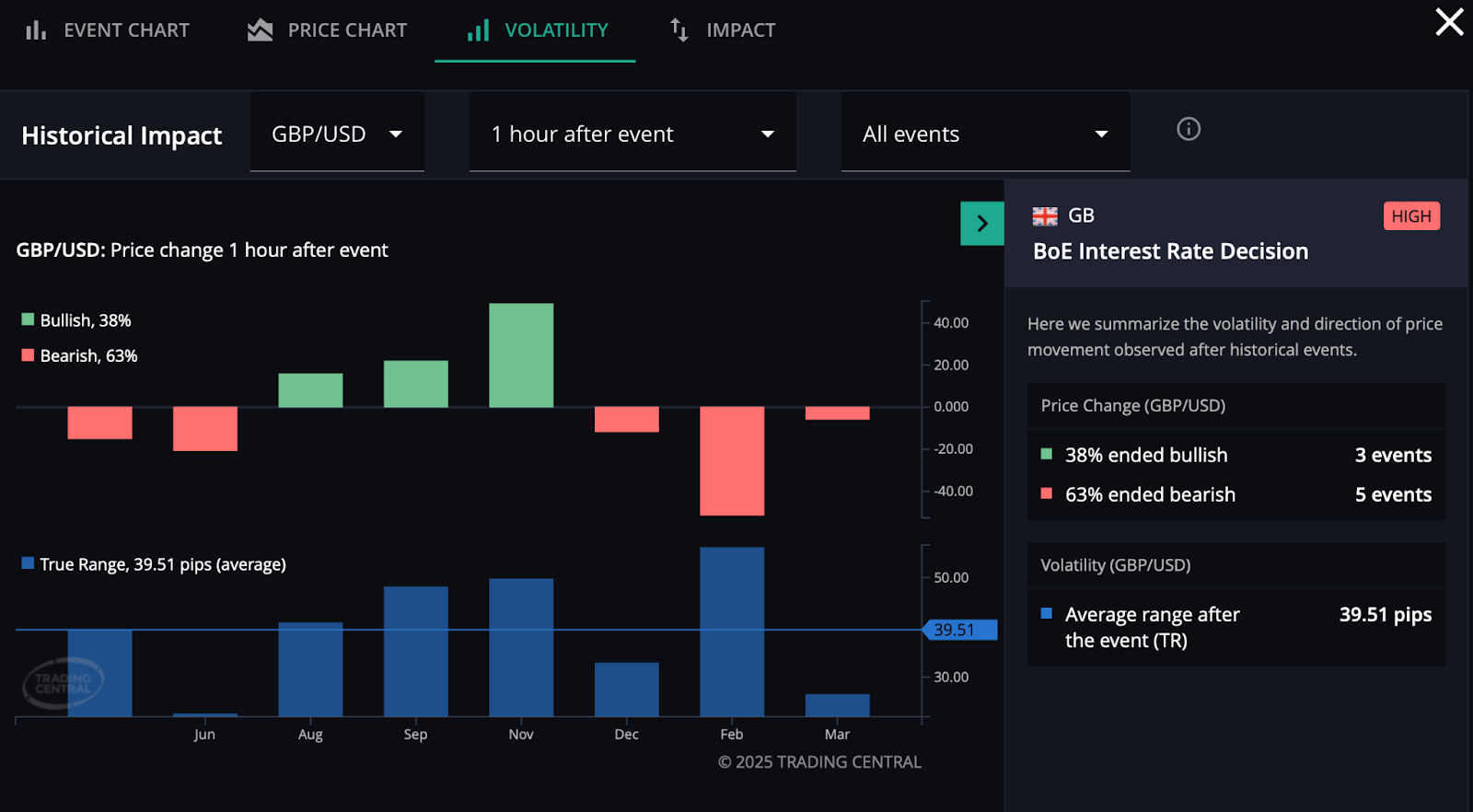

Historically, the BoE decision triggers an average move of 39.51 pips in GBP/USD one hour after release. This time, the move followed the pattern of past downside reactions, with the pound selling off sharply before stabilising into the US session.

May 2025 Earnings Calendar

The first half of May brought a wave of earnings from major tech and consumer names, with more critical reports still to come. While Apple and Amazon helped lift early sentiment, attention now shifts to how the remaining companies, especially in tech and retail, may influence broader indices as the month progresses.

📅 Earnings Calendar – May 2025

| Date | Company | Ticker | Time | Sector |

|---|---|---|---|---|

| May 1 | Apple Inc. | AAPL | After Market Close | Technology |

| Amazon.com Inc. | AMZN | After Market Close | Consumer Discretionary | |

| May 6 | Advanced Micro Devices Inc. | AMD | After Market Close | Technology |

| May 7 | Uber Technologies Inc. | UBER | Pre-Market Open | Industrials |

| The Walt Disney Co. | DIS | Pre-Market Open | Communication Services | |

| May 8 | Shopify Inc. | SHOP | Pre-Market Open | Consumer Discretionary |

| Coinbase Global Inc. | COIN | After Market Close | Financials | |

| May 13 | JD.com Inc. | JD | Pre-Market Open | Consumer Discretionary |

| May 14 | Cisco Systems Inc. | CSCO | After Market Close | Technology |

| May 15 | Walmart Inc. | WMT | Pre-Market Open | Consumer Staples |

| May 20 | The Home Depot Inc. | HD | Pre-Market Open | Consumer Discretionary |

| May 22 | Nvidia Corp. | NVDA | After Market Close | Technology |

| May 28 | Costco Wholesale Corp. | COST | After Market Close | Consumer Staples |

May’s key earnings come from Apple, Amazon, and Nvidia, which will heavily influence the Nasdaq and S&P 500. Apple and Amazon kick off the month with insight into consumer and tech demand, while Nvidia’s report on May 22 will shape sentiment around AI and semiconductors. These results are likely to drive volatility and set the tone for broader market direction.

Key Story: Gold vs US Dollar

This month’s key narrative is the battle between Gold and the US Dollar, two classic safe havens diverging in structure and sentiment.

Gold remains firmly in an uptrend, currently consolidating between $3,240 and $3,433 after a strong breakout. Price is respecting a clear ascending trendline from March, and a break above resistance could signal continuation toward the previous high near $3,580. The structure suggests bullish momentum is intact unless we close below support.

Meanwhile, the US Dollar Index (DXY) is in a broader downtrend, capped by a descending trendline and stuck in a sideways range between 98.70 and 99.85. It’s currently testing the upper boundary of this consolidation zone, but repeated rejections hint at weakness unless there’s a clean break above both horizontal and trendline resistance.

The setup is clean: if DXY breaks down, Gold is likely to push higher. But if the dollar finds strength and breaks out above 100, it could stall Gold’s advance or trigger a deeper correction. With CPI and Fed tone in focus, this pair reflects the broader market tug-of-war between easing expectations and persistent inflation risk.

Wrapping Up May’s Outlook

May is shaping up to be a pivotal month, with several key events that could shift market direction, including central bank decisions, inflation data, and major earnings reports. These developments will offer more clarity on interest rate paths and broader market trends. Traders should stay focused on how assets like gold, the US dollar, and equities react around these moments.

With your FXIFY account, you can use Trading Central’s tools to support your trading decisions. The Economic Calendar helps you track upcoming events, Technical Views provide clear chart analysis, and Featured Ideas highlight potential setups based on technical and macro factors—all designed to keep your trading process informed and consistent.