Why Most Traders Fail (And How to Avoid Their Mistakes)

Discover why a high percentage of traders ultimately lose money. This article explores the most common pitfalls, including setting unrealistic goals, implementing poor risk management strategies, making emotional trading decisions, and trading without a solid plan. Learn practical steps focused on discipline, strategy refinement, and effective risk control to improve your chances of long-term trading success.

While trading offers the dream of financial freedom and the excitement of testing your ideas against the markets (stocks, forex, futures), the reality is often challenging. Understanding why most traders fail, especially when starting out, is the critical first step towards success.

However, the hard truth is that most traders fail to achieve consistent profits. Understanding why most traders fail is the crucial first step to improving your chances. Many traders lose money when they start trading.

This article explores the common saying that “90% of traders fail,” breaks down the key common pitfalls and same mistakes that cause traders to lose money, and provides practical steps you can take. Whether you are a new or experienced trader, these lessons can help you trade better and longer.

90% of Traders Fail: Myth or Fact?

You often hear that nine out of ten traders lose money. Recent official data show just how steep the odds can be:

- According to the FCA press release “FCA highlights continuing concerns about problem firms in the CFD sector” (1 December 2022), approximately 80 % of customers lose money when investing in CFDs

- A July 2024 press release from India’s Securities and Exchange Board (SEBI) found that 70 % of individual intraday traders in the equity cash segment incurred net losses in FY 2022 (SEBI press release 13/2024).

- An updated SEBI analysis published in September 2024 revealed that 93 % of individual traders in the equity futures & options segment suffered losses between FY 2022 and FY 2024 (SEBI press release 22/2024).

Even if the exact percentages vary by market and product, the clear message from multiple regulators is that the majority of retail participants do not turn a profit.

Although 90% is an estimate, the evidence is clear: the vast majority of retail traders do lose money. This is often why traders fail. For prop firm candidates aiming to pass challenges, these statistics are even more important. Passing requires consistency and discipline that many retail traders don’t maintain.

It’s also vital to know that success in trading isn’t instant. Even profitable traders face periods without gains or periods where their account value drops (drawdowns). The key difference is how successful traders manage these challenges.

So, why do traders fail so often? The reasons usually fall into five main categories.

Top Reasons Traders Fail and Lose Money

1. Unrealistic Goals

One of the biggest common pitfalls for a new trader is believing trading is a fast way to make money or get rich quickly with little effort. Social media often shows exaggerated success stories, creating unrealistic expectations. This tempts new traders (and sometimes even experienced traders) to use position sizes that are too large or chase daily profit targets that even professional traders would find difficult to manage.

Overconfidence leads to taking too much risk. When a losing streak inevitably happens, the trading account might not survive. These unrealistic expectations are a primary reason why most traders fail.

| “The goal of a successful trader is to make the best trades. Money is secondary.” – Dr. Alexander Elder |

How to manage expectations:

- Redefine success: Focus on steady growth month after month, not a risky goal like “doubling my money quickly.” Aim for consistent profits over time.

- Use a trading journal: Focus on how well you followed your trading plan. Did you stick to your rules? Was your position sizing correct?

- Set sensible benchmarks: Many professional traders aim for single-digit percentage returns per month with low risk. If that’s good enough for them, it should be for you too.

Remember, successful trading builds over time. Focus on creating good habits rather than chasing huge short-term gains. This builds a foundation for potential long-term rewards.

2. Poor Risk Management

Risk management is your set of rules to protect your capital when the market goes against you. Ignoring this principle is the fastest way to join the 90% of traders who lose money. Managing risk well is essential for survival.

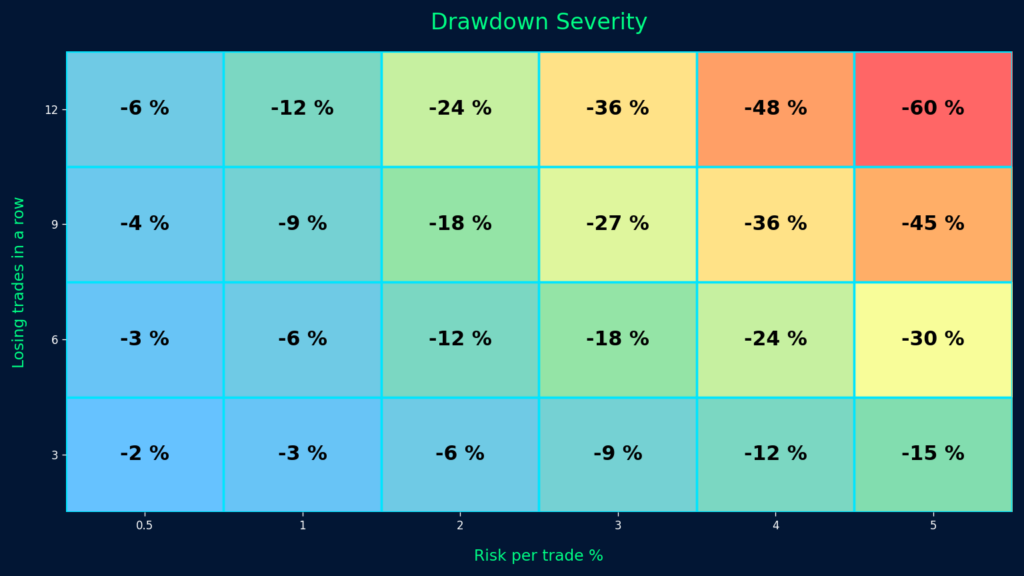

- The 1% rule: Never risk more than 1% of your trading capital on any single trade. This prevents a few losing trades from causing substantial losses.

- Position sizing: Calculate your trade size based on your stop-loss distance and the percentage of risk you’ve chosen per trade, not just a feeling. Proper position sizing should always reflect both your account balance and your risk tolerance.

- Stop-loss orders: Decide your exit point before you enter a trade. This removes emotional guesswork when under pressure. This should be part of every trading plan.

Prop firms place a strong emphasis on risk management — and for good reason. Their evaluation models are designed to protect both the firm’s capital and help traders develop discipline. At FXIFY, the daily and maximum drawdown limits act as structured safeguards, similar to those used in institutional trading environments.

Rather than being obstacles, these limits are best viewed as built-in accountability tools. They encourage traders to manage risk proactively and stay within the boundaries of a sound plan. Traders who succeed long-term typically operate well inside these limits — developing strong trading habits in the long run.

While all prop firms implement risk controls, FXIFY’s specific structure reflects a broader commitment to helping traders build professional habits. If you’re not yet familiar with how daily and overall drawdowns differ — and why they matter — it’s worth reviewing our guide on the different types of drawdowns in prop trading.

3. Lack of a Solid Trading Strategy and Plan

A trading strategy defines your edge—what you trade, why you trade it (e.g., based on technical or fundamental analysis), and the general conditions for entry/exit. A trading plan details the exact rules for executing your trading strategy: entry signals, exit signals (stop-loss and take-profit), position sizing, and risk management rules.

Many beginners jump between different indicators and trading methods every week, often without doing their research. Without enough trades (sample size) using one strategy, they can’t tell if their results are due to luck or a real edge. This leads to frustration and losses, another reason traders fail.

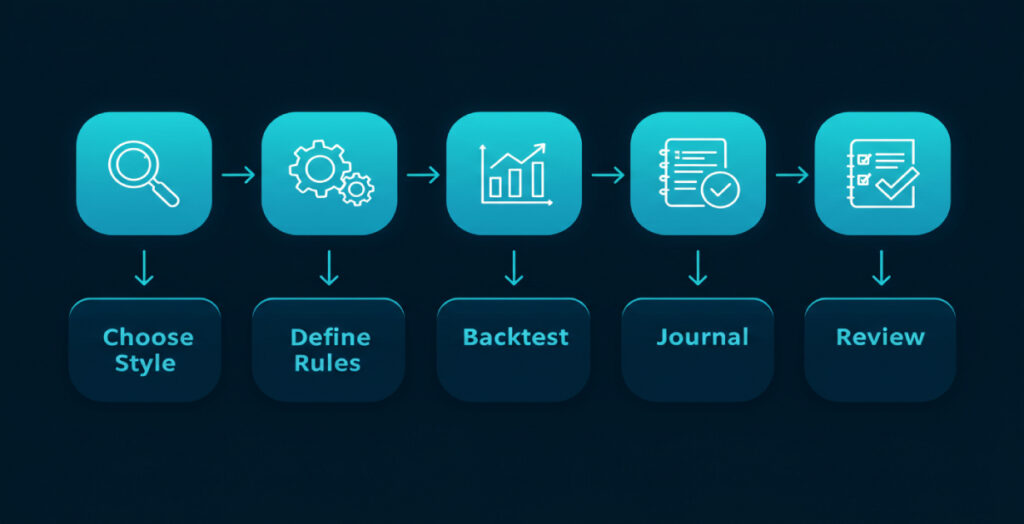

Build or adopt one core trading strategy and master its execution through a detailed trading plan:

- Choose a trading style that fits your personality and schedule (e.g., scalping, day trading, swing trading, position trading). Suitable for stocks, forex, etc.

- Define clear entry rules in your trading plan (e.g., trend alignment + specific price pattern).

- Test your trading strategy using historical data (back-testing) or a demo account (forward-testing).

- Record every trade in your trading journal and review your performance regularly.

Commit to one strategy and refine your trading plan. This builds the confidence needed for disciplined trading decisions under real market conditions.

4. Emotional Trading Decisions

Markets trigger strong human emotions: fear, greed, hope, and disbelief. Trading psychology plays a huge role. Making trading decisions based on these emotions leads to common errors and is a major reason traders fail.

- Fear: Closing winning trades too early because you fear giving back profits.

- Greed: Adding to trades without a good reason, or risking more money after a winning streak.

- Revenge trading: Increasing trade size to try and recover from losing trades quickly. This often leads to bigger losses.

- Confirmation bias: Only looking for information that supports your current trade, ignoring warning signs.

Keeping a trading journal that notes your emotional state alongside your trades helps identify these destructive patterns. Reviewing your journal helps build self-awareness and change bad habits, improving your trading psychology. Comparing your results to other traders isn’t helpful; focus on your process. Avoid making the same mistakes repeatedly.

Prop firm evaluations add pressure. Using tools like FXIFY’s dashboard to track performance objectively helps you stay grounded when emotions rise, leading to better trading decisions.

Managing emotions isn’t about feeling nothing; it’s about recognising emotions and having pre-set rules in your trading plan to prevent impulsive actions. Acting emotionally can have a strong negative effect.

5. Ignoring Transaction Costs and Market Conditions

Transaction costs – spreads, commissions, and slippage (price differences in execution) – reduce your returns. Active traders, especially day traders scalping for small profits, are heavily affected by transaction costs on every trade. Swing traders, on the other hand, would feel these costs less. Understanding why spreads and commissions matter in forex trading is crucial here.

Also, market conditions change. A strategy designed for quiet, range-bound markets will likely fail during strong trends or high volatility. News events can cause sudden market changes that hit stop-losses. There are many variables to consider.

Practical tips:

- Know your total transaction cost per trade.

- Trade during the most liquid market sessions for your chosen instrument (like stocks or forex pairs) to get tighter spreads.

- Adjust your position size or don’t trade if current market conditions don’t suit your trading strategy.

FXIFY offers RAW trading accounts (0.0 spread + round-turn commissions) and All-In trading accounts (tight spread with no commissions). This lets traders choose the transaction cost structure that best fits their trading method.

Successful traders adapt to market changes and manage transaction costs. They don’t stubbornly trade setups that aren’t working in the current market conditions.

How Trading with a Prop Firm Can Help You Manage Risk & Emotions

A good prop firm provides a structure that helps improve risk management and emotional discipline, boosting a trader’s ability:

- Clear risk rules: FXIFY’s drawdown limits and leverage settings foster proper risk management and prevent the kind of major losses that end trading careers.

- Capital access: Starting with funded accounts of up to US $400,000, traders are incentivised to target realistic percentage returns, rather than overrisking on small personal accounts to make money. Exploring the differences between funded trading and retail trading can help clarify which path is suitable.

- Unlimited trading days: Removes the time pressure that causes many traders to take poor trades.

- Performance data: The FXIFY dashboard provides objective feedback on your trading, helping manage trading psychology.

Trading with a firm like FXIFY also connects you with other traders, resources, and a professional environment, helping you become a good trader and eventually a successful trader. It encourages treating trading like a business.

If you can succeed within this structured environment, moving towards becoming a full-time professional trader is a more achievable goal.

Key Takeaways: Avoiding Why Most Traders Fail

- Most traders fail due to poor risk management, inconsistent trading strategies/trading plans, and emotional trading decisions. These are key reasons traders lose money.

- Set realistic goals: Judge success by following your trading plan, not just by profits.

- Manage risk carefully: Use appropriate risk and stop-losses, and calculated position sizing in your trading plan. Avoid overleveraging.

- Use a trading journal: Track your progress and mistakes to refine your trading edge.

- Adapt: Adjust for transaction costs and changing market conditions. Choose account types and trading styles wisely.

- Consider prop firms: Consider prop firms: Firms like FXIFY provide structure and access to capital, removing the emotional pressure to overleverage. With funded accounts, even modest risk can lead to meaningful returns — helping traders stay rational, not reckless.

Remember, trading is more like long-term investing in your skills than a get-rich-quickly scheme. Build sustainable habits.

Conclusion

Trading can be rewarding, but success requires more than strategy. Most traders fail due to poor risk control, emotional decisions, and unrealistic goals. By focusing on discipline, a clear plan, and adapting to changing conditions, you give yourself the best chance to succeed.

Approach trading like a long-term skill, not a quick win. Track your performance, manage risk, and stay focused on process over outcome. With the right habits and structure — including support from a prop firm — consistent progress is possible.