Best Times to Trade the Forex Markets

The forex market runs 24 hours a day, but not all hours are equal. Learn when trading activity peaks, which sessions overlap, and how to use timing to your advantage for smarter, more consistent trades.

When Is the Best Time to Trade Forex?

In forex trading, timing isn’t just important—it’s critical. The foreign exchange market operates 24 hours a day, five days a week, but not all hours are created equal. Knowing when the market is most active can help you make smarter decisions, reduce unnecessary risk, and spot more profitable opportunities.

In this guide, we’ll walk through the four major trading sessions, when they overlap, and which hours tend to offer the best conditions for different trading strategies. All times are listed in New York time (UTC-5) unless stated otherwise.

Forex Market Sessions: A Global Clock

Because the forex market is decentralised and operates across global financial centres, it follows a rolling schedule of trading sessions rather than fixed open and close times. These sessions—Sydney, Tokyo, London, and New York—create periods of peak activity as one market opens and another closes.

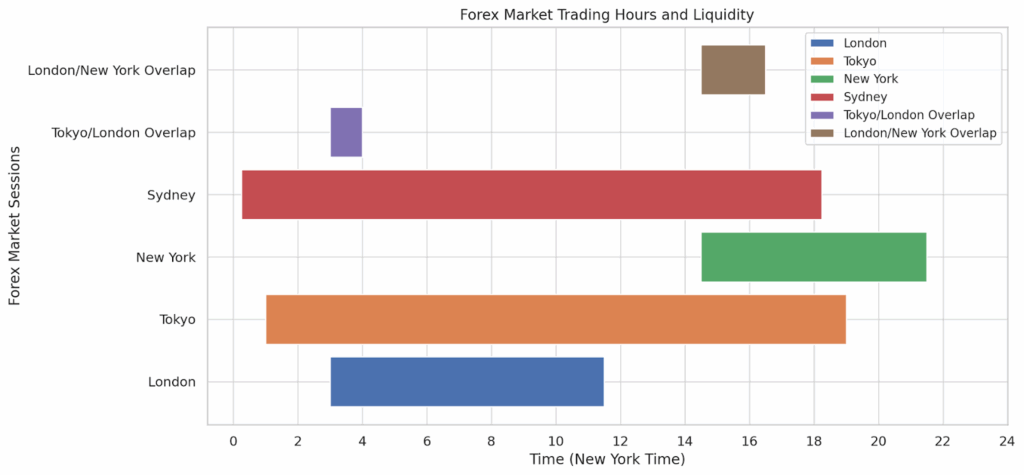

The chart below highlights the start and end times of each major forex session in New York time (UTC-5), including key overlaps that often generate the highest trading volume and volatility.

| MARKET | TRADING HOURS (NEW YORK TIME) | BEST CURRENCY PAIRS TO TRADE | LIQUIDITY/VOLATILITY |

| London Session | 3am – 11:30am | EUR/USD, GBP/USD, EUR/GBP | Highest liquidity, active market |

| Tokyo Session | 7pm – 1am | USD/JPY, EUR/JPY, GBP/JPY | Moderate liquidity |

| New York Session | 2:30pm – 9:30pm | EUR/USD, USD/JPY, GBP/USD | High trading volume, volatile |

| Sydney Session | 6:15pm – 12:15am | AUD/USD, NZD/USD | Lower liquidity, quieter market |

| Tokyo/London Overlap | 3am – 4am | EUR/JPY, GBP/JPY, USD/JPY | High liquidity, great for scalpers |

| London/New York Overlap | 2:30pm – 4:30pm | EUR/USD, GBP/USD, USD/JPY | Most liquid, high volatility, swing trading entries |

Forex Market Trading Hours and Overlaps

The forex market operates 24 hours a day, but not all hours are equal. Activity levels fluctuate depending on which global trading sessions are open. These fluctuations create key windows of opportunity—especially during session overlaps, when liquidity and volatility tend to spike.

The chart below outlines the active hours for each major forex session in New York time (UTC-5), including two critical overlaps:

When Does the Forex Market Operate

The forex market runs 24 hours a day, five days a week, offering traders the flexibility to engage in currency trading at virtually any time. This continuous cycle is made possible by the global nature of the market, with three major trading hubs: London, New York, and Tokyo. These centres drive market activity as they open and close across different time zones.

Each session operates during specific hours, which means different foreign exchange currency pairs are most liquid and active at different times of day.

London Trading Session

The London session is the most influential in the forex market and accounts for more than 30 per cent of global trading volume. It opens at 8:00 AM and closes at 4:30 PM UK time, providing the highest liquidity and tightest spreads during the day.

For traders based in the UK, this is typically the most favourable time to trade. Market activity is high, creating strong opportunities for both short-term and medium-term strategies.

- Best Currency Pairs to Trade: EUR/USD, GBP/USD, EUR/GBP

- Liquidity and Volatility: High liquidity, fast-moving price action, and elevated volatility. Conditions become even more dynamic during the London and New York session overlap, when trading volume peaks.

Tokyo Trading Session

The Tokyo session is the first major forex trading session to open each day. While it is generally quieter than the London or New York sessions, it still plays a key role in the global market—especially for traders focused on Asian currency pairs.

This session often features more stable and predictable price movements. Volatility is typically lower, which can appeal to traders who prefer a calmer market environment or who are testing strategies with smaller position sizes.

- Best Currency Pairs to Trade: USD/JPY, EUR/JPY, GBP/JPY

- Liquidity and Volatility: Moderate liquidity with steady price movement. Volatility is lower than in later sessions, making it suitable for range trading and lower-risk setups.

New York Trading Session

The New York session is the second-largest forex trading session and plays a significant role in shaping global market activity. It opens shortly before the London session closes, creating an overlap period that is often the most liquid and volatile time of day for forex traders.

During this session, the market is heavily influenced by economic data releases and news events from the United States. These announcements can lead to sharp price movements, especially in major foreign exchange currency pairs tied to the US dollar.

- Best Currency Pairs to Trade: EUR/USD, USD/JPY, GBP/USD

- Liquidity and Volatility: High liquidity and strong market volatility. The overlap with the London session and frequent US news releases make this period ideal for traders looking to capitalise on rapid market movements.

Sydney Trading Session

The Sydney session marks the official open of the forex trading week. While it is typically quieter than the Tokyo, London, or New York sessions, it still plays a valuable role—especially for traders focused on Australian and Pacific currency pairs.

This session is known for its slower pace and lower trading volume, offering a more predictable environment with reduced volatility. As the Sydney session closes, momentum begins to build with the opening of the Tokyo session, gradually increasing global market activity.

- Best Currency Pairs to Trade: AUD/USD, NZD/USD

- Liquidity and Volatility: Lower liquidity with a calmer, more stable market. Volatility is generally limited, making it a suitable window for traders who prefer low-stress conditions.

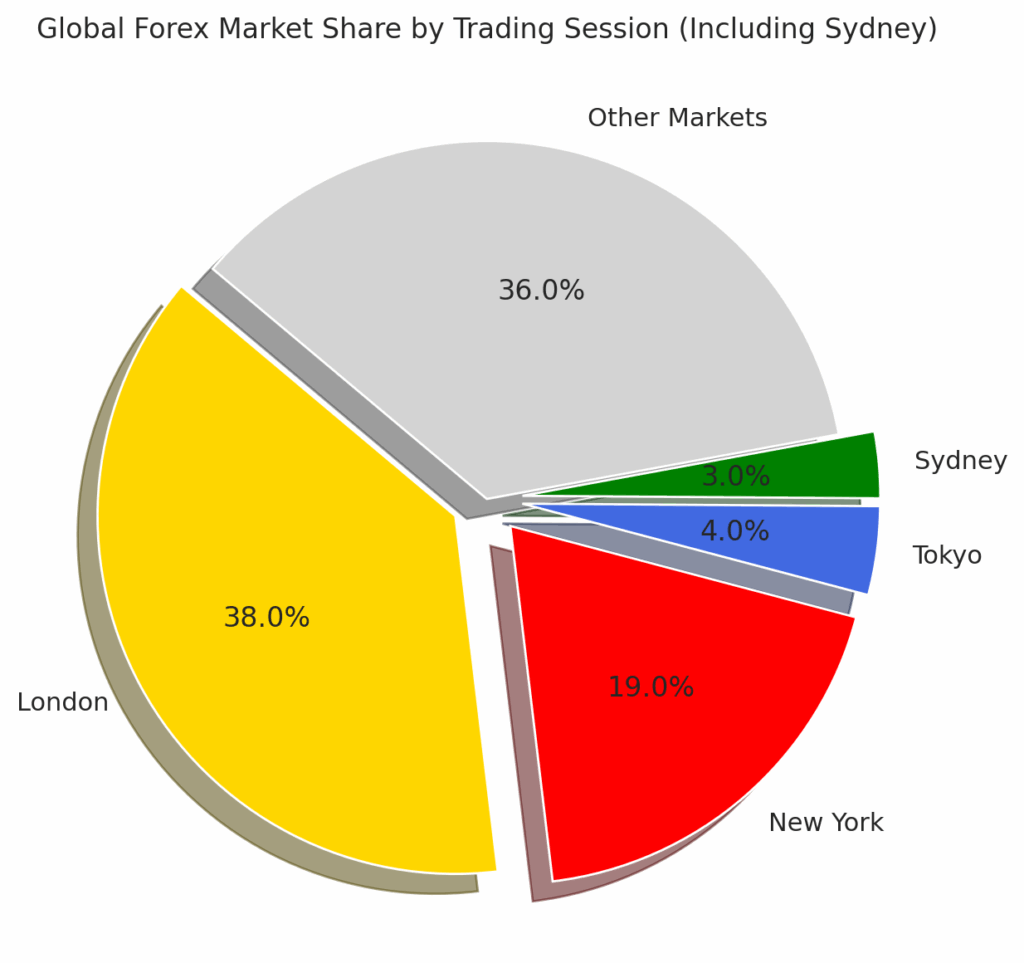

How the Trading Sessions Compare by Market Share

While all trading sessions contribute to the 24-hour forex cycle, not all of them carry equal weight in terms of trading volume. The pie chart below shows the global forex market share by trading session, helping illustrate where the bulk of liquidity comes from.

This chart highlights the proportion of total forex trading volume handled by each session. London dominates global trading with 38 per cent, followed by New York at 19 per cent. Sydney and Tokyo, while smaller, still play important roles in market continuity and offer unique trading opportunities.

Source: Investopedia

Forex Market Overlaps

Session overlaps occur when two major forex markets are open at the same time. These periods typically offer the highest levels of liquidity and volatility, making them some of the most favourable windows for active trading.

Because more traders and institutions are participating during overlaps, price movements tend to be sharper and spreads tighter. This creates ideal conditions for strategies that rely on strong momentum, such as scalping or breakout trading.

Tokyo and London Overlap

Time: 3:00 AM – 4:00 AM (New York time)

The overlap between the Tokyo and London sessions is brief but impactful. As the Tokyo session winds down and London comes online, trading volume increases, especially in pairs linked to the Japanese yen.

This window creates a unique opportunity for traders looking to capture early price action or trade the transition between two major markets. While it may not offer the same explosive volatility as the London and New York overlap, it can still deliver fast-paced moves in select pairs.

- Best Currency Pairs to Trade: EUR/JPY, GBP/JPY, USD/JPY

- Liquidity and Volatility: Increased liquidity and moderate volatility. Ideal for short-term strategies and scalpers looking for quick entries and exits during a quieter part of the trading day.

London and New York Overlap

Time: 2:30 PM to 4:30 PM (New York time)

The overlap between the London and New York sessions is widely regarded as the most active and liquid period in the entire forex market. This window brings together the two largest financial centres, combining London’s institutional power with New York’s news-driven volatility.

During these two hours, trading volume peaks, spreads are typically at their lowest, and price movements are sharp and frequent. This makes it an ideal time for day traders, scalpers, and breakout strategies, especially when trading major currency pairs that involve the US dollar or euro.

- Best Currency Pairs to Trade: EUR/USD, GBP/USD, USD/JPY

- Liquidity and Volatility: This is the most liquid and volatile period of the trading day. It offers strong momentum, rapid execution, and a wide range of opportunities for active traders.

Does Forex Trade on Weekends?

The forex market operates continuously from Sunday at 5:00 PM to Friday at 5:00 PM (New York time). Once the market closes on Friday, trading pauses for the weekend.

This break gives traders time to review performance, refine strategies, and prepare for the week ahead. While some platforms may show minor price fluctuations during this period, actual trading activity is paused until markets reopen on Sunday evening.

So, When is the Best Time of the Day to Trade Forex?

The forex market is open 24 hours a day from Sunday to Friday. But not all hours offer the same trading potential. Certain times of day are more active, liquid, and volatile—making them more favourable for most trading strategies.

The most active trading window is when the London and New York sessions overlap, between 2:30 PM and 4:30 PM (New York time). This period sees the highest trading volume and strongest price movements, particularly in major currency pairs such as EUR/USD, GBP/USD, and USD/JPY.

Midweek tends to offer the best conditions overall. Tuesday, Wednesday, and Thursday are typically the most volatile days of the week, with fewer gaps and more consistent momentum. Mondays can be slower as markets digest weekend developments, while Fridays often see lighter volume as traders close positions ahead of the weekend.

These insights are based on aggregated institutional volume data and typical volatility patterns across major sessions.

Timing Matters More Than You Think

Success in forex trading isn’t just about what you trade—it’s also about when you trade. By aligning your strategy with the most active trading hours and understanding the dynamics of each session, you can increase your chances of catching meaningful moves, managing risk more effectively, and improving consistency over time.

Whether you’re a scalper chasing quick momentum or a swing trader seeking precision entries, knowing the best times to trade gives you a strategic edge.

At FXIFY, we empower traders with the capital, tools, and support to maximise those opportunities. With access to up to $400,000 in funded accounts, real-time market resources, and flexible payout structures, you’re never trading alone—and never trading blind.