Fed Chair Powell Speaks: How His Statements Move the Markets

Every time Fed Chair Jerome Powell steps up to a microphone, the markets hold their breath. Whether you’re trading forex, indices, or commodities, understanding the…

Every time Fed Chair Jerome Powell steps up to a microphone, the markets hold their breath. Whether you’re trading forex, indices, or commodities, understanding the impact of Powell’s words is essential for timing entries and managing risk.

Why the Market Listens to Jerome Powell

As Chair of the Federal Reserve, Powell is the most influential voice in U.S. monetary policy. When he speaks, global markets move—sometimes violently.

The Fed controls the levers that influence economic growth, inflation, and employment. Its decisions shape interest rates, money supply, and financial stability.

And Powell? He’s the spokesperson whose phrasing can send asset prices soaring or crashing.

Economists and traders alike call this style of market-moving language “Fedspeak”, a blend of technical jargon and subtle hints meant to guide expectations without triggering panic.

The Fed’s Toolkit – And Where Powell Fits In

The Fed doesn’t just pull one lever. It uses multiple tools to control inflation, support employment, and maintain financial stability. Powell plays a central role in communicating how and when these tools will be used.

Here’s a breakdown of the main tools, and what their use (or talk of their use) typically signals for traders:

| Tool | What It Does | Powell’s Role | Likely Market Impact |

| Interest Rates | Raising/lowering the Fed Funds Rate to cool or boost growth | Signals hikes or cuts via tone or statements | Hike = Bearish; Cut = Bullish |

| Quantitative Easing (QE) | Buying bonds to inject liquidity into markets | Justifies QE as needed to support conditions | Bullish |

| Quantitative Tightening | Selling bonds to withdraw liquidity | Warns of tightening to control inflation | Bearish |

| Forward Guidance | Outlines future policy path | Sets expectations for months ahead | Depends on tone/direction |

Powell is often referred to as the “communicator-in-chief”—tasked with balancing transparency with market stability. A poorly chosen phrase can trigger panic. A measured statement can calm fears instantly.

How the Market Reacts to Powell’s Language

Markets don’t just listen to what Powell says—they obsess over how he says it.

A subtle shift in tone, a single new adjective, or the omission of a familiar phrase can flip market sentiment within seconds. Traders look for signs that Powell is either:

- Hawkish – signaling concern about inflation and favouring tighter monetary policy (usually bearish for stocks, bullish for USD)

- Dovish – prioritizing growth and employment, supporting looser policy (often bullish for stocks, bearish for USD)

Even in prepared statements, Powell’s phrasing is closely analyzed. Words like “uncertain,” “modest,” or “substantial” can all carry different market implications.

Real Examples of Market Moves After Powell Speaks

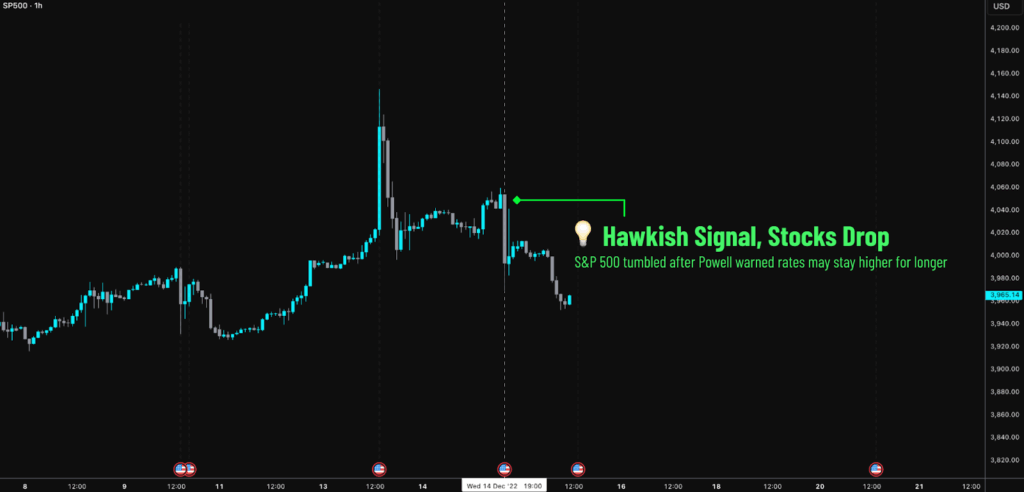

Case Study 1: Rate hike signal causes stock selloff

In December 2022, Powell hinted that rates could remain “higher for longer.” Within minutes, the S&P 500 shed nearly 3%. Bond yields spiked. Traders rushed to reprice their rate expectations.

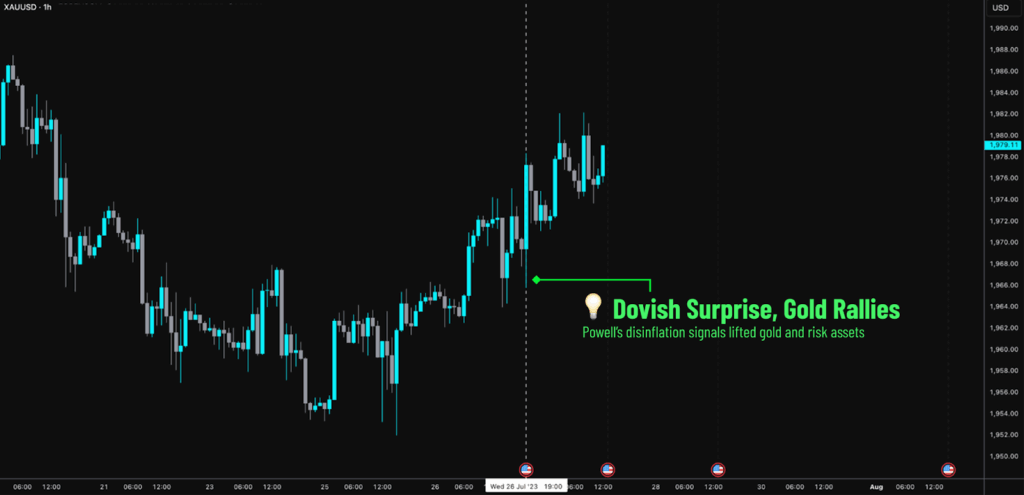

Case Study 2: Dovish surprise lifts gold and risk assets

In July 2023, Powell noted that the Fed was seeing “disinflationary signals.” Gold rallied. Tech stocks surged. The USD weakened against major pairs.

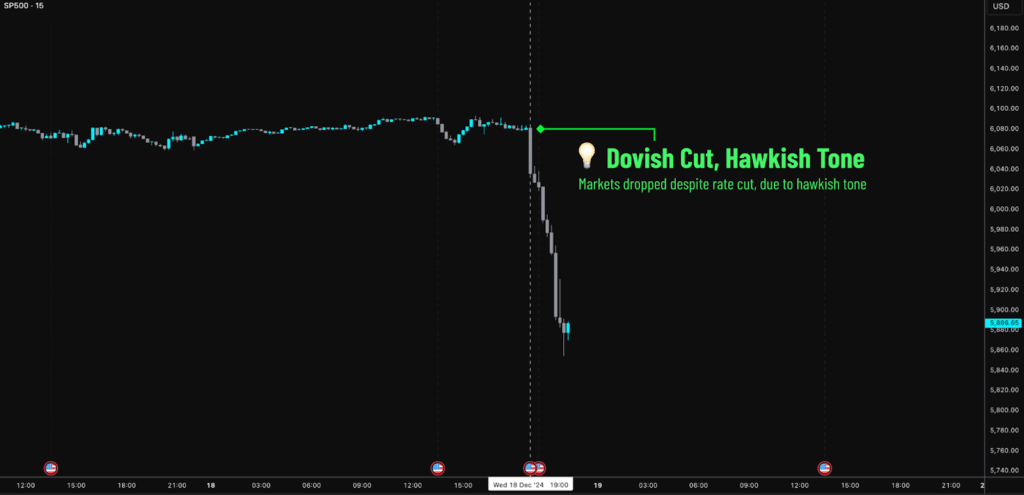

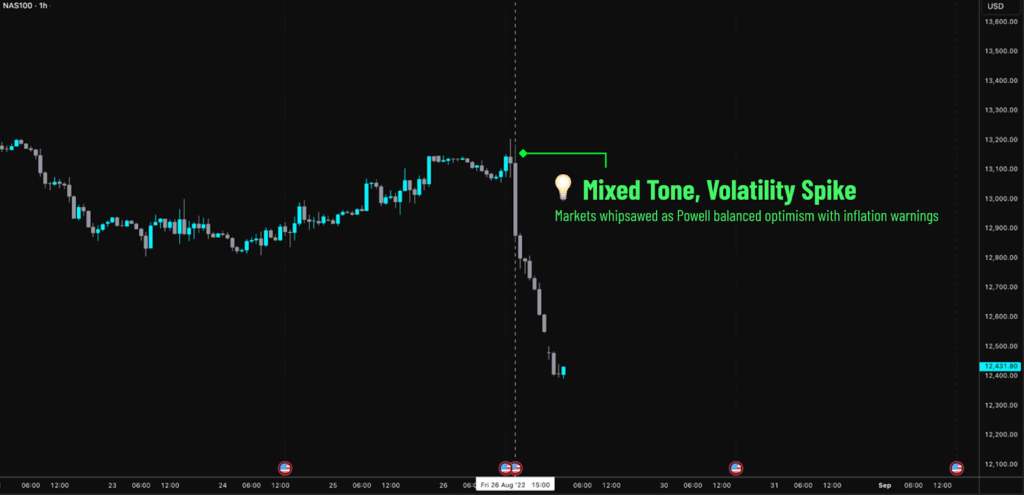

Case Study 3: Mixed tone creates volatility spike

At Jackson Hole 2021, Powell praised recovery progress but warned inflation risks were rising. The result? Whipsaw volatility as markets struggled to price in both optimism and caution.

Phrases Traders Should Look for in Powell’s Speeches

Certain phrases appear regularly in Powell’s language—and each carries weight. Here’s a cheat sheet:

| Phrase | What It Suggests | Market Reaction |

| “Higher for longer” | Rates likely staying elevated beyond expectations | Bearish for risk assets |

| “Data dependent” | No clear path; will respond to economic reports | Increased volatility |

| “Appropriate” (tone shift) | A shift in how aggressive policy should be | Depends on context/tone |

Understanding these phrases—and when Powell deviates from them—is key to reading his intentions.

The Q&A is Where the Real Info Comes Out

While Powell’s prepared remarks are carefully crafted, it’s the live Q&A that often moves markets the most. Journalists push for clarity, and Powell’s responses can reveal hesitation, confidence, or a change in stance.

Watch for:

- Repeated emphasis on certain risks (e.g., “inflation” or “tight labor markets”)

- Rewording of guidance from past statements

- Any divergence from recent FOMC minutes or dot plot expectations

How to Prepare for a Powell Speech as a Trader

- Check the calendar: Know when major events like FOMC meetings, Jackson Hole, or Senate testimony are happening. The FXIFY calendar is your friend here.

- Reduce exposure: If you’re not comfortable trading high-volatility environments, it’s okay to sit out. No trade is a trade.

- Set alerts: Have your trading platform notify you when Powell begins speaking, or if certain asset prices hit key levels.

- Avoid overtrading: The temptation to chase short-term moves can lead to losses. Wait for clarity, don’t guess.

Tip Box: 3 Golden Rules for Trading Powell Speeches

- 1. Don’t predict—react.

Trying to guess Powell’s exact words is a gamble. Wait for the market’s initial reaction and trade the response, not the speech. - 2. Know the rules—and the risks.

FXIFY allows news trading, but traders should still be mindful of the risks. Volatility can cause wider spreads and undesirable fills. We advise you to manage your risk appropriately during these trading periods. - 3. Watch the Q&A.

Prepared remarks are just the beginning. The real market movers often come during the Q&A, when Powell answers tough questions and reveals tone shifts.

Final Thoughts – Why Powell Will Keep Moving Markets

Jerome Powell isn’t just another central banker—he’s the voice of the world’s most powerful monetary institution. His statements ripple across Forex, stocks, commodities, crypto, and beyond.

For traders, listening carefully isn’t just smart—it’s necessary. Whether you’re shorting the dollar, fading the S&P, or buying gold, understanding Powell’s language gives you an edge.

Because in this market? One word really can change everything.