A Deep Dive into the Most Volatile Forex Pairs

Volatility is the double-edged sword of the forex world. For some, it spells doom in the form of blown accounts. For others, it’s the source…

Volatility is the double-edged sword of the forex world. For some, it spells doom in the form of blown accounts. For others, it’s the source of extraordinary opportunity. The difference lies in preparation, discipline, and the right strategies.

In this guide, you’ll discover simple tactics for trading highly volatile forex pairs. We’ll also explain why gold (XAU/USD)–although not a forex pair—is often traded like one and included in these conversations.

Let’s begin by understanding what makes a forex pair volatile in the first place.

What Makes a Forex Pair Volatile?

Volatility reflects the speed and scale of price fluctuations in a currency pair. It’s driven by several key factors:

| Volatility Driver | Explanation | Example Impact on Pairs |

| Interest Rate Differentials | High interest rates attract capital inflows, increasing market volatility. | Sudden spikes and wider spreads during rate hikes. |

| Economic Instability | Political turmoil or weak economic data shake investor confidence. | USD/ZAR, USD/MXN often spike on inflation or downgrades. |

| Geopolitical Tensions | Wars, elections, and sanctions spark safe-haven flows. | JPY gains against risk currencies like GBP in risk-off scenarios. |

| Commodity Price Shifts | Currencies like AUD, NZD, CAD move with key commodity prices (iron ore, oil, etc.) | AUD/USD or USD/CAD drop when demand for iron or oil falls. |

| Low Liquidity Periods | Outside major sessions, thin markets exaggerate price moves. | GBP/NZD can see erratic moves after the New York session closes. |

Volatile pairs can move 100-300+ pips daily, offering huge opportunities but demanding precision and discipline.

The 9 Most Volatile Forex Pairs (and Gold)

1. GBP/JPY – The Dragon Pair

Nicknamed the “Dragon”, with the traders playfully referred to as Dragon Riders, GBP/JPY is a beast built for high-speed trading.

It reacts sharply to UK macro data, BoE shifts, and global risk sentiment, thanks to its unique mix of the volatile pound and safe-haven yen.

| Volatility Range | Key Drivers | Typical Behaviour |

| 130–220 pips/day | BoE policy decisions, UK inflation, yen risk flows | Massive breakouts followed by deep pullbacks |

Psychology Tip: Don’t get shaken out by fakeouts. GBP/JPY often retests breakout levels violently before committing to a trend. Stay patient, stay structured.

- Tactic 1: Use the London open for directional bias.

- Tactic 2: Combine ATR-based stops with tight trailing to lock in fast-moving profits.

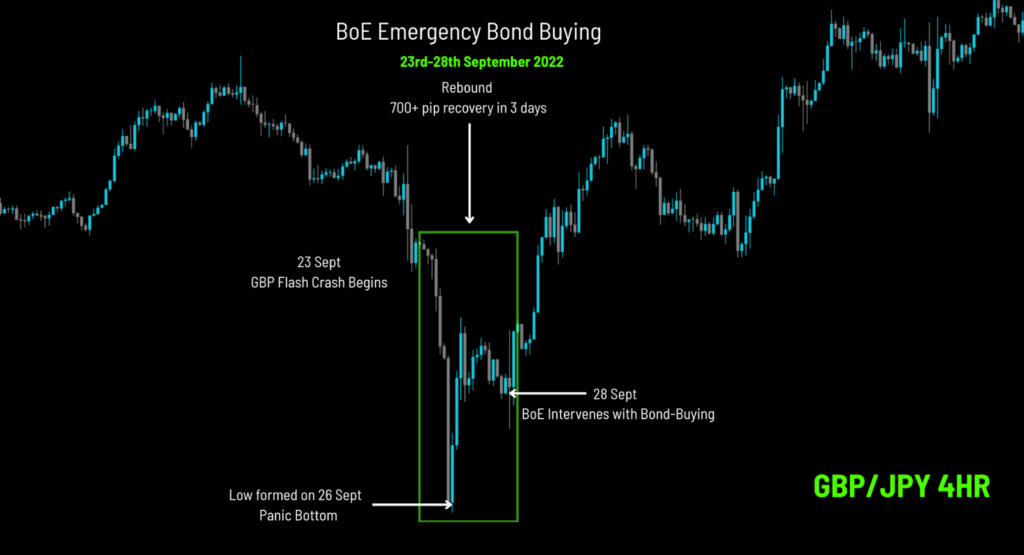

Volatility in Action: When GBP/JPY Made Headlines

In September 2022, GBP/JPY made history. Then–PM Liz Truss’s government unveiled a shock “mini-budget” with unfunded tax cuts. The pound crashed. Gilt yields exploded. And GBP/JPY plummeted in real time.

Days later, the BoE stepped in with emergency bond-buying to stabilise the market. GBP/JPY snapped back violently – creating one of the most extreme whipsaws in recent memory.

Notice the sharp plunge beginning on 23rd September, bottoming on the 26th. The Bank of England’s emergency bond-buying on 28th September then triggered a sharp 700+ pip recovery in just three days–showcasing the dramatic whipsaw nature of GBP/JPY.

2. USD/TRY – High-Risk, High-Reward Pair

The Turkish Lira has become a symbol of economic turbulence–its value eroded by years of inflation, political interference, and unconventional central bank moves.

USD/TRY is the battlefield where these forces clash. It doesn’t just reflect policy–it reveals the fault lines in Turkey’s fragile economy, often in the form of explosive, one-sided moves.

| Volatility Range | Key Drivers | Typical Behaviour |

| 200–300+ pips/day | Turkish inflation, central bank manipulation, US rate decisions | Sharp directional swings, aggressive breakouts, frequent gaps |

Psychology Tip: Avoid overexposure due to high swap costs and frequent price gaps.

- Tactic 1: Swing trade around CPI and CBRT news

- Tactic 2: Use wide stops and aim for higher R:R.

Volatility in Action: When USD/TRY Made Headlines

USD/TRY surged and then crashed by over 50,000 pips on 20 December 2021, after President Erdogan unveiled the FX-linked deposit scheme. Initially viewed as a stabilising measure, it triggered a dramatic intraday reversal — with the lira recovering nearly 30% in hours — marking one of the wildest episodes in the pair’s history.

This chart captures the chaos of that first day, where USD/TRY reversed over 5 lira in a flash, igniting a whipsaw that stunned traders and defined a new era of Turkish FX volatility.

3. GBP/NZD – Wide Spread, Wild Ride

GBP/NZD is often skipped by beginners due to its wide spreads–but professionals love its momentum. This pair moves in strong, impulsive waves, reacting to divergences in UK and New Zealand economic data, dairy export fluctuations, and broader risk sentiment.

| Volatility Range | Key Drivers | Typical Behaviour |

| 140–280 pips/day | UK and NZ interest rate differentials, dairy prices, risk sentiment | Sharp trends with deep retracements, volatile during news releases |

Psychology Tip: Don’t let the spread scare you off—just scale accordingly and wait for confirmation. GBP/NZD often rewards patience with strong follow-through.

- Tactic 1: Focus on clean breakouts or pullbacks after major data.

- Tactic 2: Best traded during the London and early Asia sessions, especially around UK CPI or RBNZ rate decisions.

Volatility in Action: When GBP/NZD Made Headlines

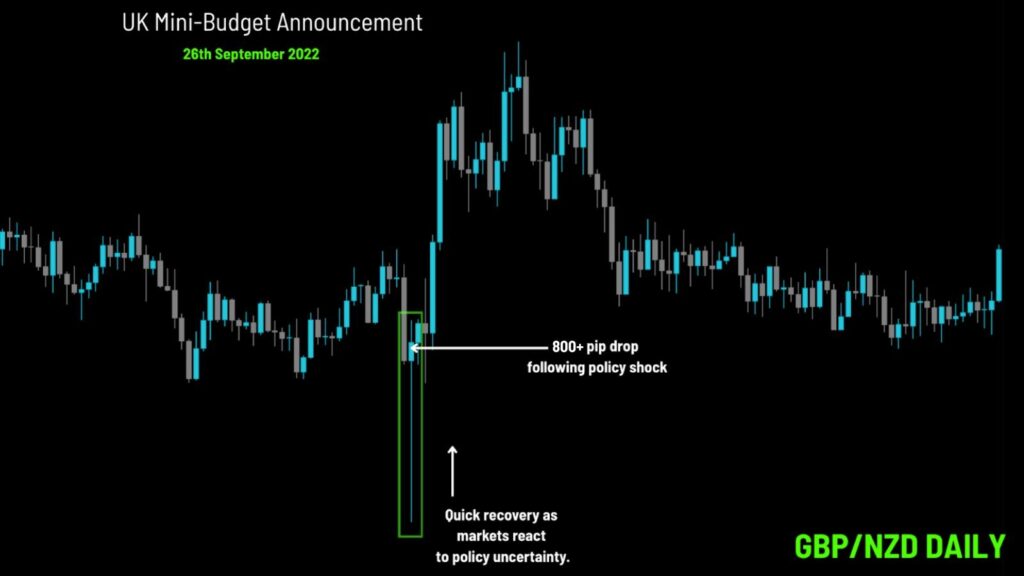

On September 26, 2022, GBP/NZD experienced a dramatic flash drop following the UK government’s mini-budget announcement.

The government’s unveiling of unfunded tax cuts triggered immediate panic, leading the pound to plummet against the New Zealand dollar. GBP/NZD dropped over 800 pips in a matter of hours before a partial recovery, demonstrating how policy uncertainty can shake market sentiment.

4. USD/ZAR – Emerging Market Tension

USD/ZAR reacts sharply to risk sentiment, gold prices, and South Africa’s economic and political shifts. This pair is often at the mercy of geopolitical shocks and regional instability, making it prone to wild swings, especially in times of uncertainty.

| Volatility Range | Key Drivers | Typical Behaviour |

| 120–200 pips/day | US CPI, Fed decisions, South African political news | Rapid reactions to news, frequent gaps, erratic price swings |

Psychology Tip: Brutal overnight gaps make USD/ZAR a challenging pair. Reduce position size and avoid overnight exposure to mitigate risks.

Tactic 1: Optimal for event-driven swing trades.

Tactic 2: Avoid scalping in periods of heightened uncertainty, such as political news or global risk-off conditions.

Volatility in Action: Zuma’s Finance Minister Firing

On 9 December 2015, South Africa’s President Jacob Zuma abruptly fired respected Finance Minister Nhlanhla Nene — a decision that blindsided markets and sparked panic over the country’s fiscal future.

Within hours, USD/ZAR spiked violently as investors priced in a collapse in credibility and looming credit downgrades.

As a result, USD/ZAR surged over 13,000 pips from December 9th to 11th. What began as a 1-day panic spiralled into a multi-day meltdown in the rand, with the pair rallying nearly 9% in just three sessions — a staggering move even by emerging market standards.

5. GBP/AUD – Brexit Fog Meets China Proxy

GBP/AUD is influenced by a unique mix: UK inflation and politics (like Brexit) on one side, and Australia’s economic health—often a proxy for China’s demand—on the other. This pair is highly sensitive to both Brexit developments and China’s economic performance, making it a wild ride for traders.

| Volatility Range | Key Drivers | Typical Behaviour |

| 140–280 pips/day | UK inflation, Australian employment data, Chinese PMI | Frequent fakeouts, volatile ranges, sharp reversals |

Psychology Tip: GBP/AUD is prone to false breakouts and sharp reversals. Patience and a disciplined entry strategy are essential for navigating the volatility.

Tactic 1: Combine Fibonacci levels with price action for swing trades.

Tactic 2: Focus on entries around the London close when market liquidity is highest.

Volatility in Action: GBP/AUD and the Flash Crash Surge

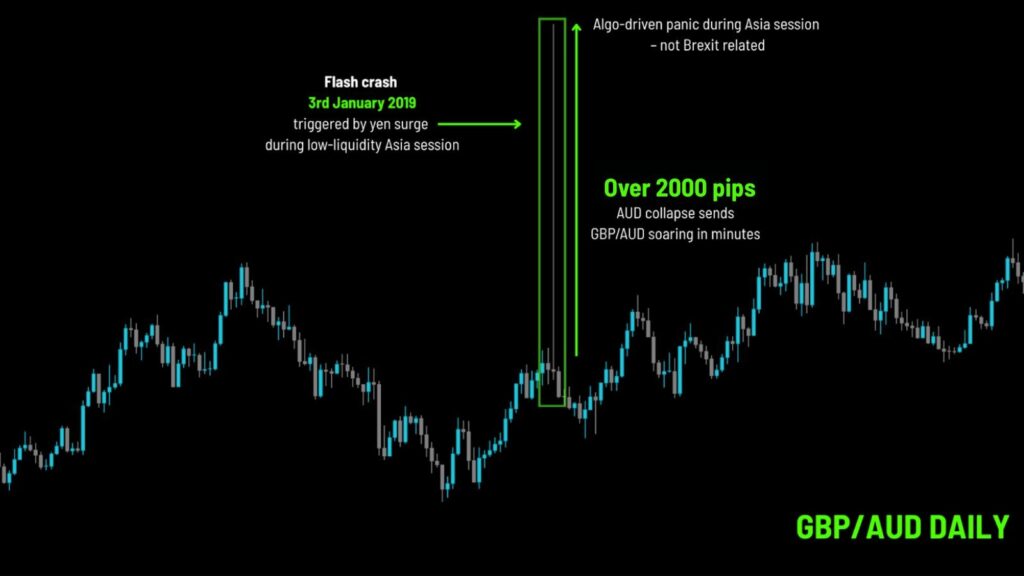

On 3 January 2019, GBP/AUD experienced a shocking intraday spike of over 2,000 pips during one of the most violent flash crashes in recent forex history. The move wasn’t driven by UK or Brexit-related news – instead, it was the result of a sudden surge in demand for the Japanese yen during illiquid Asian trading hours.

As the Australian dollar collapsed against the yen, cross-pairs like GBP/AUD were sent soaring. This event highlighted the chain-reaction nature of volatility in the forex market – where a crisis in one corner can trigger explosive moves elsewhere, even when unrelated to the currency pair’s fundamentals.

6. USD/MXN – Oil and Politics

USD/MXN reflects shifts in US-Mexico relations, oil prices, and Mexican political cycles. This pair moves sharply on economic announcements, geopolitical tensions, and changes in the global oil market.

| Volatility Range | Key Drivers | Typical Behaviour |

| 100–180 pips/day | Crude oil prices, US CPI, Mexican elections, political risk | Wild swings during news, gappy moves, sensitive to US-Mexico dynamics |

Psychology Tip: USD/MXN is highly volatile around political events and global risk-off scenarios. Reduce position size and avoid trading during low liquidity periods.

Tactic: Use breakout-fade setups around key economic releases, especially US CPI and Mexican political news.

Volatility in Action: When USD/MXN Made Headlines

Starting from March 2020, USD/MXN surged by more than 58,000 pips, breaking above 25.00 for the first time in history. This explosive move was driven by the perfect storm of a global oil price collapse, the COVID-19 pandemic, and a powerful flight to the US dollar as investors scrambled for safety.

As a major oil exporter, Mexico’s economy was hit hard by plummeting crude demand and OPEC+ tensions, causing a brutal selloff in the peso. For traders, it was a textbook example of how fast emerging market currencies can unravel when macro fear grips global markets.

7. USD/SEK – Nordic Market Moves

USD/SEK is driven by US economic data, Swedish central bank policy, and global commodity price shifts. While generally less volatile than some emerging-market pairs, USD/SEK can experience sharp moves during key economic events or geopolitical developments.

| Volatility Range | Key Drivers | Typical Behaviour |

| 80–140 pips/day | US economic data, Swedish interest rates, global risk sentiment | Strong reactions to central bank decisions and economic reports |

Psychology Tip: USD/SEK can have sharp, erratic moves during Fed or Riksbank decisions. It’s best to trade with a defined strategy and avoid entering during low liquidity hours.

Tactic: Focus on Riksbank and Fed policy decisions for entries. Look for moves post-announcement or when commodity prices shift unexpectedly.

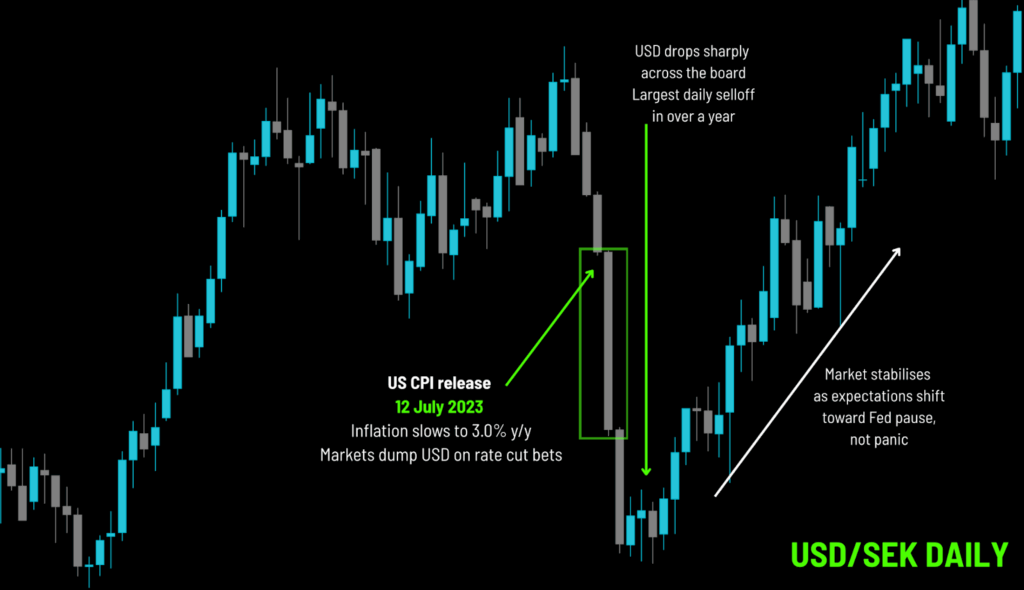

Volatility in Action: When CPI Shook the USD

On 12 July 2023, USD pairs saw a sharp, sudden drop after US CPI data came in softer than expected. Headline inflation slowed to 3.0%, triggering a broad repricing of interest rate expectations.

Markets interpreted the print as a sign the Fed was nearing the end of its tightening cycle, and the dollar fell across the board – with some pairs moving over 1,000 pips in a single session.

Treasury yields tumbled, and risk assets surged. It was a reminder that even one data release can jolt the forex market when it shifts the monetary policy narrative.

Moving Forward: USD/SEK in 2025

USD/SEK remains sensitive to US economic data, Riksbank decisions, and commodity market trends. Keep an eye on US CPI, interest rate decisions from both the Fed and Riksbank, and any geopolitical developments that could spur volatility.

8. NZD/JPY – Low Volume, High Drama

NZD/JPY trades like AUD/JPY’s skittish cousin; less liquidity, more spikes. It’s driven by RBNZ policy, Asian risk sentiment, and global commodities.

| Volatility Range | Key Drivers | Typical Behaviour |

| 70–130 pips/day | RBNZ policy, Asian risk sentiment, global commodities | Sharp intraday spikes, low liquidity, erratic in risk-off moves |

Psychology Tip: Be surgical with entries and risk management. NZD/JPY can move aggressively in low liquidity, so avoid hasty decisions during market closes.

Tactic: Use limit orders at key support and resistance levels, and avoid breakout trades.

Volatility in Action: When NZD/JPY Unwound Fast

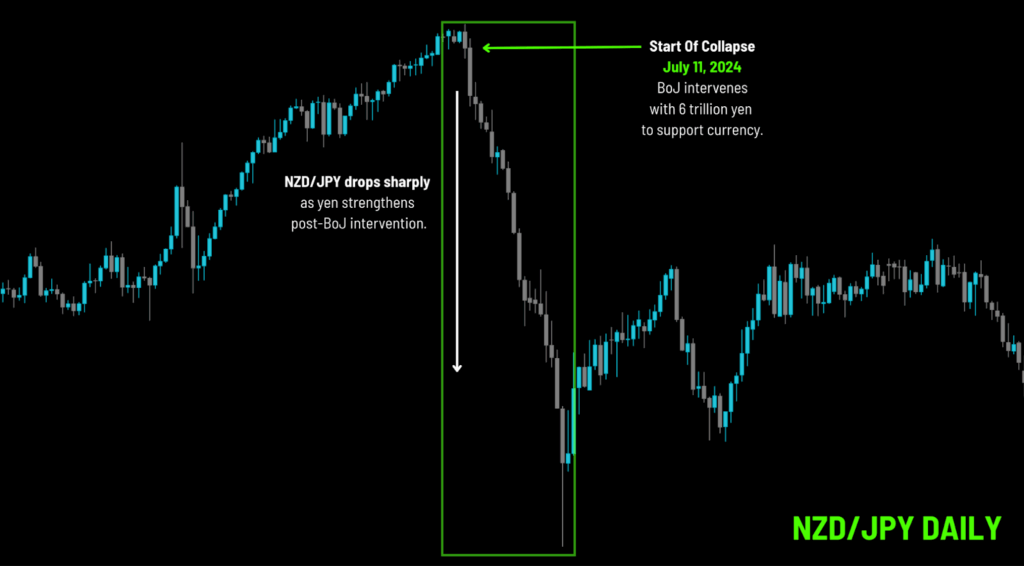

On 11 July 2024, NZD/JPY experienced a violent plunge after the Bank of Japan intervened in the currency markets, deploying nearly 6 trillion yen to halt the yen’s decline. The surprise intervention triggered an immediate spike in JPY strength, sending carry trades like NZD/JPY crashing lower.

Within hours, the pair had dropped over 1,500 pips, marking one of the sharpest intraday moves of the year. As markets digested the shock and recalibrated for potential future action from the BoJ, NZD/JPY staged a partial recovery – but the damage was done. It was a stark reminder that policy intervention can override technicals, sentiment, and fundamentals in a flash.

9. EUR/USD: The Classic Pair

The EUR/USD pair experienced significant volatility in April 2025, driven by a confluence of factors including diverging monetary policies, geopolitical uncertainties, and shifting investor sentiment.

| Volatility Range | Key Drivers | Typical Behaviour |

| 100–250 pips/day (early April 2025) | Divergent Fed and ECB policies, escalating trade tensions, US and Eurozone inflation data | Sharp spikes, breakout moves, reduced liquidity under stress |

Psychology Tip: EUR/USD volatility is often fuelled by sudden shifts in economic sentiment or unexpected policy announcements. Traders should avoid reacting impulsively to initial moves and instead wait for confirmation from sustained price action, particularly around major news events.

Tactic 1: Focus on trading during high-liquidity sessions, particularly the London and New York overlap.

Tactic 2: Use catalysts such as US CPI releases, ECB interest rate decisions, and major geopolitical developments to time entries.

Tactic 3: Maintain disciplined risk management when trading around economic data due to the potential for sharp intraday movements.

Volatility in Action: When EUR/USD Liquidity Collapsed in April 2025

On 9 April 2025, EUR/USD experienced one of its most extreme liquidity collapses since the COVID-19 crisis. According to a Risk.net’s report, liquidity conditions deteriorated sharply, with spreads widening and available trading volumes drying up.

During this period, EUR/USD surged over 400 pips, rising from $1.0900 to $1.1145 before sharply reversing below $1.10. This surge was triggered by escalating global trade tensions, following the announcement of new US tariffs, and diverging expectations between the Federal Reserve and the European Central Bank.

It was a textbook display of how even the most liquid forex pairs can experience violent instability when liquidity vanishes, underscoring the importance of disciplined risk management during macro-driven volatility.

Bonus: XAU/USD – The Volatility King

Gold (XAU/USD) isn’t a forex pair, but it’s a key focus for many traders due to its massive liquidity, fast market movements, and high reaction to macro news. Gold is highly volatile, especially during inflation data, Fed policy decisions, and geopolitical events.

| Volatility Range | Key Drivers | Typical Behaviour |

| 150- 300+ pips/day | Inflation, Fed policy, geopolitical risk | Massive liquidity, fast reactions to news, prone to intraday fakeouts |

Psychology Tip: XAU/USD moves rapidly during global economic turmoil and inflationary fears. Be patient and wait for market confirmation during volatile times, as gold can easily move in both directions before settling into a trend.

Tactic 1: Trade during London/NY overlap using session highs/lows and Fibonacci levels.

Tactic 2: Wait for price retests to improve risk-to-reward ratios.

Volatility in Action: The Unanticipated Start of a Year-Long Surge

In April 2024, XAU/USD experienced a sharp rally that defied prior market expectations, driven by a sudden acceleration in global inflation concerns and significant policy shifts from the Federal Reserve.

While inflation had been a growing concern since 2023, the magnitude and speed of the central banks’ responses caused a more rapid surge in gold prices than anticipated, breaking away from previous projections of a gradual recovery.

The Bottom Line: How to Survive and Thrive in Volatile Forex Markets

| Tip | What It Means | Why It Matters |

| Use ATR to Adjust Stops and Lot Sizes | Use the Average True Range to set your stop-loss and position size. Bigger ATR = wider stop, smaller lot. | Aligns your risk to market volatility. Prevents oversized losses during wild moves. |

| Trade during liquid sessions | Focus on the London and New York sessions when volume is highest. | Tighter spreads, better fills, and cleaner price action. Avoids slippage and low-volume traps. |

| Focus on 1–2 volatile pairs | Don’t spread yourself too thin. Master just one or two high-volatility pairs. | Builds consistency and confidence. Each volatile pair has a unique personality and rhythm. |

| Journal everything | Record every trade, including entry/exit, reason, and emotional state. | Turns volatility into a learning tool. Helps spot patterns and refine your strategy over time. |

Surviving and thriving in volatile forex markets requires more than just technical analysis–it demands a disciplined approach to understanding the drivers of volatility and leveraging them to your advantage.

By staying ahead of key economic releases, understanding geopolitical developments, and keeping a close eye on central bank policies, traders can position themselves for success in even the most unpredictable markets.