What is a Lot in Forex and What are Lot Sizes?

Discover what a ‘lot’ means in forex trading and how it can impact your profits. Learn the basics and take your trading to the next level.

When you step into the world of forex trading, you quickly discover that understanding the basics is essential to long‐term success. One such fundamental concept is the “lot”, a standardised unit that defines the size of a trade.

This article explores different lot types and their impact on risk management in the foreign exchange market.

Let’s dive in.

Understanding Lot Sizes in Forex Trading

Entering the forex market requires a solid grasp of fundamental concepts, and one of the most crucial is understanding lot sizes. A lot in forex refers to a standardised unit that dictates the volume of a trade.

The appropriate lot size determines your risk exposure, potential profits, and losses.

What is a Lot in Forex Trading?

A lot in forex trading is a predetermined quantity of currency units used to execute trades. Instead of randomly selecting trade sizes, traders use standardised lots, which helps manage trading capital effectively.

Different Forex Lot Sizes

Forex lot sizes are categorised into four primary types:

| Lot | Units | Description |

| Nano Lot | 100 | Smallest trade size, ideal for beginner traders with limited capital. |

| Micro Lot | 1,000 | A small trading size suitable for testing strategies and low-risk trades. |

| Mini Lot | 10,000 | One-tenth of a standard lot commonly used by retail traders. |

| Standard Lot | 100,000 | The primary lot size in forex trading, preferred by professional forex traders. |

This table summarises the different lot sizes and their respective currency units. For example, if you trade the currency pair EUR/USD pair with a micro lot, you are trading 1,000 Euros. A one-pip movement in a micro lot equals approximately $0.10, making it a great choice for beginner traders or those wanting to manage risk carefully.

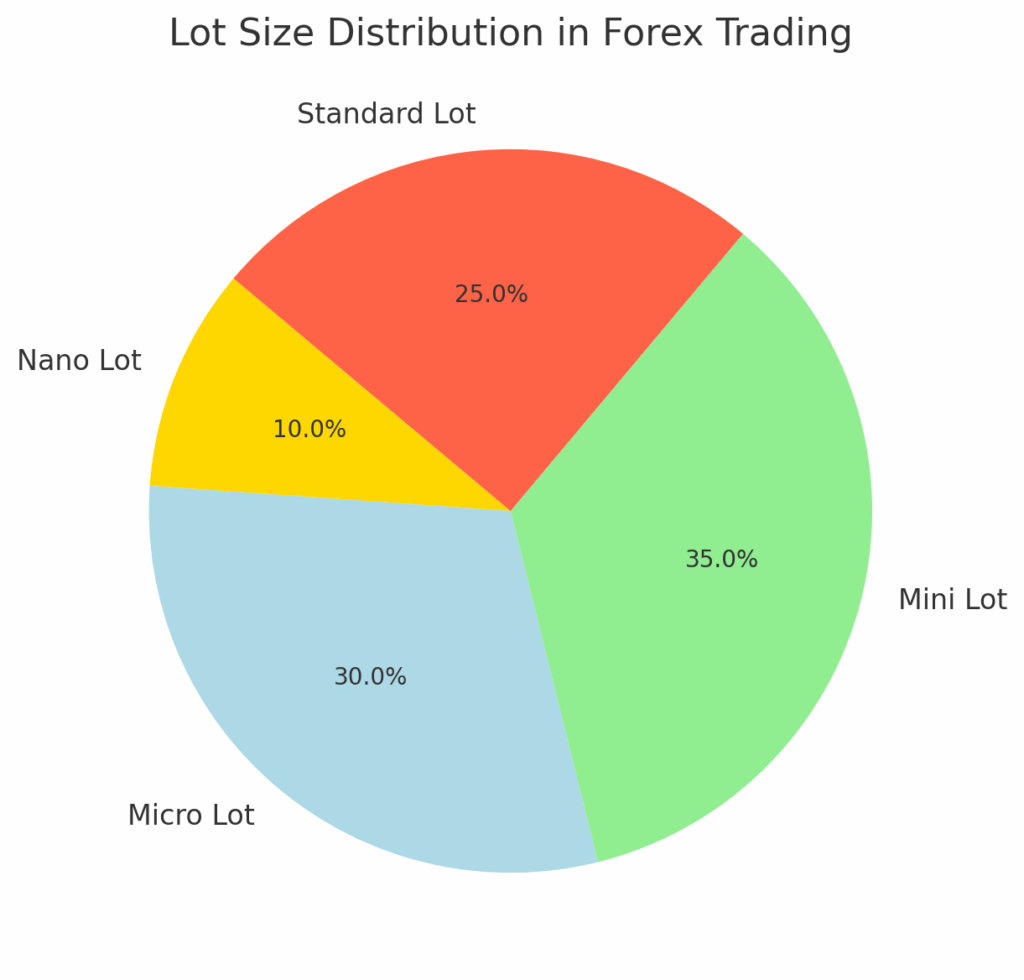

Lot Size Popularity in Forex Trading

The following chart illustrates the estimated distribution of lot sizes based on popularity to help traders understand how often different lot sizes are used in the forex market.

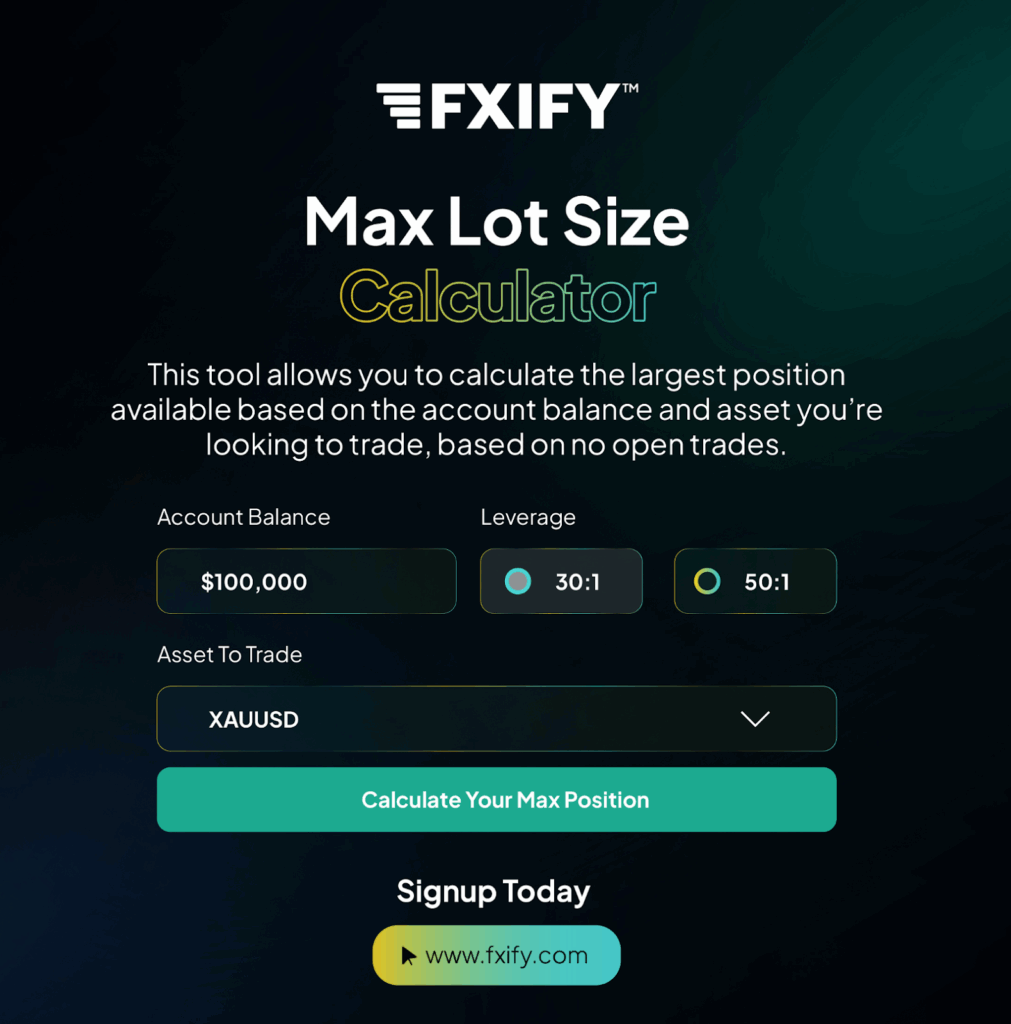

What’s the Maximum Lot Size You Can Trade?

Selecting the right lot size isn’t just about choosing a number, it’s about balancing your account balance, risk tolerance, and leverage. These elements work together to determine the maximum position size you can safely open.

Want to simplify the process?

Use the FXIFY Max Lot Size Calculator to instantly calculate the optimal lot size based on your available capital, the asset you’re trading, and your broker’s leverage settings. It’s especially helpful for finding the maximum lot size available when you have no open trades, allowing you to plan your entries with precision and stay within your risk limits.

Remember, while leverage can amplify your profits, it also magnifies your losses.

Always choose a lot size that aligns with your personal risk management strategy rather than chasing higher profits with oversized positions.

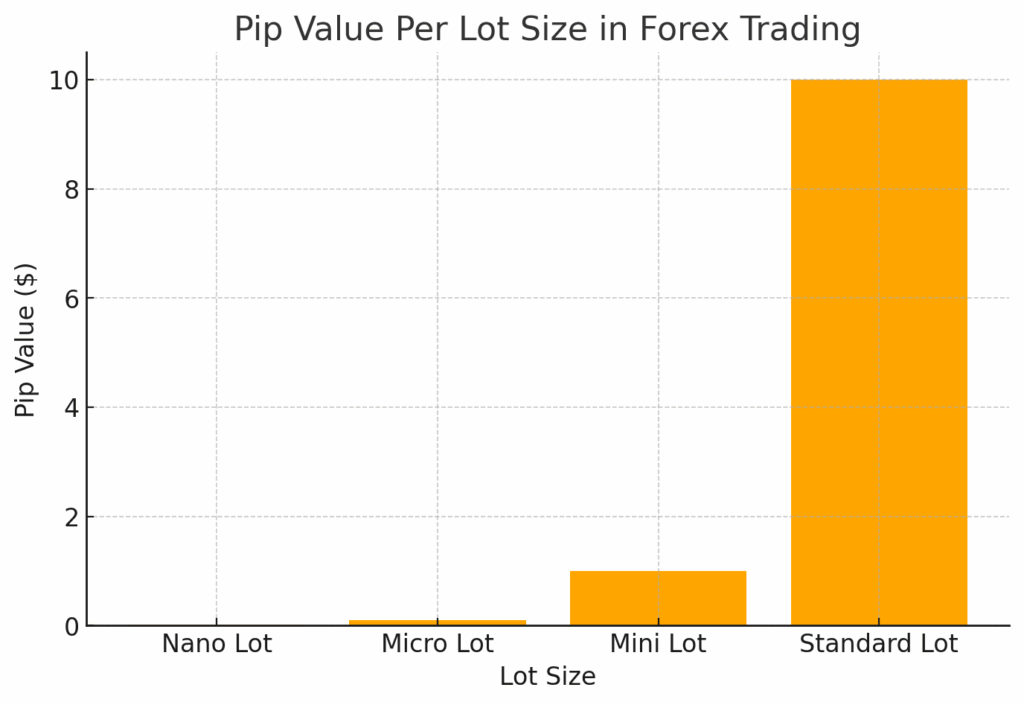

Pip Values Based on Lot Sizes

Understanding pip value is crucial for effective risk management. The following chart visually represents the pip value for different lot sizes, helping traders gauge their potential profit or loss per pip movement.

| Lot Type | Pip Value For Eur/USD |

| Nano Lot | $0.01 per pip |

| Micro Lot | $0.10 per pip |

| Mini Lot | $1 per pip |

| Standard Lot | $10 per pip |

A micro lot is ideal for beginner traders looking to minimise losses, while standard lots offer significant profit potential but also high risk.

Visual representation of pip values for different lot sizes in forex trading.

Example of Lot Size Impact

Imagine a trader places a 1.0 standard lot trade on EUR/USD. If the price moves 10 pips in their favour, they gain $100. If the movement is negative, they lose the same amount. Conversely, with a micro lot, the gain or loss would be just $1.

How Lot Size Affects Profit and Loss

The graph below illustrates how different lot sizes impact potential profit or loss as the price moves in pips. A larger lot size increases potential gains and risks, making choosing the right position size based on your risk tolerance and strategy essential.

The Role of Leverage in Lot Sizing

Leverage amplifies both potential gain and risk. For instance, a trading platform offering 50:1 leverage allows a trader with $1,000 in capital to control a $50,000 position. While this can increase gain potential, it also significantly magnifies losses, especially when lot sizes are too large relative to account size. Poor leverage management is one of the leading causes of account blowouts in retail trading.

That’s why precise lot sizing is so important. Calculating your ideal lot size based on your capital, leverage, and risk appetite can make all the difference in sustainable trading.

Need help determining your maximum position size?

Use the FXIFY Max Lot Size Calculator to find the optimal lot size based on your available balance and leverage, before opening a trade. It’s a powerful tool to stay within safe risk limits and avoid overexposure.

Common Lot Size Mistakes and How to Avoid Them

| Mistake | Consequence | Solution |

| Trading a lot size too large for the trading account | Higher risk of margin calls | Stick to a strict risk management rule |

| Ignoring stop-loss placement | Exposes trader to too much capital loss | Factor stop-loss into lot size decisions |

| Mismanaging leverage and margin | Can lead to liquidation | Adjust position size to match risk tolerance |

| Emotional trading | Impulsive larger trades after wins | Maintain a consistent trading strategy |

Frequently Asked Questions

How much money is 1 lot in forex?

A standard lot equals 100,000 units of the base currency. If trading EUR/USD, 1 lot means controlling 100,000 euros.

What does 0.01 lot mean in forex?

A 0.01 lot is a micro lot, representing 1,000 units of the base currency.

How many lots can I trade with $100?

If you have $100 in trading capital, the number of lots you can trade depends on your account leverage and risk management approach. For example, with 1:100 leverage, your $100 gives you access to a position size of up to $10,000 in the market.

That said, it’s not advisable to use the full leverage available. Overleveraging increases the risk of margin calls and account blowouts. A more conservative and sustainable approach is to trade micro lots (0.01 lot or 1,000 units), which allows you to open smaller positions while maintaining a healthy risk percentage.

Remember: Just because you can trade more doesn’t mean you should. Effective lot sizing and leverage control are key to preserving capital and growing your account over time.

How many pips is a lot?

A lot in forex refers to trade size rather than pips. However, pip value varies based on lot size, affecting potential profit and loss.

Final Thoughts

Understanding lot sizes is vital for managing risk exposure and improving trading performance. Whether using nano lots for risk control or standard lots for significant profit potential, the right trade size aligns with your trading strategy.

Keep in mind:

- Risk Management Is Paramount: Always know the amount of capital you’re willing to risk.

- Leverage Wisely: Leverage can work for you or against you; always adjust your lot size to suit your trading goals.

- Stay Disciplined: In the fast-moving forex trading market, discipline and consistency in your trade sizing can make the difference between sustainable growth and account depletion.

“Trading is not about having the biggest position; it’s about having the right position.”

Armed with this knowledge, you’re now better prepared to navigate the intricacies of forex market trading. Whether you’re just starting out or looking to refine your strategy, remember that every pip counts–and so does every lot.