FXIFY Trade of the Month: March Recap

The top FXIFY™ trader for March secured $61,843 on a $200K — get a recap on how it happened. Your success story starts here!

Welcome back to another insightful edition of the FXIFY™ Monthly Recap, where we shine the spotlight on our trading community.

Discover the top traders, key market movements, and standout performances from last month.

March ushered in a surge of volatility, sparked by the U.S. administration’s sweeping tariff measures targeting a broad range of imports. The announcement triggered risk-off sentiment, driving sharp quarterly pullbacks in the S&P 500 and Nasdaq Composite. In contrast, safe-haven flows accelerated, propelling gold to all-time highs as investor caution took centre stage.

Let’s break down the top trades, key setups, and standout payouts that shaped March 2025.

Top 5 Payouts of the Month

For the second consecutive month, Rasul has claimed his spot at the top of the leaderboard!

Our top earning traders in March were Rasul, Durgam, Ahtesham, Abdallah, and Tomas. Congratulations!

| Rank | Username | Account Size | Payout Amount | Biggest Win |

|---|---|---|---|---|

| 1 | Rasul I. | $400K – Two Phase – LIVE | $39,600.00 | $38,096.00 |

| 2 | Durgam Al. | $400K – Two Phase – RAW | $16,613.00 | $25,115.26 |

| 3 | Ahtesham A. | $200K – Two Phase – RAW | $16,210.00 | $10,205.00 |

| 4 | Abdallah M. | $200K – Two Phase – LIVE | $15,290.00 | $2,688.25 |

| 5 | Tomas P. | $400K – Two Phase – RAW | $12,150.00 | $1,161.60 |

Trade of the Month: Aawez’s Precision Execution on XAU/USD

March’s standout trade came from FXIFY trader Aawez, who delivered an impressive $61,843.49 in realised gains on gold (XAU/USD) over just 3 days and 8 hours – showcasing patience, technical clarity, and sniper-level execution during one of the most volatile market phases of the month.

| $61,843.49 Gain Realised | XAUUSD Pair Traded | 3 DAYS, 8 HRS Holding Time |

Executed during a period of price discovery, gold was breaking into new highs with limited historical structure to trade from. Aawez captured this trade with precise timing and conviction.

Rather than chasing the move, he patiently waited for the market to come to him – spotting a textbook bullish engulfing pattern at a key support zone.

With institutional momentum building, he entered decisively – and exited just as exhaustion began to creep in, securing a flawless level-to-level move from support to the projected resistance.

Trade Breakdown

- Entry:

Aawez entered long following a confirmed bullish engulfing candle at a key support zone that had previously shown signs of consolidation—indicating its role as a key level of interest. The setup aligned with a clear momentum shift and volume spike, signalling strong buy-side interest.

- Exit:

The position was closed as price approached a projected resistance level, identified through signs of bullish exhaustion, including reduced candle body size, extended upper wicks, and declining momentum. With gold in price discovery, Aawez relied on price behaviour and order flow cues rather than historical levels, exiting precisely at $2,985.00 on 13th March with a 4HR Doji candle.

- Risk Management:

Aawez placed his stop-loss just below the support zone, accounting for potential lower lows while maintaining a favourable risk-to-reward ratio. The trade was structured to allow for natural price fluctuations without compromising protection, ensuring controlled exposure and disciplined execution.

Why This Trade Stands Out

This trade exemplifies high-level execution in a volatile, low-structure environment. By combining patience and disciplined risk management, Aawez navigated price discovery with clarity and control. This is very hard to achieve for most traders!

Rather than reacting emotionally to volatility, he relied on clean technical signals, waited for structure to confirm, and exited at the first sign of exhaustion – capturing a full level-to-level move with minimal drawdown.

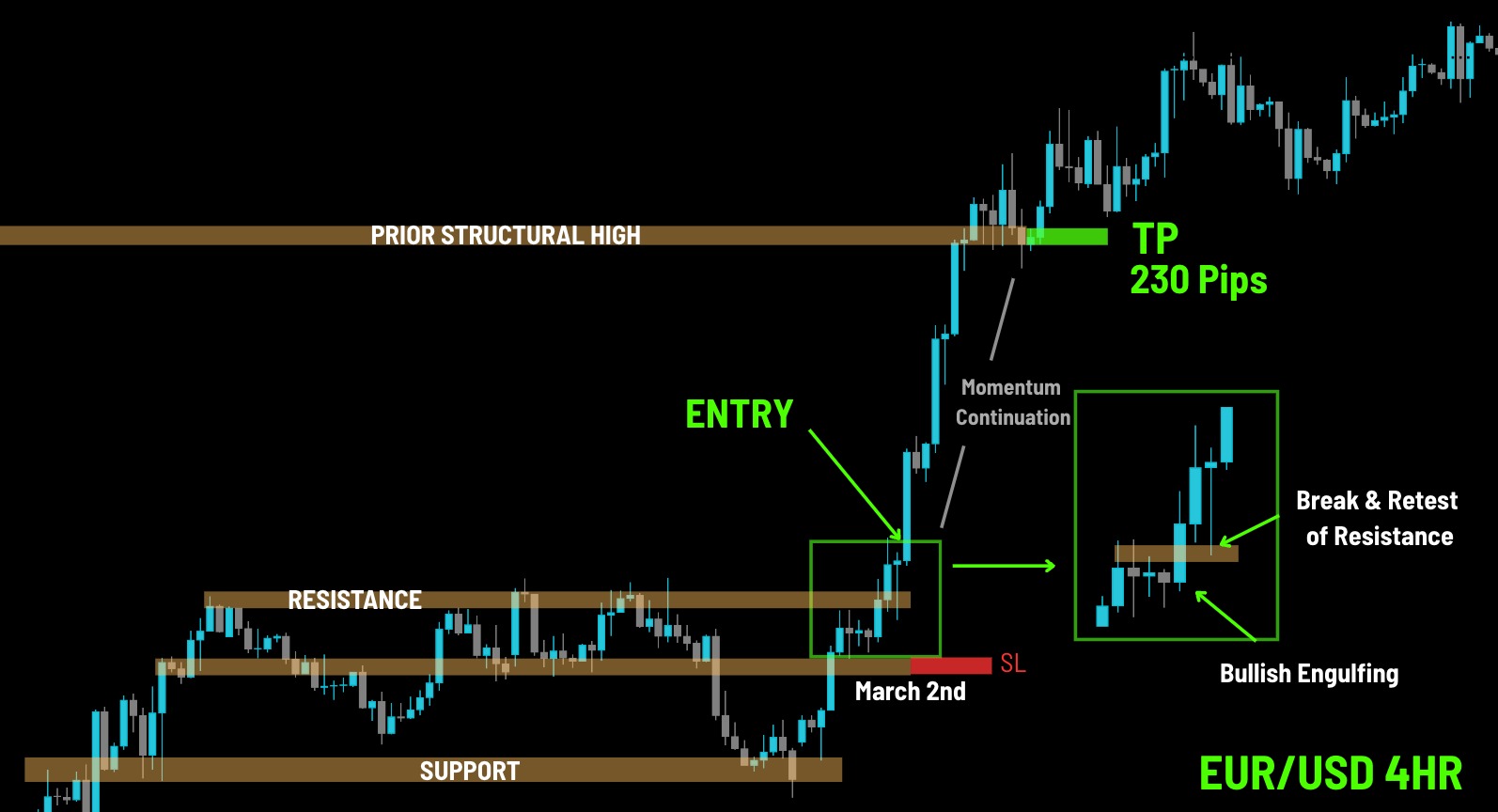

Move of the Month: EUR/USD’s Explosive Breakout Rally

In March, EUR/USD delivered one of the most explosive moves of Q1 – rallying from 1.0400 on March 1st to a high of 1.09499 by March 11th, for a staggering 549.9 pip breakout in just 10 days.

This move was fuelled by a rare alignment of high-impact fundamentals and clean technical structure:

The setup initiated with a break and retest of resistance on March 2nd, confirmed by a bullish engulfing candle and a shift in market structure. Price reclaimed a previously broken level and flipped it into support, creating the perfect base for a level-to-level rally.

Momentum accelerated as Germany announced a €500 billion fiscal stimulus on March 6th, designed to revitalise infrastructure and industrial investment. This macro catalyst triggered significant euro strength, compounded by broad USD weakness as the U.S. administration rolled out new 20% tariffs on imported goods.

The trade delivered a 230-pip level-to-level move from the support break to the prior structural high, with clean technical validation and zero drawdown post-entry. Price then extended even further to form the monthly high at 1.09499 on March 11th, marking the strongest single-currency advance of the month.

EUR/USD March Price Action Overview

| Start Date: | 3rd March |

| End Date: | 6th March |

| Starting Price: | 1.05420 |

| Ending Price: | 1.07720 |

| Pip Change: | 230 |

| Percentage Change: | 2.18% |

Top Traded Assets of March

March delivered decisive movements across FX, commodities, and indices, with traders laser-focused on momentum-driven breakouts and macro-fuelled volatility ahead of the quarterly close. Once again, XAU/USD, EUR/USD, and USTEC dominated trading activity across the FXIFY™ community. Below is a breakdown of internal trade volumes and their respective month-on-month price changes.

| Symbol | Total Trade Volume | % Price Change M/M |

| XAUUSD | $54,811,041,597 | +9.32% |

| EURUSD | $15,000,424,645 | +4.25% |

| USTEC | $10,313,513,937 | -7.77% |

🏅XAU/USD (Gold)

Gold remained the most heavily traded asset on FXIFY™, generating $54.8 Billion in volume and closing the month +9.32% higher. This marked one of gold’s strongest monthly performances in recent years – part of a broader 15% Q1 surge, its largest quarterly gain since 2016.

Bullish sentiment was fuelled by continued central bank accumulation, geopolitical tensions, and a sharp rise in safe-haven flows. Traders capitalised on sustained momentum and level-to-level cleanouts as gold entered price discovery, breaking through all-time highs above $3,100.

💶EUR/USD

EUR/USD attracted over $15 Billion in trade volume, posting a +4.25% gain for the month. The move was triggered by Germany’s €500 billion fiscal stimulus package, announced early March, which sharply boosted euro demand. Simultaneously, renewed trade tensions out of the U.S. weakened the dollar, providing additional tailwinds.

FXIFY™ traders seized the opportunity through structured breakouts, particularly in the first half of the month, as the pair cleared resistance with conviction and sustained volume.

📈USTEC (Nasdaq 100 Index)

USTEC recorded over $10.3 Billion in trade volume but ended the month down -7.77%, making it the weakest of the top-traded assets. Rising bond yields, risk-off flows, and stretched tech valuations drove the decline.

Traders within the FXIFY™ community leaned into the bearish momentum, executing clean intraday shorts and breakdown continuation setups – particularly around key psychological levels and during high-volatility U.S. session opens.

The Next Top Trader Could Be You!

This month, Aawez demonstrated the power of disciplined execution, securing $61,843.49 on his $200K FXIFY™ funded account with a precise XAU/USD breakout trade. By recognising structure, waiting for confirmation, and executing at a key support rejection with a defined risk parameter, Aawez exemplified what high-performance trading looks like.

Building on Atanas’s standout February performance and Zaid’s January success, Aawez now joins the ranks of FXIFY™’s elite traders. His composure and timing during gold’s high-volatility breakout in March serve as a clear reminder: opportunity rewards preparation.

If you’re refining your edge, managing risk, and showing up with intent – the next top trading milestone could be yours.

The next big trading success story could be yours—Stay focused!