Swing Trading vs Day Trading: Which is Best For You?

Swing trading vs day trading: Which suits you? Compare time, risk, strategy & mindset. Discover the best trading approach for your goals.

Swing trading vs day trading — two popular paths that dominate trading conversations. But choosing between them goes far deeper than just picking a style — it affects your routine, mindset, and account management.

Think of it like choosing between cardio 🏃 and strength training 💪 — both can be effective, but which one fits your personality, schedule, and goals best?

In this guide, we won’t hand you specific strategies or setups for swing trades or day trading. Instead, we’ll break down how each style works, with pros and cons and real-world examples to help you decide which one fits your trading approach.

What is Swing Trading?

Swing trading is a style built for patience and perspective. It’s about catching market swings — short- to medium-term price moves that play out over several business days to a few weeks. Unlike day trading, where positions are closed before the market ends, swing traders hold trades through the market closes, sometimes even over weekends.

Most swing traders rely heavily on technical analysis — scanning price charts, drawing support and resistance zones, spotting trends, and using technical indicators like moving averages or the Relative Strength Index (RSI) to time their entry and exit points. Some also factor in news or fundamentals, but the backbone is often the chart.

The goal? Capture the majority of a trend without needing to sit in front of the screen all day. Many swing trading strategies aim for a higher risk-reward ratio, such as 2:1 or 3:1, accepting fewer trades but potentially larger gains.

Swing trading works well in markets with clear directional moves and moderate volatility — think Forex, stocks, or even commodities. But holding trades overnight means being exposed to the risk of gaps caused by unexpected news. That’s why risk management and careful lot size allocation, stop-loss, and take-profit planning are essential.

What is Day Trading?

Day trading — or intraday trading — is built around speed, precision, and closing out positions before the trading day ends. Day traders open and close their positions within the same trading day, avoiding overnight risk and focusing on short-term price movements.

These traders live in the fast lane — analysing real-time market data, reacting to price fluctuations throughout the day, and executing trades quickly.

Common day trading approaches include scalping, trading breakouts, and mean reversion strategies. Each trade aims to grab quick profits from small moves, often using tight stop-losses and narrower take-profit levels. But it’s not just about strategy — execution speed, discipline, and emotional control are non-negotiable.

In traditional retail environments, day trading often comes with:

- Capital requirements like the $25K PDT rule (especially in the U.S.).

- Limited leverage restrictions.

- Broker-imposed margin rules that limit trade size.Strict regulatory hurdles.

- That’s why many day traders turn to proprietary trading firms like FXIFY — accessing larger capital allocations, flexible rules, and far fewer restrictions.

Best Timeframes for Swing Trading and Day Trading

Believe it or not, your trading timeframe doesn’t just affect your strategy — it shapes your daily routine, risk management, and overall lifestyle. Choosing the right timeframe becomes even more critical under prop firm rules like daily drawdowns and minimum trade durations.

But beyond just lifestyle fit, the chosen timeframe has to support your strategy’s edge. That means having a positive profit factor, even after factoring in commissions, average slippage, and execution delays.

This becomes even more important in prop trading, where rules like drawdown limits can punish volatile inoptimal entries, especially with an oversized position.

Swing Trading Timeframes

Swing traders typically focus on higher timeframes to filter out noise and target larger price moves:

- 1-Hour Charts (H1): Sharper entries for trades held 1-3 days but more vulnerable to noise.

- 4-Hour Charts (H4): Balanced signal quality and setup frequency.

- Daily Charts (D1): Clear trend structure, clean price action for swing setups.

- Weekly Charts (W1): Context for major trend direction and support/resistance levels.

- Multi-Timeframe Strategy: Analyse on weekly, daily timeframes, then fine-tune entries on H4 or H1.

Day Trading Timeframes

Day traders favour lower timeframes to capitalise on short intraday moves:

- 1-Minute (M1) & 5-Minute (M5): Popular with scalpers.

- 15-Minute (M15): Balances detail and context — good for most day trading strategies.

- 30-Minute to 1-Hour Charts: Helps define the broader trend within a trading day.

- Tick Charts: Show price changes based on trades, not time — favoured by those analysing pure market data flow.

Day Trading vs Swing Trading: Key Differences

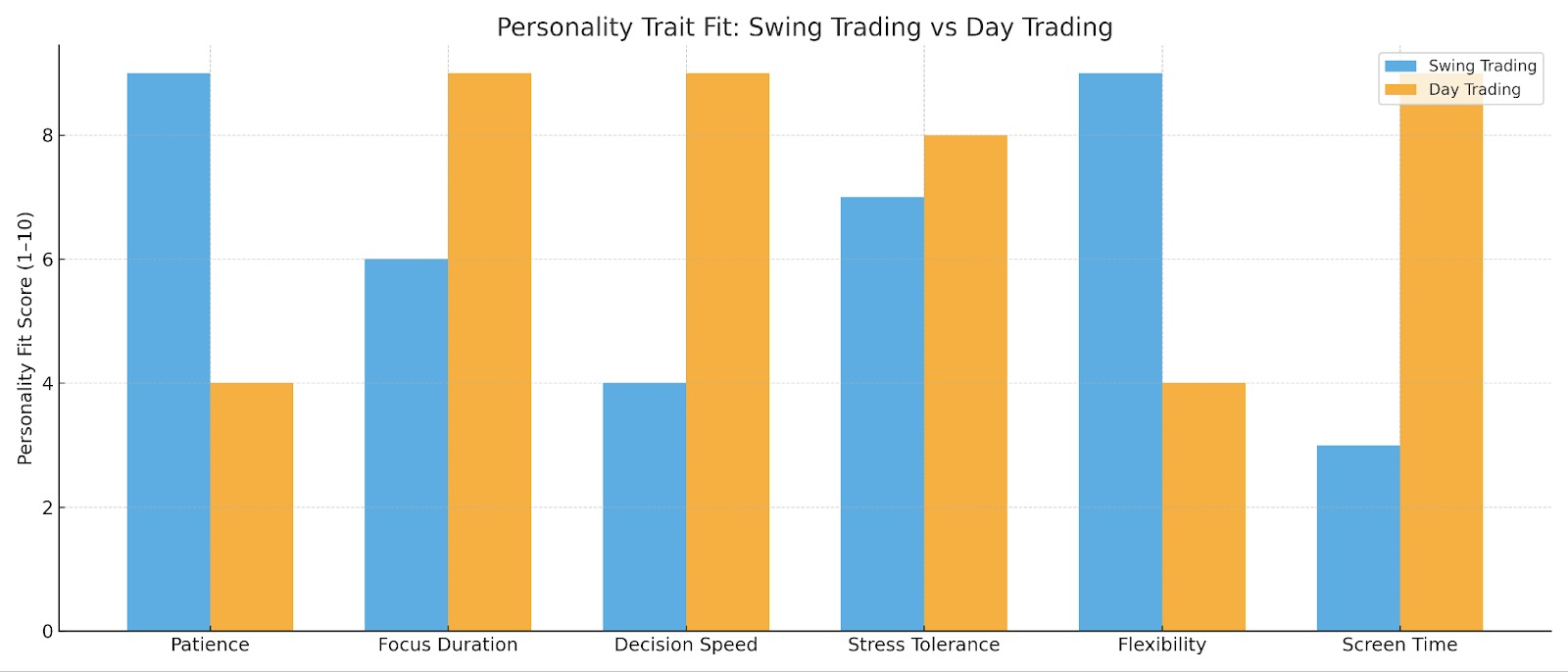

Swing trading and day trading differ not only in strategy but in how they demand your time, test your psychology, and expose you to risk. Each approach operates on distinct rhythms — and understanding those differences will be key to finding the right fit for you.

Tip: Use this table as a self-check. If you thrive under pressure and love charts, day trading might suit you. If you’re patient and want flexibility, swing trading could be more suited to your style.

| Swing Trading | Feature | Day Trading |

| Days to weeks | Trade Duration | Within the same trading day |

| Part-time friendly | Time Commitment | Often a full-time job |

| Fewer trades | Trading Frequency | Many trades per day |

| Occasional check-ins | Monitoring | Constant during active hours |

| Wider SLs, larger TPs | Stop-Loss & Take Profit | Tighter SLs, smaller TPs |

| Smaller lots, larger swings | Lot Size | Larger lots, smaller targets |

| Overnight/weekend gaps | Drawdown Exposure | Intraday volatility only |

| Slower, more patient | Stress & Pace | Fast-paced, high-pressure |

| Bigger gains per trade | Profit Potential | Frequent, smaller profits |

| Less session-dependent | Market Sessions | Often session-driven |

| Less affected | Spreads & Costs | Highly sensitive |

| Gentler for beginners | Learning Curve | Steeper, more demanding |

| Gaps can lead to losses if unmanaged | Risk of Losing Money | Frequent trades can compound losses quickly |

Next, we’ll explore how different market sessions affect day traders — and why timing matters.

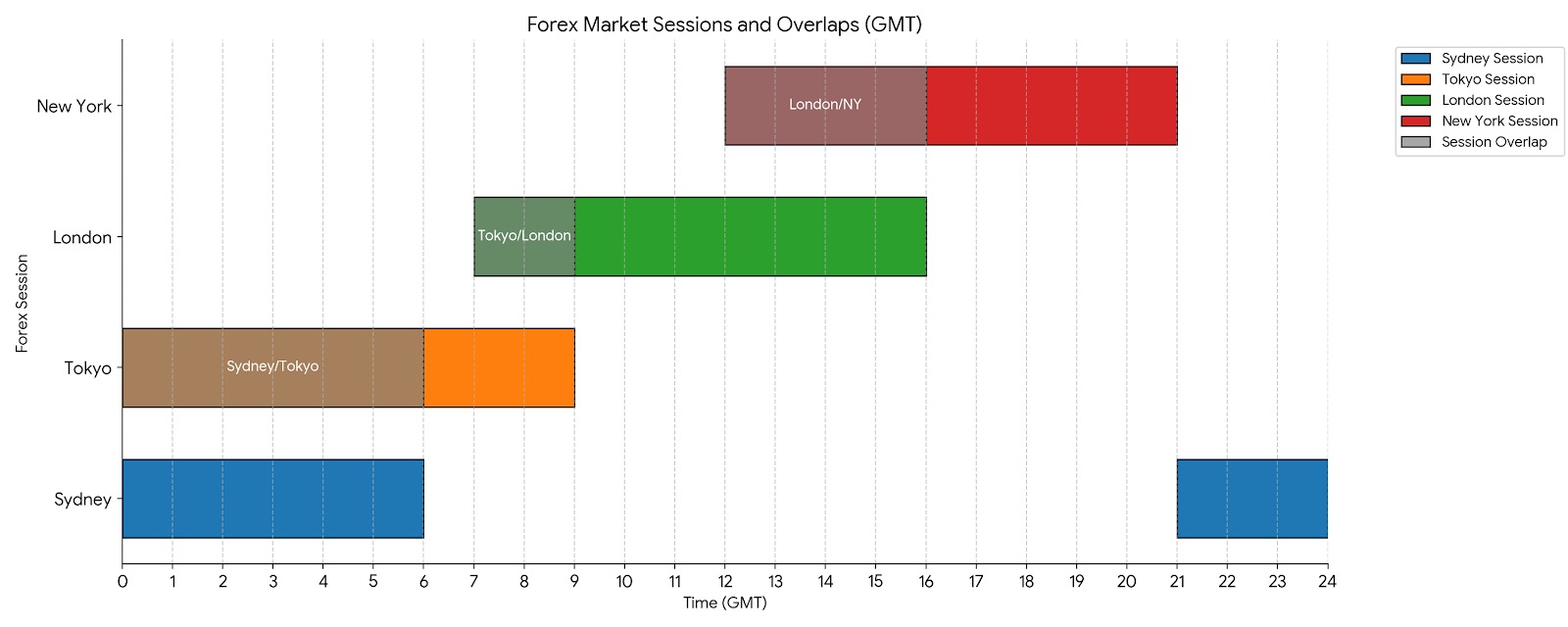

Best Market Sessions for Day Trading

Before we dive into timing strategies, let’s start with what “market sessions” actually are.

Market sessions are distinct trading periods tied to the business hours of major financial hubs like London, New York, and Tokyo.

Because Forex trades 24 hours a day, global markets are divided into major sessions — based on when financial centres around the world open for business. Each session brings its own rhythm of liquidity, volatility, and trading opportunities.

For day traders, these sessions are critical. Since you’re opening and closing trades within a single day, the hours you trade can make or break your results. Some sessions deliver fast-moving price action and tight spreads, while others bring low activity and choppy markets.

Let’s break them down.

Major Forex Market Sessions

The financial markets operate 24 hours a day, five days a week — but they’re driven by global centres opening and closing across time zones. Here’s how the key sessions break down:

- Sydney Session: Starts the trading week with lower volume. Most relevant for AUD and NZD pairs.

- Tokyo Session: Brings more activity to JPY pairs like USD/JPY, particularly in the early hours.

- London Session: The busiest Forex hub, driving strong volume in EUR, GBP, and USD pairs.

- New York Session: Delivers high volatility in USD pairs, commodities, and U.S. indices.

Session Overlaps

Markets are most active and liquid when major sessions overlap, making them ripe for volatile market moves. This is because multiple major financial centers are operating simultaneously, leading to a higher concentration of traders, increased trading volume, and a greater likelihood of significant economic news releases from different regions impacting the markets at the same time.

| Session Overlap | Best For | Time (GMT) |

|---|---|---|

| London–New York | High volatility, best liquidity (EUR/USD, GBP/USD, USD/CAD) | 12 PM — 4 PM |

| Tokyo–London | Moderate volatility | 7 AM — 9 AM |

| Sydney–Tokyo | Quietest overlap, best for AUD/JPY pairs | 12 AM — 6 AM |

Why Session Timing Matters

During peak sessions, spreads are tighter, slippage is lower, and price moves are more decisive — ideal conditions for most day trading strategies, especially momentum trading and breakout trading.

Outside of these windows, markets often drift in a tighter trading range, offering fewer clean setups and a greater risk of losing money due to noise or low liquidity.

Pro Tip: Align your strategy with the session. If you’re trading breakouts, the London–New York overlap gives you the best chance at explosive moves. If you’re a range trader, quieter hours may offer clearer setups between established support and resistance levels.

Mastering Swing Trading Under Prop Rules

Swing trading fits well within prop firm accounts — but only if you stay disciplined around risk and account rules.

Here’s how to adapt your swing trading approach for prop trading:

- Pre-plan trades: Use higher timeframes to map key support and resistance levels. Set price alerts when price approaches your entry zones.

- Size your positions carefully: Always calculate lot size based on your daily drawdown limit, not just your stop-loss distance.

- Use trailing stops: Once price moves in your favour, trail your stop-loss to secure profits while still allowing room for swings.

- Know your reset time: Most prop firms operate on a fixed trading day reset (e.g. midnight GMT+3). Always check your firm’s reset rules to avoid accidental violations.

- Set-and-forget (when appropriate): For well-defined trades, consider placing stop-loss, take-profit, and alerts — but monitor for any market-moving events or significant shifts.

By staying structured and prepared, swing traders can maximise flexibility while fully respecting risk management rules.

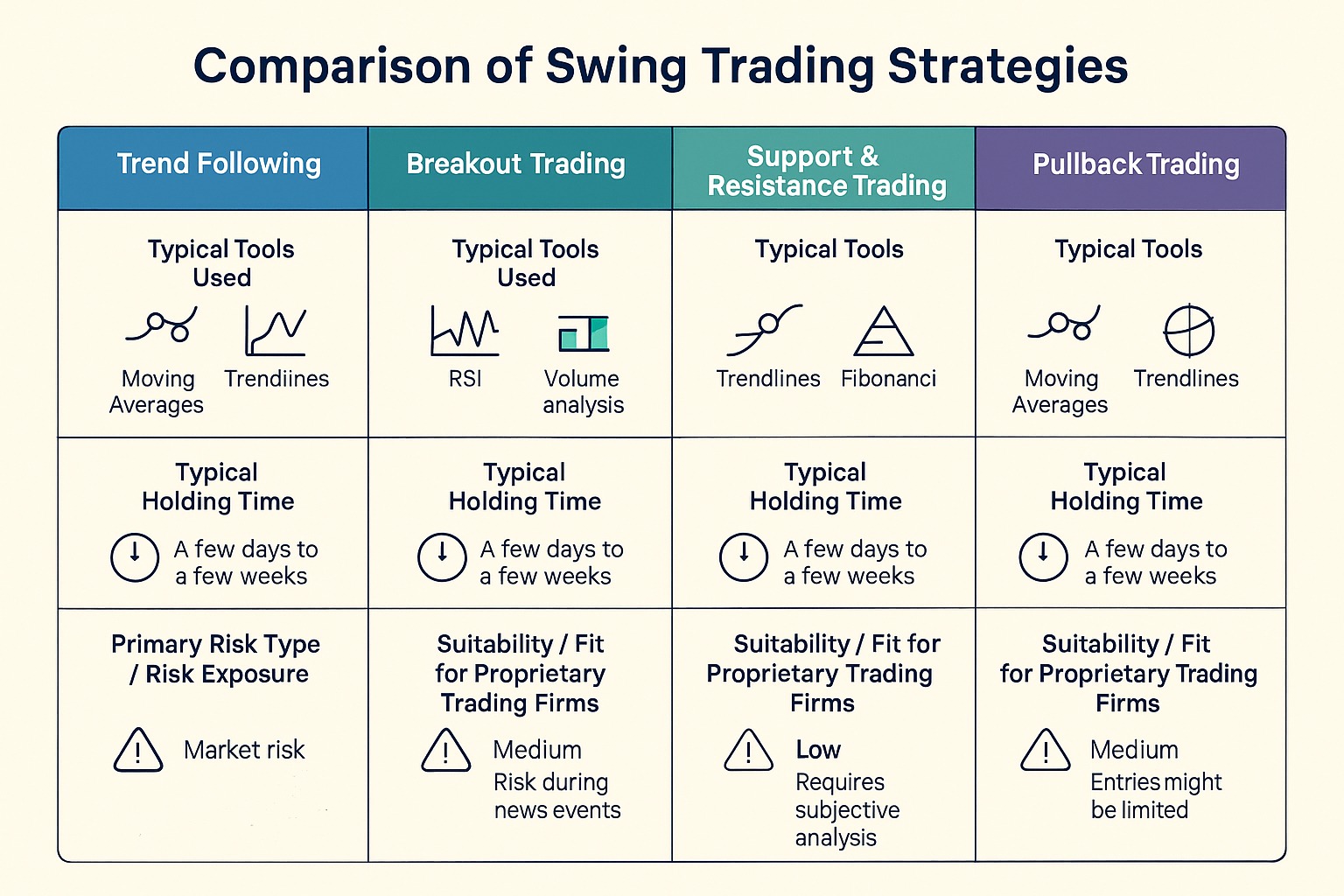

Common Swing Strategies (and How They Fit)

Swing trading isn’t one-size-fits-all. There are several distinct strategies, each with its own tools, trade logic, and risk profile. Here’s a breakdown of how they work in practice.

- Trend Following: Trade in the direction of the dominant trend using tools like moving averages or the Relative Strength Index (RSI). For example, buy pullbacks in an uptrend and ride the momentum to the next exit point.

- Support and Resistance: Identify key levels where the price has previously reversed. Place your trades near these zones with well-placed stop-loss orders to protect against sharp reversals.

- Breakouts: Look for price moving outside a defined trading range (consolidation) and enter once the breakout is confirmed — ideally with rising volume.

- Pullback Trading: Use technical indicators like Fibonacci retracements to catch short-term corrections before a trend resumes.

- Set and Forget: Define your entry, stop-loss, and take-profit, then let the trade play out — but be cautious. In prop trading, you still need to monitor for daily drawdown risk.

Mastering Day Trading Under Prop Rules

Day trading under prop firm rules is all about precision — fast decisions combined with strict risk control. Here’s how to keep your day trading efficient and compliant:

- Control your lot size: More trades mean your position sizes should be smaller to avoid stacking risk and breaching daily drawdown limits.

- Trade during active sessions: Focus on high-liquidity overlaps (like London–New York) for better volatility, tighter spreads, and smoother execution.

- Stay flexible on reward-to-risk: Not every setup will offer big targets. Some may work better with partial profits or tighter stops, depending on intraday conditions.

- Allocate dedicated screen time: Scalping often requires full attention during key sessions. Slower day trading may allow more planned entries with alerts, depending on your strategy intensity.

The key to consistent prop firm day trading isn’t speed alone — it’s staying sharp, focused, and fully in control of your risk exposure.

Common Daytrading Strategies (and How They Fit)

Day trading comes in many forms; from lightning-fast scalps to momentum plays and news-driven reactions. Each strategy fits different conditions, tools, and trader personalities. Here’s a breakdown of the most common approaches.

- Scalping: If you’re confident with fast execution and tight risk, scalping focuses on tiny price moves — often just a few pips — aiming for small but frequent wins. This works best during peak sessions (London–New York overlap) when spreads are tight and execution is reliable.

- Pullback Trading: Instead of chasing breakouts, pullback traders enter on small intraday retracements within strong trends. Unlike swing traders who may target multi-day moves to key levels, day traders often work with tighter reward-to-risk ratios — sometimes 1.5:1 or 2:1 — focusing on clean entries during momentum pauses.

- Breakouts: Look for consolidation ranges on lower timeframes, then enter when price breaks out with confirmation. Because of the fast pace, tight stop-loss orders are essential to minimise losses from false breakouts.

- Mean Reversion: When price deviates sharply from its average, traders may scalp small moves back toward the mean. Tools like VWAP or Bollinger Bands® help identify these reversion points. These setups suit high-liquidity sessions where spreads stay narrow.

- Range Trading: Trade between well-defined intraday support and resistance levels, especially during lower volatility periods or session transitions.

- News Trading: Capitalise on major economic releases where volatility spikes sharply. Always confirm your prop firm’s rules — at FXIFY, trading within 5 minutes of scheduled news releases is restricted

Key Prop Trading Rules to Manage for Both Swing & Day Trading

Whether you’re trading intraday or holding positions for days, prop firm rules add an extra layer of discipline. Here’s what every prop trader needs to stay aware of:

- Daily Drawdown Management:

Your daily loss limit applies no matter your trading style. Use strict position sizing and monitor cumulative losses carefully — especially if taking multiple trades or holding positions overnight.

- Trade Duration & Frequency:

Many prop firms restrict ultra-short-term trades (e.g. under 60 seconds) to prevent non-strategic activity. Always confirm your firm’s minimum trade duration rules, especially for high-frequency or scalping strategies.

- News Event Restrictions:

Some prop firms block trading during major economic releases to avoid volatility spikes. Check your firm’s rules around news blackout periods, and plan your entries accordingly.

- Execution Speed & Platform Stability:

Smooth order execution matters for all strategies — whether entering swing positions at key levels or managing rapid intraday trades. Reliable platforms help you maintain precision.

- No Minimum Equity Barrier:

Unlike retail brokers, prop firms typically fund your account without minimum capital requirements (such as the U.S. PDT rule), allowing you to focus fully on skill and strategy.

At FXIFY, these flexible conditions allow traders to approach both swing and day trading with fewer retail limitations — but risk discipline always remains the foundation.

Choosing Between Swing Trading and Day Trading

So, which is better — swing trading or day trading?

The truth: it depends on you. Your schedule, mindset, and trading style all play a role. There’s no single “best” — only what fits your reality.

Consider the following key differences:

| Category | Swing Trading | Day Trading |

|---|---|---|

| Time & Lifestyle | Fits part-time schedules. Analyse and set trades outside market hours. | Requires full focus during active sessions. Best for full-time or highly flexible schedules. |

| Personality | Patience to hold trades for days or weeks. Can tolerate slow moves. | Fast decision-making. Comfortable managing rapid price changes and cutting losses quickly. |

| Capital Access | Prop firms provide access without retail minimums or PDT rules. | Same access advantage under prop firms; no $25K equity barrier. |

| Risk Exposure | Holds trades overnight — exposed to gaps. Wider stops, bigger moves. | No overnight risk. Many small trades with tight stops. |

| Learning Curve | Slower pace, often better for newer traders. | Steep curve. Demands high skill for consistent intraday success. |

Keep in mind: You can always adjust your approach — there’s no rule forcing you to stick with one style. Many traders start with one method and later shift or blend both, depending on market conditions and personal schedules.