Copy Trading Nancy Pelosi: Smart Money Or Meme Play?

Should you copy Pelosi’s trades? We explain the disclosure delay, why options and sizing change outcomes, and a checklist to help you use filings wisely.

TL;DR

The public is fascinated by Nancy Pelosi’s trading success—but the real advantage for you comes from understanding timing, structure, and risk. Disclosures are delayed by law, options change the payoff, and your bankroll is not hers. Enjoy the meme, learn the mechanics, and trade your plan.

Why Everyone Keeps Saying “Copy Nancy”

Nancy Pelosi is a significant figure in the trading world, serving both as an example and a point of discussion.When public filings from Paul Pelosi are released, the stock market often reacts strongly—social media fills with trade trackers, quick opinions, and charts showing successful trades across America.

The idea of her being “smart money” conflicts with the reality that markets move because of specific events (catalysts), not famous names.

A quick, neutral backdrop helps.

Pelosi is a long-time Democratic leader and the first woman to be House Speaker. That influence is why people watch her family’s trades.

The Pelosi-led House saw narrow passage of the Affordable Care Act (reshaping health care for millions of Americans) and pushed for a higher minimum wage. This spanned across multiple administrations, including the current Trump administration. This history explains why many invest their time tracking her family’s financial moves.

None of that is a buy signal by itself, but it explains why traders watch Congress, standoffs between House Democrats and House Republicans, and policy calendars at the Capitol. The attention is structural before it is personal—politicians can move sectors.

The Pelosi Alpha, In Plain Language

The idea of a special “Pelosi advantage” comes from a simple mix: focusing on long-term winning stocks, being selective with timing, and using options to change how a trade can profit.

Where many portfolios spread widely, the Pelosi household has repeatedly leaned into leadership stocks and then used structure to express conviction.

Example 1 — Tesla (Calls, Then Exercise):

On 22 December 2020, Paul Pelosi purchased 25 call options on Tesla with a $500 strike expiring 18 March 2022; the trade was disclosed on 21 January 2021. He later exercised those calls on 17 March 2022 to acquire 2,500 shares—a classic example of using long-term options to manage risk until the investment idea and the market timing were right.

Example 2 — NVIDIA (Sale Around CHIPS Narrative):

On 26 July 2022, Paul Pelosi sold 25,000 shares of NVIDIA at about $165.05, taking an estimated $341,365

loss — just before the House considered major semiconductor funding (the CHIPS-plus package). The timing raised eyebrows: sell first, then Washington moves.

You can read it as simple risk management ahead of a big week — or as being very close to the calendar. That kind of sequence is exactly what keeps the “copy Pelosi” meme alive.

Example 3 — Alphabet/Google (Before DOJ Ad-Tech Suit):

Disclosures show sales of Alphabet (GOOGL) in December 2022, roughly a month before the Department of Justice filed its ad-tech antitrust case on 24 January 2023—another reminder that justice and legislation calendars can move mega-caps. Correlation is not causation, but traders must know the docket.

Those highlights are cinematic; what’s repeatable is the strategy DNA: clear thesis, appropriate instrument, and patience in risk management (sizing small enough, long enough, to survive the trade). The rest is just focusing on the winners while ignoring the losers (survivorship bias) and looking back with the benefit of hindsight.

How The Rules Actually Work (And Why You’re Late)

A “disclosure” in this context means a Periodic Transaction Report (PTR)—the public filing that lawmakers (or their spouses) submit after a qualifying trade under the Stop Trading on Congressional Knowledge (STOCK) Act.

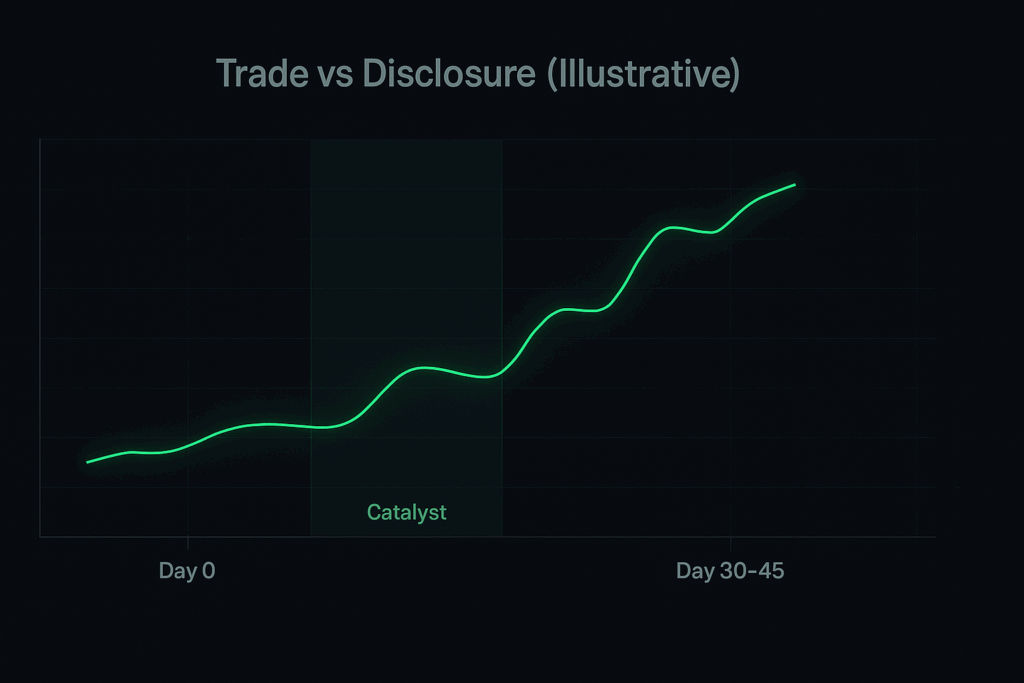

PTRs must be filed within 30 days of receiving notice of a transaction and no later than 45 days after the trade. In practice, that’s a lag—often enough for the price to move before you read the form.

The headline takeaway is simple: the market responds to catalysts, not paperwork. By the time a PTR is public, the market conditions (like trading volume, investor mood, or even regulations) may have changed—making it a bad idea to blindly copy a trade that already happened.

What The Data Says (Short, Real, Useful)

A 2022 peer-reviewed analysis found that House Members’ buys underperformed by ~26 bps over six months, and sells underperformed by ~11 bps—hardly evidence of easy alpha.

Meanwhile, several 2024/25 trackers reported that dozens of members beat the S&P 500 in 2024, a result that sparks headlines but doesn’t tell you how to replicate outcomes after the disclosure lag. Both can be true: individual years can look great while the long run is mixed and hard to copy.

There’s also the optics: new research shows that simply learning about congressional stock trades can reduce public trust and perceived legitimacy—one reason the government keeps debating stricter rules or an outright ban.

Copy Trading Pelosi: The Real Frictions

The STOCK Act lag means you’re late. The instrument choice means you’re mismatched. And the capital base means you’re not in the same league.

First, timing. A PTR is not a signal; it’s a dated postcard. Your reality is that catalysts—earnings, guidance revisions, regulatory milestones, elections—tend to cluster before you read the filing. Second, instruments. The household often uses Long-Term Equity Anticipation Securities (LEAPS)—options that expire in more than one year.

These completely change the potential profit and risk compared to just buying the stock. Third, bankroll and time. Wealthy households with millions of dollars can handle temporary losses (drawdowns), extend their options contracts, or spread their trades over several days without revealing their strategy.

Finally, context. Forms tell you what happened, not why. A sale might be for tax reasons, to rebalance the portfolio, or simply to raise cash for another private investment. A purchase might be a small starter position within a bigger plan. Also, crowd behaviour is powerful. When members of Congress disclose a trade, the excitement can briefly push the stock price up.

Late followers often buy at this high price, becoming the “exit liquidity” for early investors who are selling to take profits.

Psychology: Why Traders Follow (And How To Stay Sane)

There’s a meme buzz: copying leaders feels like hacking the game, and “inverse Cramer”-style jokes keep it fun. There’s herd comfort: if Democrats and Republicans in the House look active, joining the wave feels safer. There’s anti-establishment spice: use the system’s own players against it. All of that is relatable—and risky if you stop thinking.

If you want an easy bridge from meme to method, two reads help: game theory for traders (thinking in incentives and payoffs), and managing FOMO (because chasing late is how plans die). See FXIFY’s Game Theory, In Plain English and Toxic Relationship With FOMO for deeper, practical frameworks that fit prop-style discipline.

Disclosure Sanity Checklist (Quick Scan Before You Act)

- Verify who traded (often Paul Pelosi) and the date on the PTR.

- Map Day 0 (trade) to Day 30–45 (disclosure) and list catalysts in between.

- Match the instrument (e.g., LEAPS vs common stock) and allowable risk under your rules.

- Size for survival; your account is not the same as Pelosi’s.

- Write your trade idea in one clear sentence — if you can’t, you don’t have a good enough understanding of your strategy.

Golden Rules For Turning Disclosures Into Lessons

Treat filings as idea starters. Keep a clock—trade date vs disclosure vs catalysts. Match the instrument to the thesis: if the disclosed move used LEAPS, understand decay, delta, and assignment risk. Put prudence before memes: position sizing must survive volatility. And never let a single position define you—if a trade becomes your identity, it will start writing your rules.

So… Is She The Final Boss?

The record is dramatic. Think of the Tesla options trade. Think of the moves around the big semiconductor funding vote. When trades appear just before big votes, people notice. It can look like someone keeps a very good calendar. The filings land later, but the order of events is hard to ignore. That is why the meme lives on.

But your edge will not come from copying a politician. It comes from strategy: a clear idea, the right instrument, and risk done with patience (position size and time in the trade). Use PTR filings as a clue for research. Write your reason to trade in one sentence. If you cannot, skip the trade.

Markets do not care who stood on the Capitol steps or which party is in charge. They care that you planned, sized, and executed. That is the craft. Trade your plan, not a personality.

Two Quick FAQs

Are these Nancy Pelosi’s personal trades?

Most filings that made headlines involve Paul Pelosi. They appear in Nancy Pelosi’s PTRs because the STOCK Act covers trades by a member, spouse, or children/dependents. Precision matters; it’s usually her husband executing.

What exactly are PTRs and LEAPS again?

A Periodic Transaction Report (PTR) is the post-trade disclosure required by the STOCK Act; it can be filed up to 45 days after a transaction, so it’s not real-time. Long-Term Equity Anticipation Securities (LEAPS) are options expiring beyond one year, often used to shape convexity and capital use.