Hedging in Forex: Definition and Strategies

Learn how Forex hedging acts like insurance against market volatility. This guide explains core hedging concepts, compares perfect vs. imperfect hedges, discusses legality in the US (FIFO rule) and UK, and details practical strategies like correlation, multiple currency, and swap hedging to help you manage risk and protect your capital effectively.

Hedging is a core technique in the foreign exchange market, primarily used for risk management. Understanding various Forex hedging strategies is crucial for managing this risk effectively. Forex traders must understand that its main purpose is to minimise the potential to lose money from adverse currency movements, rather than to generate profit.

What is Forex Hedging?

Think of hedging as insurance. You pay a premium (the cost of the hedge) to protect yourself against a potentially larger loss. For instance, you might pay for car insurance to avoid the financial burden of a major accident. Similarly, when trading forex, the cost of a hedge provides protection if a position moves against you, helping to reduce potential losses.

How Does Hedging Work?

Now that we’ve explained what hedging is, let’s look at how it works in the forex market.

Hedging works by offsetting the risk of a trade in one foreign currency pair with another trade that benefits from movement in the opposite direction.

For example, taking a trade on EUR/USD that benefits from Euro strength, and taking a short on EUR/JPY that benefits from Euro weakness. The goal isn’t to make a guaranteed profit; it’s to reduce the impact of adverse price movements in the market; in other words, offsetting your risk.

Effective Forex hedging strategies require a good understanding of market correlations. You need to know how different currency pairs tend to move in relation to each other. Hedging isn’t a magic bullet; it’s a tool that must be used strategically and carefully.

Is Hedging Legal?

In the United States, holding two opposing positions (“direct hedging”) in the same currency pair within a single retail forex account is prohibited under the National Futures Association (NFA) rules, specifically due to the FIFO (First In, First Out) rule. Hedging itself is not illegal, and traders often use permissible alternatives to manage risk.

While direct hedging is restricted in the US, traders may manage risk using alternative Forex hedging strategies, such as trading correlated currency pairs that tend to move predictably relative to each other.

Disclaimer: While opening multiple accounts to facilitate direct hedging in the U.S. isn’t explicitly prohibited by NFA or CFTC rules, using multiple accounts to direct hedge is a violation of compliance standards. Many brokers explicitly prohibit this practice. Traders should review broker-specific terms carefully and ensure their activities comply with applicable regulations and broker guidelines.

In the UK, hedging is generally permitted. There are fewer restrictions compared to the US, but it’s always wise to check with your broker’s specific policies.

Hedge Example:

For instance, if you’re long USD/JPY (betting on USD strength against JPY), you might hedge against the strength of that particular currency (JPY) specifically by taking a short position in EUR/JPY.

Alternatively, to hedge against USD weakness broadly while remaining compliant with U.S. trading regulations, traders can minimise risk by going long EUR/USD, as this currency pair typically rises when the USD weakens overall. This method allows traders to effectively hedge currency risk despite restrictions on direct hedging.

| FXIFY™ Policies: Hedging between different accounts is prohibited. For a detailed explanation of prohibited trading strategies, please refer to our guidelines. |

Forex Hedging Strategies

Hedging strategies are popular in forex trading because they help traders manage risk and limit losses. However, these strategies require a deeper understanding of market dynamics and aren’t ‘set and forget’ solutions.

Correlation Hedging

A well-known hedging strategy that involves using currency pairs that are inversely correlated. This means that when one pair goes up, the other tends to go down.

For example, if you’re long AUD/USD (expecting the USD to weaken against AUD), you might hedge by going long USD/CHF (positioning to benefit if the USD strengthens against CHF). This setup balances your exposure to USD movements — if the USD weakens, your AUD/USD long benefits; if the USD strengthens, your USD/CHF long can offset losses.

A practical tip is to study historical correlations between currency pairs using one of the many correlation matrices available online. Here’s a table of some commonly inversely correlated currency pairs:

| Currency Pair | Inversely Correlated Pair | Notes |

|---|---|---|

| EUR/USD | USD/CHF | Very strong and consistent inverse correlation (-0.80 to -0.95). |

| GBP/USD | USD/CHF | Moderate inverse correlation; less stable than EUR/USD. |

| AUD/USD | USD/JPY | Sometimes inverse, but weaker; correlation varies with risk sentiment. |

| NZD/USD | USD/JPY | Weak to moderate inverse correlation at times; not highly reliable. |

This H4 chart illustrates the inverse correlation between EUR/USD (blue) and USD/CHF (red) plotted against percentage change. Notice how, generally, when one pair’s percentage change rises, the other’s falls.

Direct Hedging

This is a strategy that involves decisions to buy or sell simultaneously, holding both long and short positions on the same currency pair.

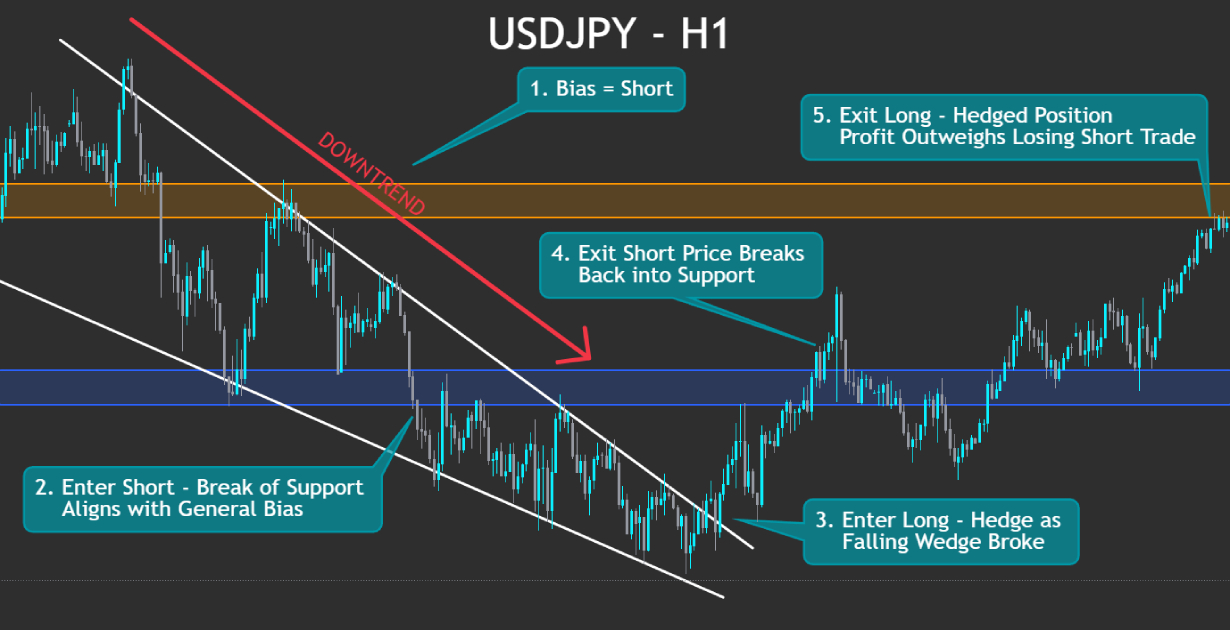

This USDJPY chart illustrates how a hedge can be used to manage the uncertainty of a potential trend reversal after a short trade.

Multiple Currency Hedging

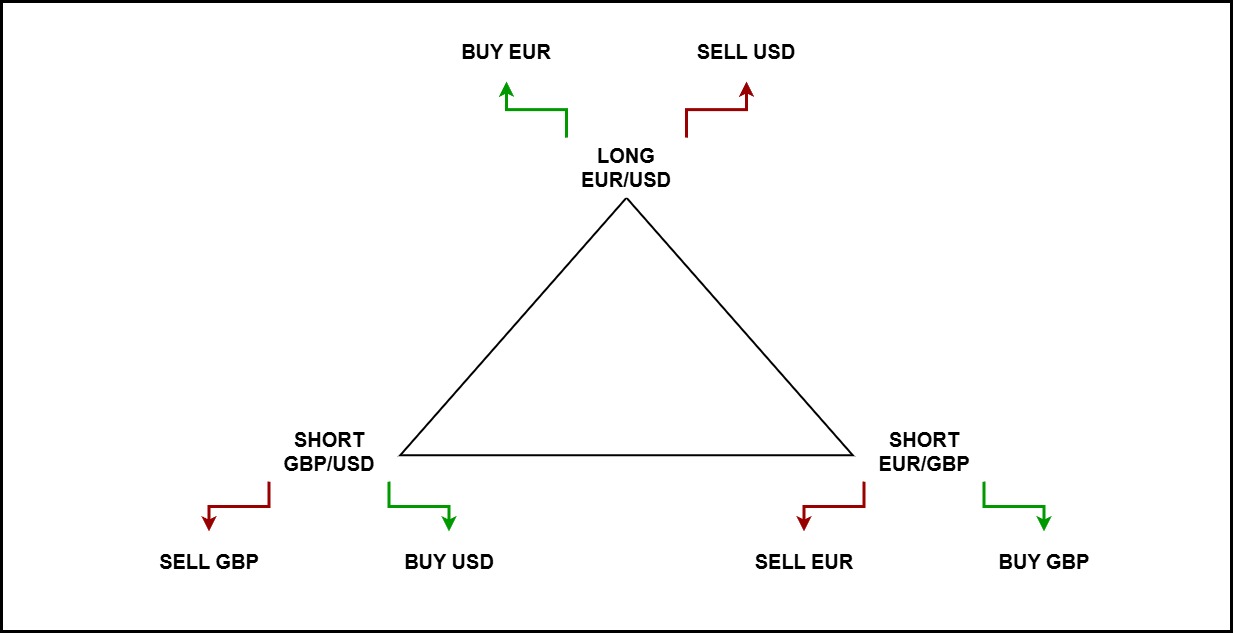

This forex strategy uses multiple related currency pairs to construct a hedge aimed at neutralising overall exposure to exchange rate fluctuations. It’s important to distinguish this hedging technique from Triangular Arbitrage. While both may use a similar structure of trade involving three currencies, their objectives are fundamentally different. Arbitrage seeks to exploit temporary price discrepancies between the pairs for a risk-free profit. In contrast, this hedging strategy assumes relatively efficient pricing and focuses purely on risk management.

Example Scenario: Triangular Currency Hedge for Risk Neutralisation

Consider a structure involving positions designed to balance exposure across EUR, GBP, and USD:

| Currency Pair | Position | Action Taken | Reason for Trade |

|---|---|---|---|

| EUR/USD | Long | EUR ↑ USD ↓ | Profit if EUR strengthens against USD |

| EUR/GBP | Short | EUR ↓ GBP ↑ | Protects against EUR weakness; profits if GBP strengthens vs EUR |

| GBP/USD | Short | GBP ↓ USD ↑ | Protects against GBP weakness vs USD; balances USD exposure |

How it Works for Neutralisation:

By simultaneously holding these positions:

- You are long EUR (via EUR/USD Long) and short EUR (via EUR/GBP Short).

- You are long USD (via GBP/USD Short) and short USD (via EUR/USD Long).

- You are long GBP (via EUR/GBP Short) and short GBP (via GBP/USD Short).

Structure for a Triangular Currency Hedge: Combining Long EUR/USD, Short GBP/USD, and Short EUR/GBP to neutralise risk across three currencies, potentially.

Essentially, you are both buying and selling each currency involved through different pairs. This creates a closed loop designed to significantly reduce (though not necessarily completely neutralise) the net impact of exchange rate movements.. The goal isn’t to profit from the hedge itself but to offset potential losses from adverse currency movements. By neutralising potential losses, this strategy also inherently neutralises potential gains that would have arisen from favourable movements.

The aim is a highly controlled, potentially near-neutral exposure, relying on the correlations and interrelationships between the currencies to achieve balance. This strategy requires a deep understanding of currency correlations, precise position sizing, and active management, distinguishing it clearly from the opportunistic nature of arbitrage.

Swap Hedging

In Forex trading, brokers charge or pay swap fees based on the interest rate differential between the two currencies in a pair:

- A positive swap means you earn interest for being in a trade.

- A negative swap means you pay interest instead.

Swap hedging involves holding one position that earns positive swap interest to help offset the cost of another that incurs a negative swap. The aim is to reduce financing costs over time, or potentially generate a small net gain if the positive swap outweighs the negative.

For example, a trader might go long AUD/JPY to earn a positive swap, while also holding a short position on GBP/CHF, which has a negative swap. In this case, the AUD/JPY position isn’t about price speculation—it’s simply used to reduce the overnight cost of holding the GBP/CHF trade.

This approach focuses on the interest rate differential, not on the price correlation between the two positions. However, traders still need to manage the risk of price movements, as a strong adverse move can easily offset any swap benefit.

Swap hedging is typically used by experienced traders operating with their capital or through brokers that pass on swap earnings.

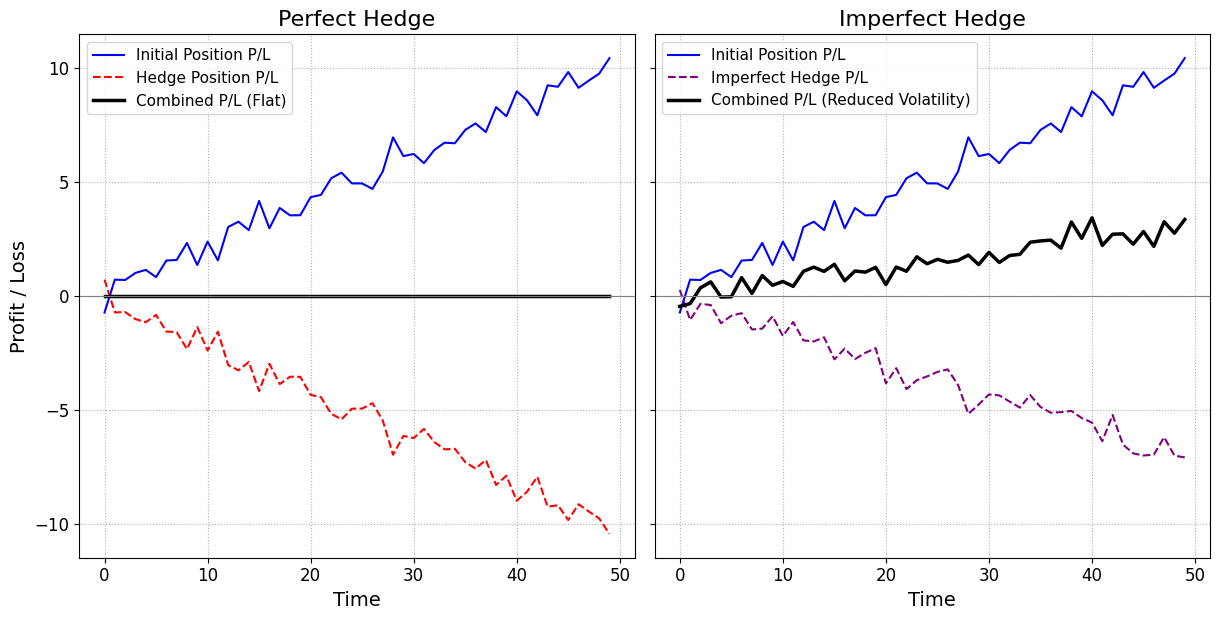

Perfect Hedge vs Imperfect Hedge

A perfect hedge eliminates risk—and thus profit potential—as long as both positions remain active simultaneously. However, when you close the losing side and allow the profitable side to continue, you reopen the potential for gains (and risk). In other words, a perfect hedge removes risk but also removes the chance to profit while active.

Imperfect hedging, on the other hand, reduces risk without removing it completely. This can be done in a few ways:

- Using correlated assets, such as hedging a long EUR/USD position with a long GBP/USD position. Because these pairs tend to move in the same direction, gains in one can partially offset losses in the other if their movements are not perfectly synchronised.

- Reducing size, such as hedging only part of the exposure—e.g., long 1 lot EUR/USD, hedged with a 0.5 lot short.

Using different instruments, such as pairing a spot position with a derivative like a futures contract.

The benefit of an imperfect hedge is that it still leaves some room for the upside while dampening the downside. However, it requires more analysis to get right and doesn’t fully eliminate risk.

The table and charts below highlight how perfect and imperfect hedges behave in practice:

Notice the black line on both charts, which represents overall P/L (profit & loss). A perfect hedge completely neutralises P/L changes while active, thus resulting in a flat, horizontal line. An imperfect hedge dampens P/L volatility but does not eliminate it, resulting in a P/L line that trails after the initial position’s profits.

| Hedge Type | Pros | Cons |

|---|---|---|

| Perfect Hedge | Complete risk elimination while active. | No profit potential while the hedge is active. Often incurs extra trading fees. |

| Imperfect Hedge | Reduces risk; allows for some profit potential. Often cheaper or more accessible to implement. | Doesn’t fully eliminate risk; the potential for loss remains. Requires careful correlation analysis. |

Choosing between perfect and imperfect Forex hedging strategies depends on the trader’s specific objectives and risk tolerance.

Is Hedging Suitable for Prop Traders?

Many prop traders ask what is hedging and how it can help them stay within risk limits during high volatility. The answer lies in understanding its true purpose…

Hedging primarily safeguards capital, making it vital for prop traders managing drawdown. Proper execution of hedging can reduce stress, especially when holding trades overnight, albeit at the cost of potential profits. Like paying for insurance, you lose out on some cash, but benefit overall from the safety and peace of mind.

The deployment of a hedge can help prop traders offset their equity drawdown, which reduces the likelihood of an account breach and increases the likelihood of passing an evaluation (or maintaining a funded account).

FXIFY’s real-time performance dashboard and comprehensive economic calendar empower traders to identify optimal moments for deploying hedging strategies. These tools provide timely market insights, helping prop traders strategically manage exposure by determining when market conditions are favourable for risk reduction through hedging.

Disclaimer

Remember, hedging is fundamentally a risk management strategy, not a profit guarantee. It demands knowledge and planning. Prop traders aiming to protect capital can explore these techniques further on FXIFY’s platform.

If you’ve ever wondered what is hedging and whether it fits your trading style, FXIFY’s tools and resources can help you implement these strategies more confidently.