Most Effective Scalping Strategies for Traders

Dive into forex scalping: Understand the high-speed method, weigh pros & cons, and explore popular forex scalping strategies for experienced traders.

Scalping is a fast-paced and demanding method that attracts some traders in the forex market due to its focus on capturing small, rapid profits. While quick gains are alluring, scalping is high-risk and demands discipline, skill, and risk management. Explore effective forex scalping strategies for experienced, high-risk tolerance traders.

What Is Scalping in Forex?

Scalping is a trading strategy focused on profiting from minimal price movements generated by rapid price fluctuations in the forex market. Forex scalpers operate in seconds to minutes, aiming for tiny profits via high-volume trading and rapid decisions.

It’s essential to recognise that while aiming for small profits can limit exposure per trade, the cumulative effect of transaction costs and the need for high accuracy can make scalping a challenging and potentially stressful approach.

Unlike day or swing trading, scalping relies heavily on real-time technical analysis of currency prices and market moves, demanding exceptional precision and speed for quick entries and exits.

A low-commission environment is ideal for scalpers, as they place many trades rapidly. Scalpers also require the tenacity to constantly monitor the live feed to capitalise on emerging trading opportunities.

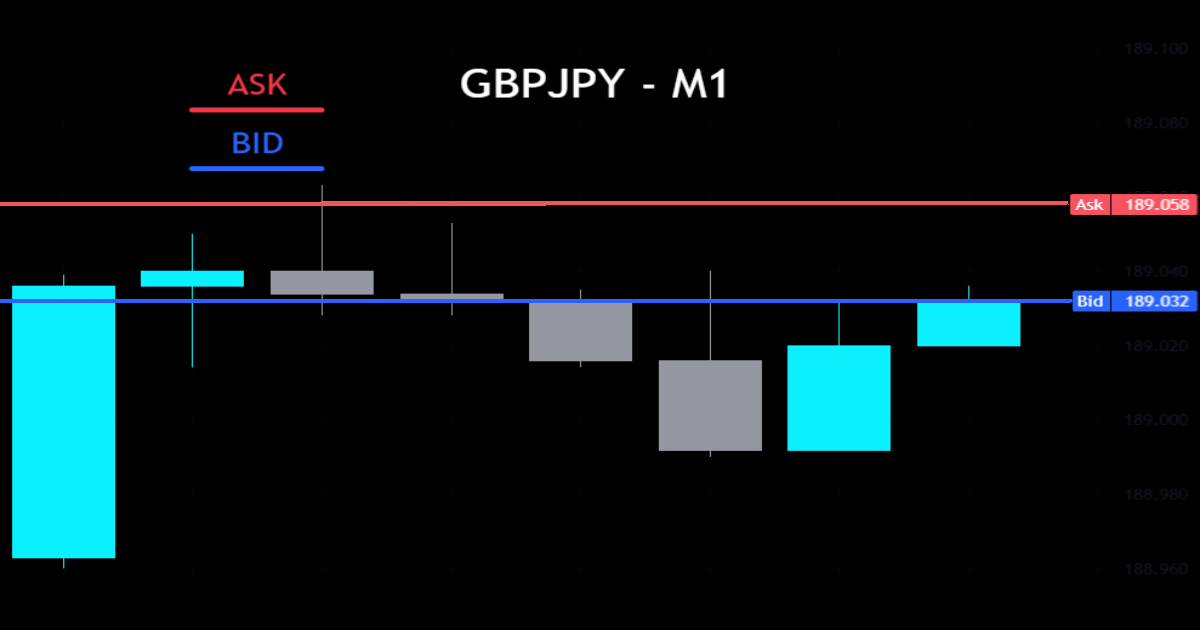

Spreads in Scalping

In the forex market, the ‘ask’ price is the lowest price a seller is willing to accept, while the ‘bid’ price is the highest price a buyer is willing to pay when buying or selling currency pairs. The bid-ask spread, the difference between these two prices, reflects market liquidity in currency markets.

Due to the high frequency of trades in liquid markets, lower spreads are crucial for scalpers. A low spread—ideally less than 1 pip for major currency pairs—is ideal for potentially successful trades, as it helps preserve the small profit margins scalpers target. High spreads can quickly negate gains.

What Are The Popular Scalping Strategies?

Discover popular scalping strategies in foreign exchange that form part of a broader trading strategy.

The effectiveness of a strategy will vary by asset, as each price chart reflects unique market psychology influenced by asset type and timezone, optimising trade execution.

Price Action in Scalping Strategies

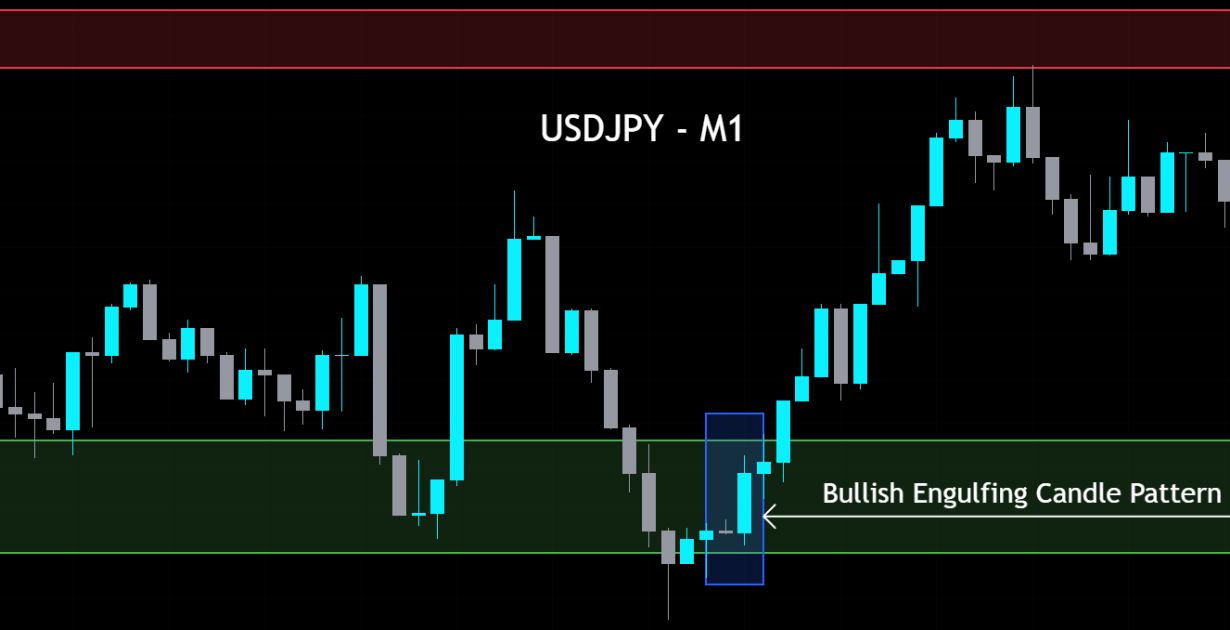

Scalpers use price action on the 1—or 5-minute charts to identify key support/resistance levels. Prices tend to reverse or consolidate at these levels, providing critical entry or exit points for scalping. Accurately identifying these levels is vital for timing entries and exits.

Candlestick patterns (e.g., bullish engulfing, pin bars) around support/resistance pinpoint buying/selling opportunities. For example, a scalper may enter a long trade (buy) when a reversal candlestick forms at a well-established support level, targeting the closest resistance level.

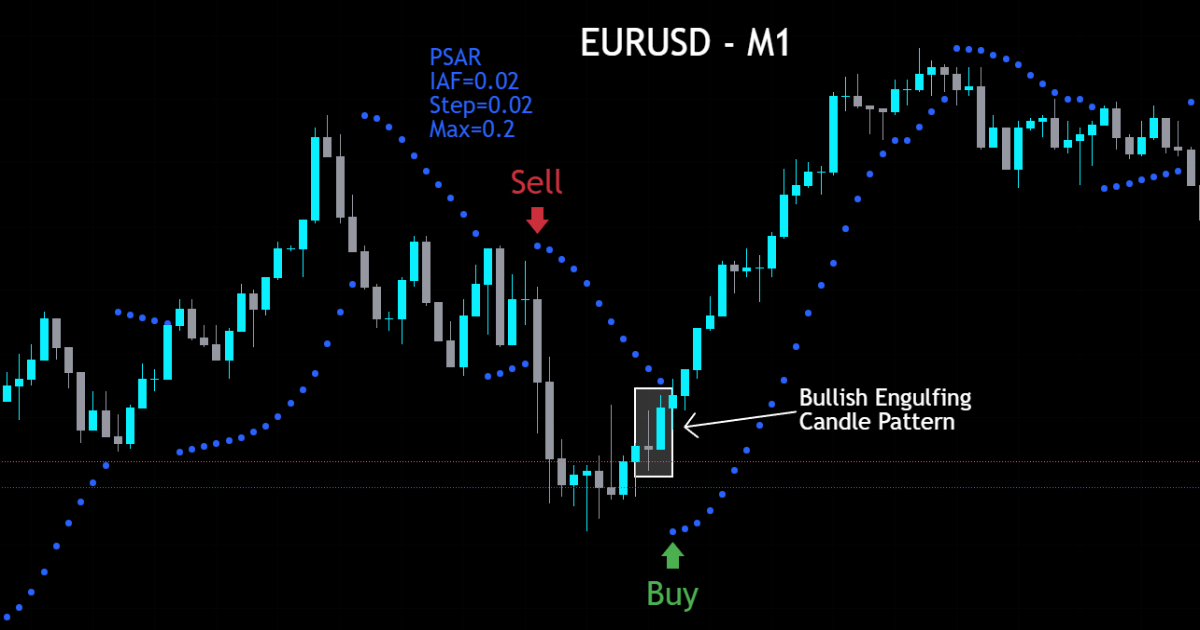

In this USDJPY M1 chart, a Bullish Engulfing candle pattern forms at a key support level, highlighted in green. This pattern, where a large bullish candle completely ‘engulfs’ the previous bearish candle, suggests a potential short-term reversal and provides a scalping entry as a long position.

Moving Average in Scalping Strategies

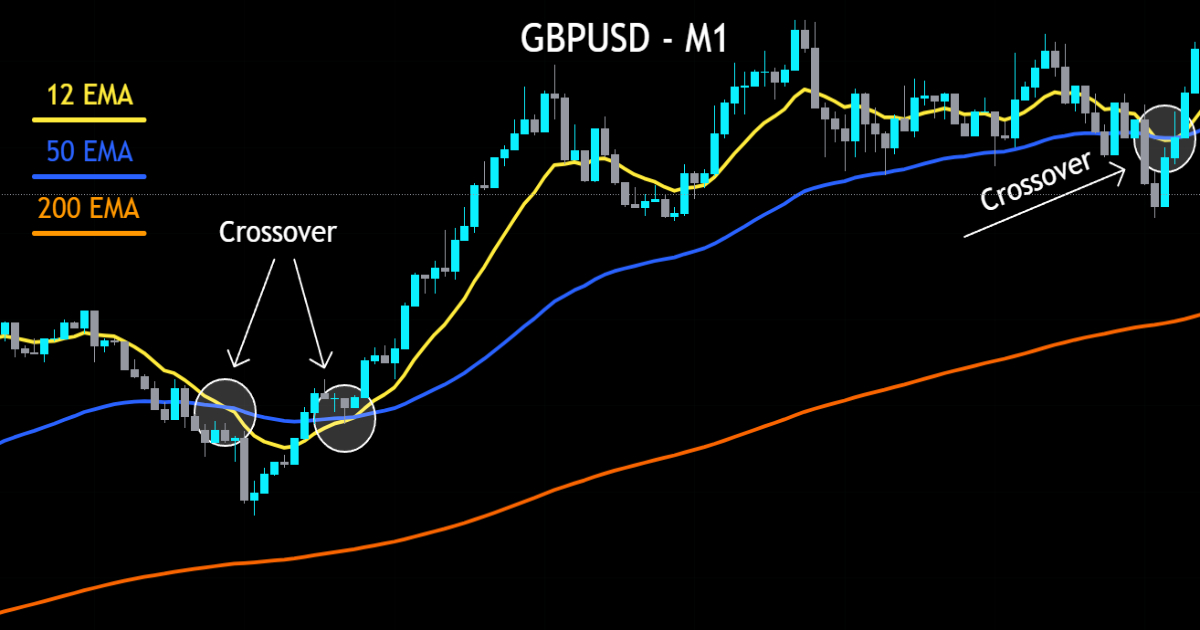

Exponential Moving Averages (EMAs) are preferred for scalping due to their responsiveness in currency markets. A moving average ribbon consists of multiple Moving Averages layered together, highlighting the trend across multiple periods. This technical indicator aids in confirming market direction and timing entries in scalping.

To construct a moving average ribbon, traders overlay multiple EMAs (e.g., 12, 50, and 200 periods). The shorter-period EMAs stay close to the price and react quickly, so it can signal a buy or sell position when they cross longer EMAs.

Additionally, the price’s position relative to the ribbon helps confirm the trend—when the price stays above the ribbon, it suggests strength, while movement below signals weakness. This also applies to individual EMAs:

- When the price is above an EMA, it indicates an uptrend relative to that EMA.

- When the price is below an EMA, it indicates a downtrend relative to that EMA.

The example shows the 200 EMA (orange line) on the GBPUSD M1 chart as a key trend indicator. With the price consistently above the 200 EMA, the bearish crossover between the 12 EMA and 50 EMA is less significant. In contrast, the subsequent bullish crossover confirms alignment with the prevailing trend, enhancing the strategy’s robustness.

Signal Generating Indicators

Technical indicators are tools that analyse market data to identify momentum trading opportunities. They help a forex scalper simplify decision-making during scalping trading in fast-paced market conditions, providing clear signals to enter or exit trades.

The Parabolic SAR (PSAR) indicator places dots above or below price candles to indicate buy or sell signals for trades. It is popular for scalping as it swiftly identifies short-period reversals in market prices, guiding entry and exit points.

Based on the USDJPY M1 chart, the Parabolic SAR (PSAR) indicator is signalling a bullish reversal. The PSAR dots were initially positioned above the price bars, indicating a downward trend. However, a bullish reversal is signalled as the PSAR dot shifts below the price candles. This transition suggests an opportune moment for scalpers to consider entering an extended position and capitalising on the emerging upward momentum.

Other technical indicators, such as the Stochastic Oscillator and RSI, are also popular among scalpers, as they provide quick insights into momentum and potential reversals.

Custom Scalping Strategies

Customisation is essential in scalping. It enables day traders to develop strategies that align with their own trading style, schedules, and visual preferences. By tailoring custom strategies to specific markets, traders can better adapt to market volatility and enhance their performance.

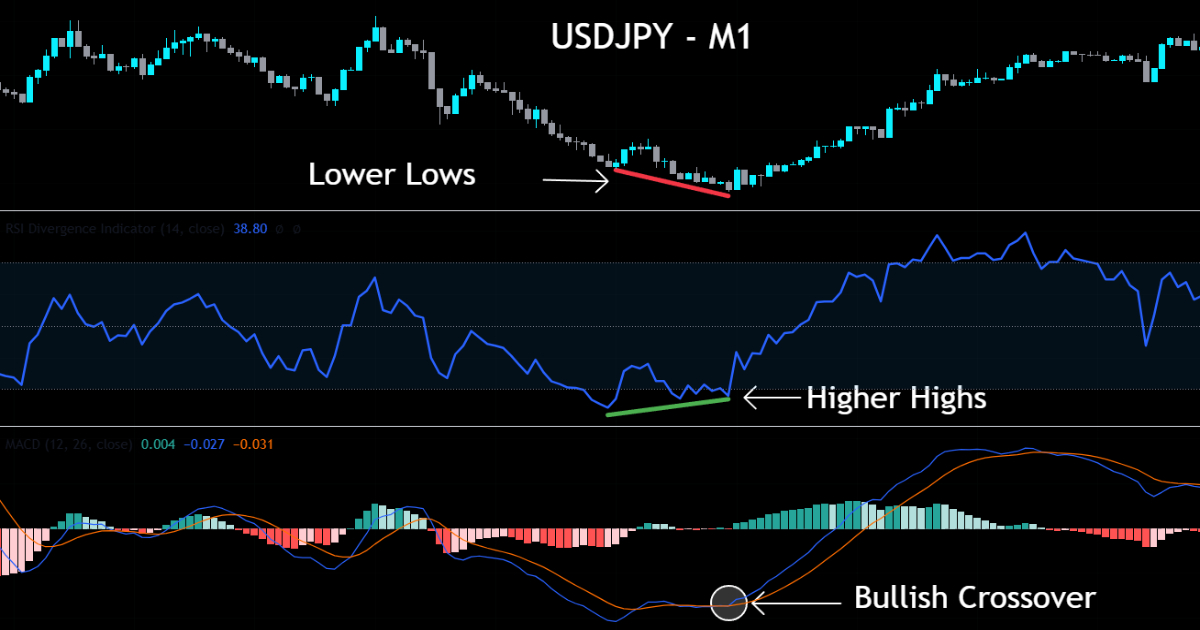

An effective custom approach combines MACD and RSI divergence, a scalping trading strategy that uses differences between price movements and indicator trends to signal quick reversals.

The USDJPY M1 chart above illustrates an example of such a custom strategy in action. It showcases how a divergence on the RSI, coupled with a bullish MACD crossover, can help confirm higher-probability trades.

Developing a custom scalping trading strategy is an iterative process. It involves continuous testing and adaptation based on live market conditions and across various symbols. Finding the best forex scalping strategy that works for you is key to trading consistently.

Does Scalping work in Prop Trading?

Scalping is a viable strategy in prop trading, favoured by many traders for several reasons. Successful prop traders benefit from rapid trades and lower overnight risks, as scalpers can have peace of mind knowing they won’t have open positions in the market, which could trigger a drawdown breach overnight. This aligns well with the strict risk management rules often enforced by prop firms.

Prop firms’ drawdown rules and daily loss limits favour scalping’s intraday focus. This allows scalpers to minimise the impact of losing trades while quickly accumulating gains from winning trades.

While you can scalp with prop firms, success depends on skill and solid risk management, not solely on the trading strategy.

Pros and Cons of Scalping Strategies

Scalping, a method of forex trading, offers distinct pros and cons. Before adopting this approach, traders should weigh its quick profit potential against challenges like high transaction costs and intense focus requirements.

Pros of Scalping

- Quick Profit Potential:

Scalping offers the advantage of rapid profit accumulation. By aiming for just a few pips per trade, traders can execute many trades during a trading session.

This high-frequency trading strategy allows small profits to compound into significant gains over time, particularly in the highly liquid forex market. The fast-paced nature of scalping makes it ideal for those seeking quick returns and the excitement of rapid market movements.

- Reduced Risk Exposure and Increased Opportunities:

Due to the extremely short holding periods, scalping minimises exposure to sudden market volatility and overnight risks.

This risk reduction benefits day traders with a low-risk appetite, while the frequent price movements in liquid markets create ample trading opportunities. The strategy’s structure enables traders to manage risk effectively while capitalising on many small, profitable trades.

Cons of Scalping

- High Transaction Costs (Spreads & Commissions):

Scalping involves frequent buying or selling, making the impact of spreads and commissions a major concern. High-volume trading amplifies these costs, reducing overall profitability.

Fortunately, you can mitigate this drawback by seeking brokers or prop firms which offer very low spreads or favourable commissions. At FXIFY™, we offer Raw Spreads from 0.0 pips, which can be particularly favourable for scalpers and intraday traders who rely on minimal transaction costs.

- Requires Intense Focus and Speed:

Scalping demands constant market monitoring and rapid reactions to market moves, requiring exceptional emotional discipline to execute trades effectively.

This scalping method can be stressful and may not suit traders who prefer a relaxed day-trading style or have limited time during the trading day.

The intensity of scalp forex trading can lead to burnout, making it challenging for some to maintain consistent performance. Overall, these factors significantly raise concerns.

Frequently Asked Questions (FAQ) about Forex Scalping

What exactly is forex scalping?

Forex scalping is a trading style focused on capturing very small profits from minor price moves in forex pairs. Trades are typically held for only seconds to minutes.

How fast do scalpers need to act?

Scalpers rely on speed and precision. They often analyse a one-minute chart to identify opportunities from small price moves and need to be ready to trade immediately to enter and exit positions quickly.

What are some common forex scalping trading strategies?

Popular approaches include using price action on short-term charts, employing moving averages to trade in the same direction as the trend, or using indicators like Parabolic SAR to potentially catch moves in the opposite direction.

Is scalping a way to make large gains easily?

Not typically. The goal is to make a profit consistently through many small wins, rather than aiming for large gains on single trades. Discipline is crucial to trade profitably over time, managing costs carefully instead of just trying to get as much profit from one setup.

What’s the primary challenge or risk-reward balance in scalping?

The main challenge involves the risk-reward dynamic. While potential loss per trade might be small, the high frequency means transaction costs (spreads/commissions) can quickly erode gains. It demands intense focus and speed to consistently make a profit from frequent small price moves.