Order Blocks Uncovered: A Deep Dive into SMC Trading Concepts

Order blocks are powerful tools that let retail traders follow institutional investors like banks and hedge funds. This guide explains how to spot these zones and combine them with other Smart Money Concepts (SMC) for more confident trading.

Order blocks are one of the most powerful tools in the trading world. By understanding them, you can start thinking and trading like big institutions – like banks and hedge funds – who influence market movements.

In this blog, we’ll explain what order blocks are, why they matter, and how you can trade order blocks in Forex, Commodities, Stocks, Crypto, and all the other markets available with FXIFY prop trading.

Whether you’re new to trading or looking to refine your strategy, this guide will help you gain a deeper understanding with this cornerstone of Smart Money Concepts (SMC).

What is an Order Block?

At their core, order blocks are areas where institutions place large buy or sell orders, often creating support and resistance levels. These zones are key spots for potential price reversals because institutions “ladder” their trades, breaking them into smaller chunks to avoid big market disruptions.

Think of it like this: if they placed their full trade at once, the price would spike dramatically. By spreading out their trades, they prevent sharp moves, causing the market to pause or reverse in these areas. When price revisits these zones, it often reacts – offering savvy traders an opportunity to jump in and capitalise on the movement.

What do Order Blocks Look Like?

Order blocks have distinct characteristics that make them easier to spot once you know what to look for.

Essentially, they appear as zones where the price pauses or reverses after a strong move, indicating that large institutional players have been active in that area.

An order block forms when a price reversal follows a series of consecutive bullish or bearish candles. It is drawn from the highest to lowest point of those candle wicks before the reversal.

There are bullish and bearish variations to the Order Block, let’s break it down.

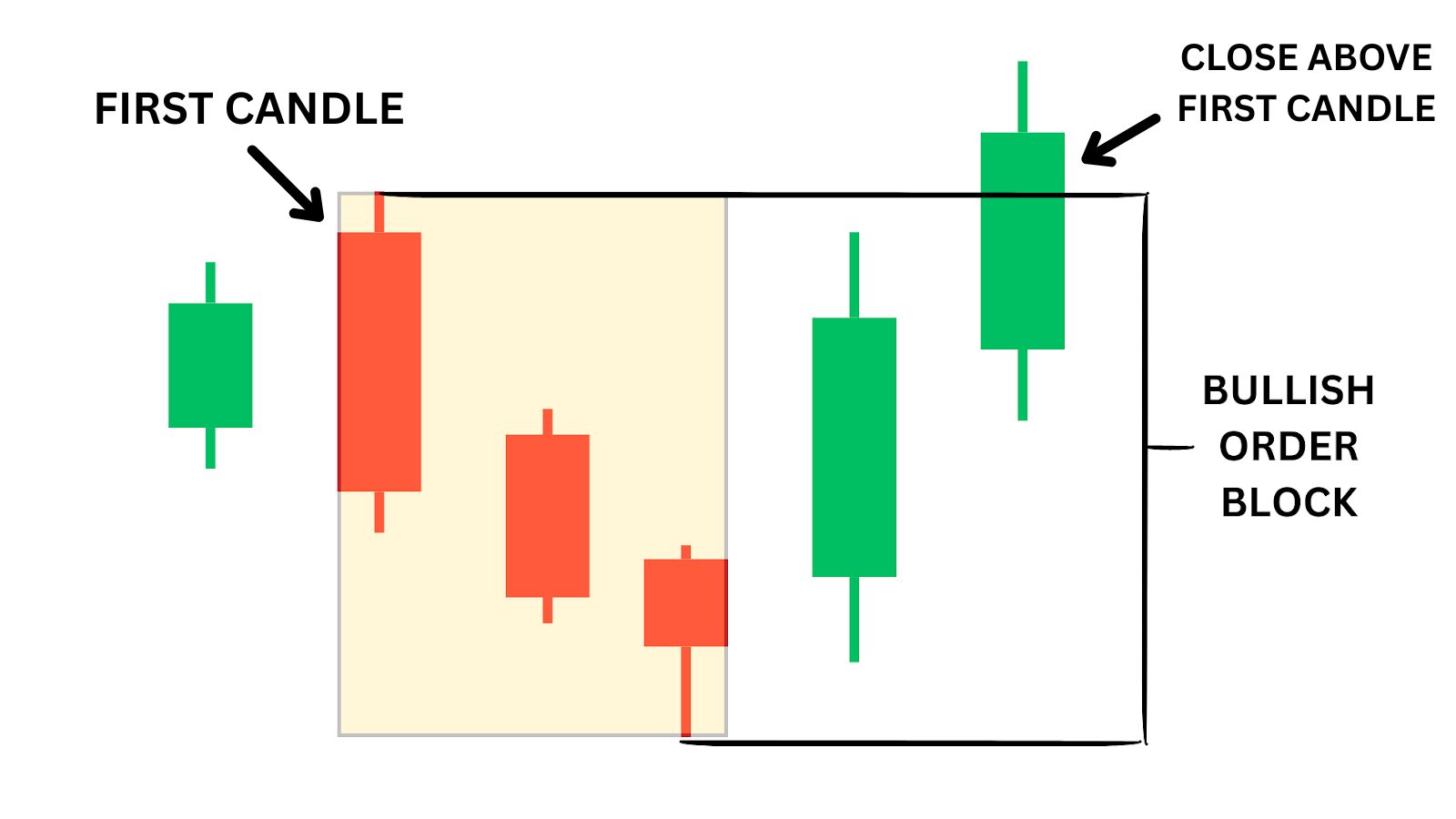

Bullish Order Blocks

A bullish order block typically appears just before the price reverses upwards. It is CONFIRMED by a bullish candle that closes above the first candle in the order block. We can see this when the second bullish candle closes above.

In this case, the large institutional buying pressure halts the downtrend and sends the price back up. When the price returns to this zone later, it often acts as a strong support level.

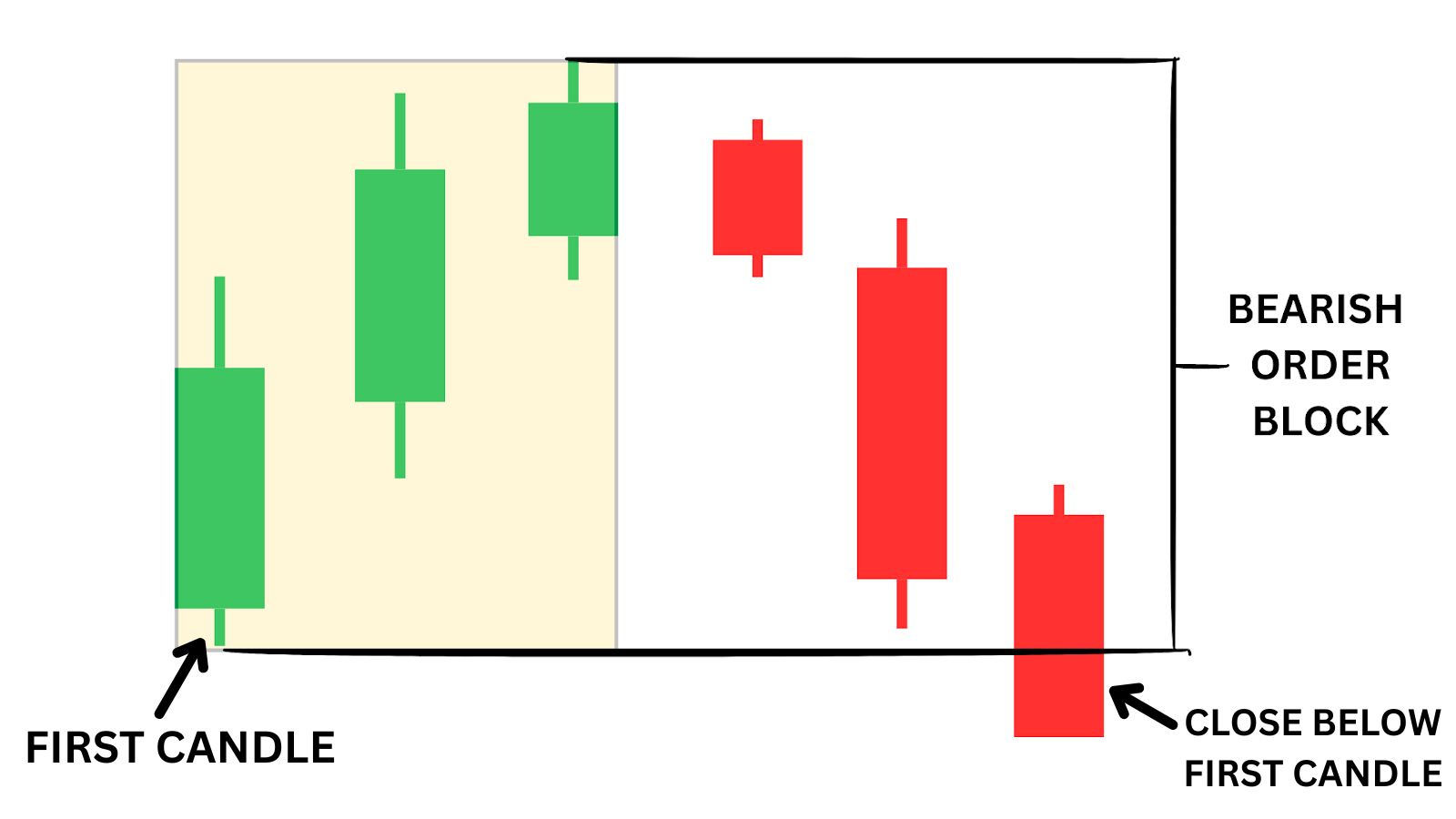

Bearish Order Blocks

These form at the end of an uptrend, signalling that institutions are offloading their positions or going short.

Generally, you’ll see the series of bullish candles (forming the order block, such as in the image above) get closed aggressively below by bearish candles. This is when the bearish order block is CONFIRMED. We can see this with the ‘close’ of the third bearish candle.

This indicates heavy selling pressure from institutional traders. When the price retraces to this zone, it typically acts as resistance, pushing the market back down.

Key Characteristics of Order Blocks:

- Consecutive Candles: Order blocks are formed by a series of consecutive bullish or bearish candles that create a clear reversal zone.

- Breakout Candle Confirmation: A breakout candle would confirm the formation of an order block. This indicates institutional traders have stepped in to push the prices higher or lower.

- Change of Character (ChoCH): A break of a major low in an uptrend or break of a major high in a downtrend, indicating a shift in market structure.

- Size: Order blocks can be any size – the larger they are, the stronger the area of interest. They don’t pinpoint precise entry points, so combining them with other strategies is essential.

- Location & Timeframe: Order blocks form at trend tops or bottoms and can appear on any timeframe. They are most reliable on higher timeframes (4-hour or daily).

- Market Reaction: Price often respects these zones in future moves. When price returns to an order block, it tends to stall or reverse due to the large institutional orders placed previously.

| Editor’s note: Your understanding of CHoCH is critical for trading Order Blocks, read more in our Smart Money Concepts article here. |

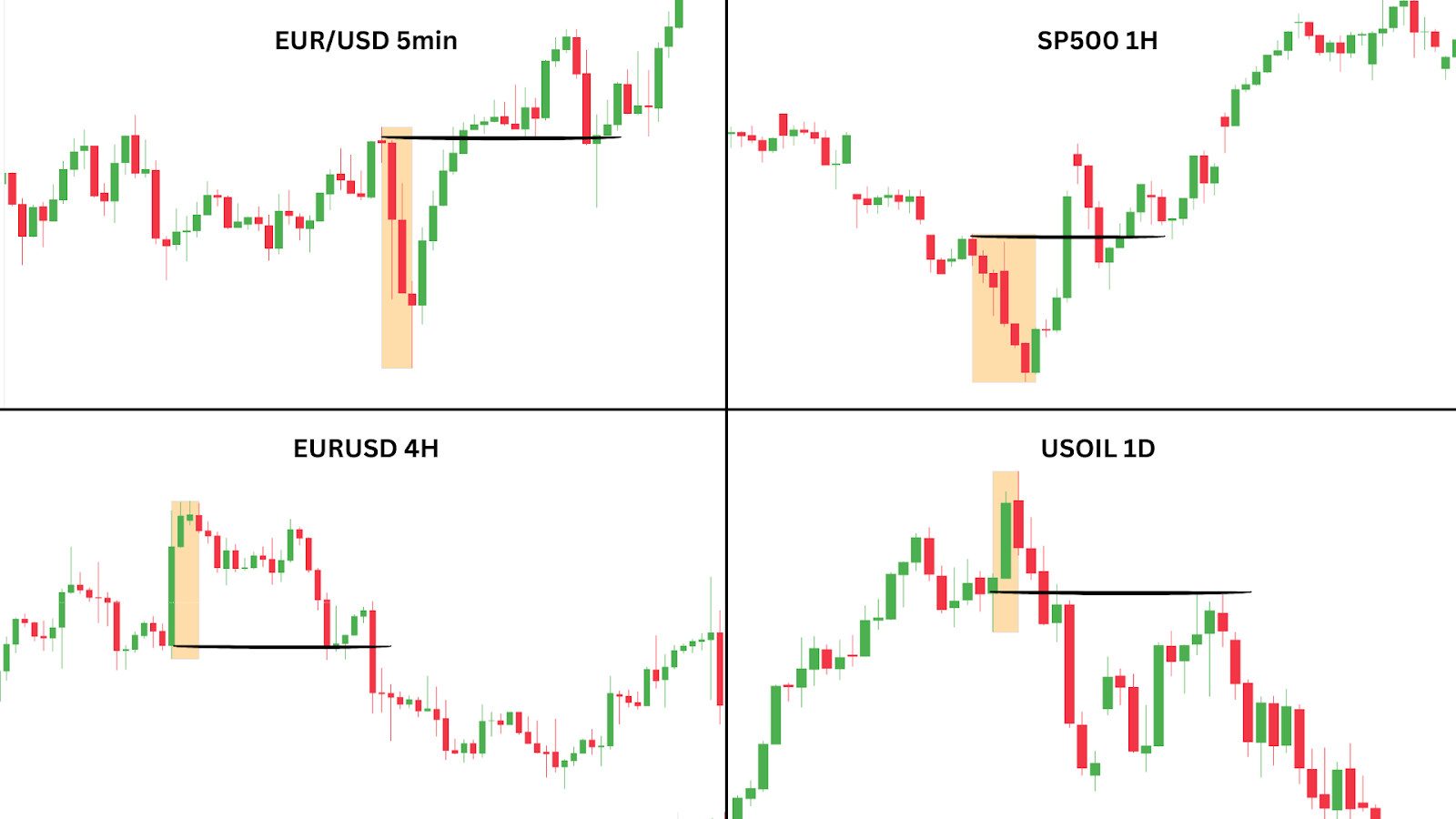

Here are some order blocks. As you can see, they appear on many time frames, and in many shapes and sizes, but their key characteristics always remain the same.

Now that you’ve seen some examples, let’s get into the nitty gritty details of how you can detect and trade these Order Blocks.

Case Study: Order Block Pattern

An order block represents an area of interest, but cannot be traded alone. It’s generally advised to pair other technical analysis tools with the Order Block to find stronger trade entries.

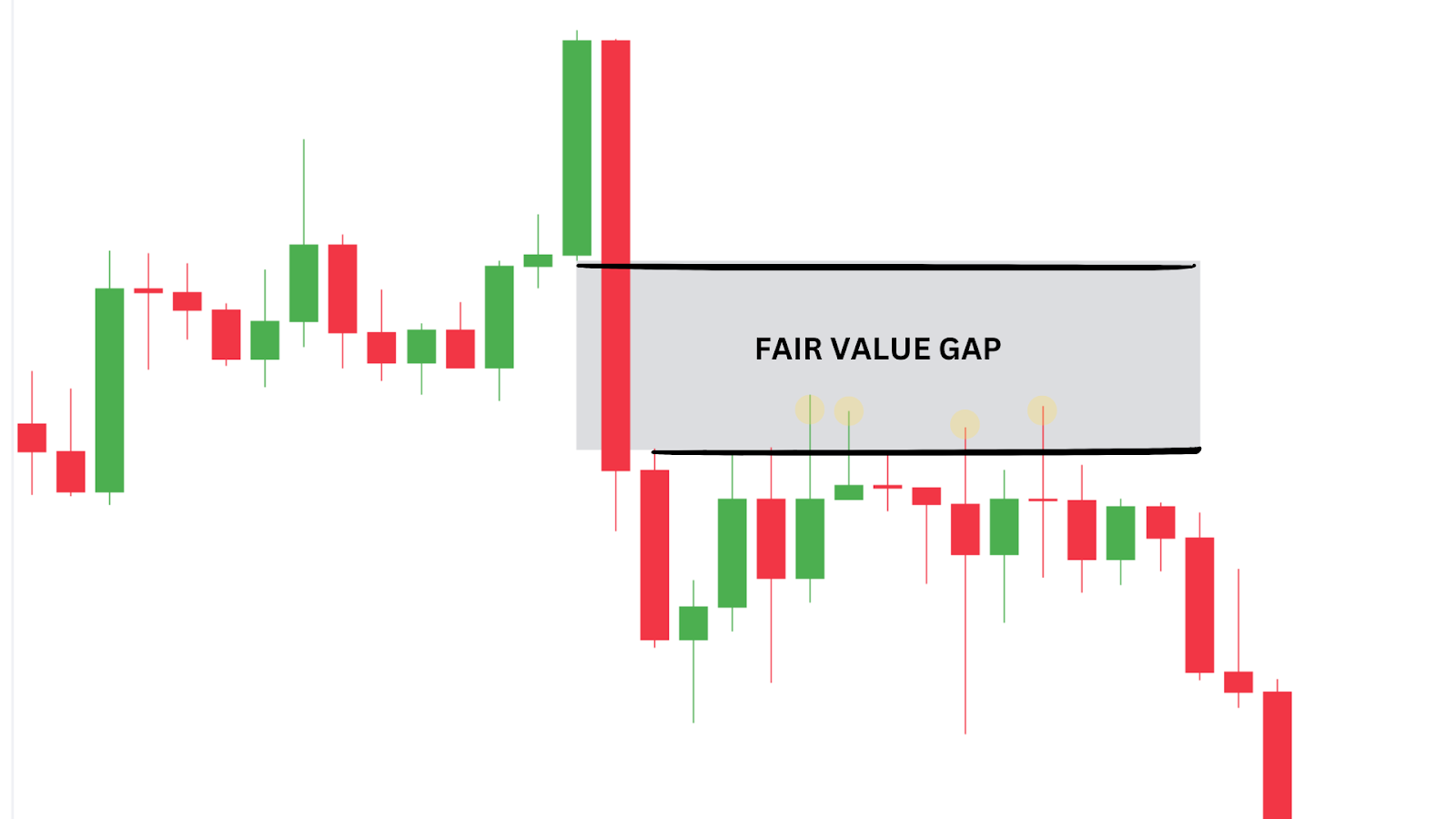

On the 26th of August, we see a clear order block forming on the 4-hour timeframe for EUR/USD. After a strong upward move, the price creates multiple Fair Value Gaps (FVGs) and a Change of Character (ChoCH), signalling a potential reversal.

Shortly after, the price tags back into one of the FVGs, testing the order block zone. Upon rejection from the FVG, the market reacts with significant bearish momentum, driving the price down to retest the previous swing low.

This case demonstrates how combining order blocks, FVGs, and ChoCH can create high-probability trade setups.

Fair Value Gap (FVG):

A Fair Value Gap occurs when there is a noticeable “gap” in price where recent price wicks have not occurred, meaning the price has moved so quickly that these areas have not been tested. These gaps act like magnets, where the market tends to return to ‘fill’ the gap, giving traders a potential entry point.

Change of Character (ChoCH):

A Change of Character is a shift in market sentiment, often marked by price breaking either a key high or low. It signals a change in direction or the end of a trend, making it a key confirmation for potential reversals.

Now we’ve got a clear understanding of order blocks, let’s dive into practical strategies for trading them effectively.

How Do You Trade Order Blocks?

In trading, flexibility is key. Order blocks can be utilised in various ways depending on your approach, but it’s up to you to find the strategy that complements your trading style.

If you’re new to trading, here are three effective methods to help you get started with trading order blocks.

Method One: Classic Order Block Strategy

The Classic Order Block Strategy uses the order block to enter a reversal trade. Once the block is formed, the price may revisit the block’s opening price and get rejected, signalling a potential entry.

For a bearish order block, you’d place your stop loss just above the high of the block, while for a bullish order block, it would go just below the low. To manage risk effectively, aim for a profit target that either aligns with the most recent swing high/low or a fixed 2:1 reward-to-risk ratio.

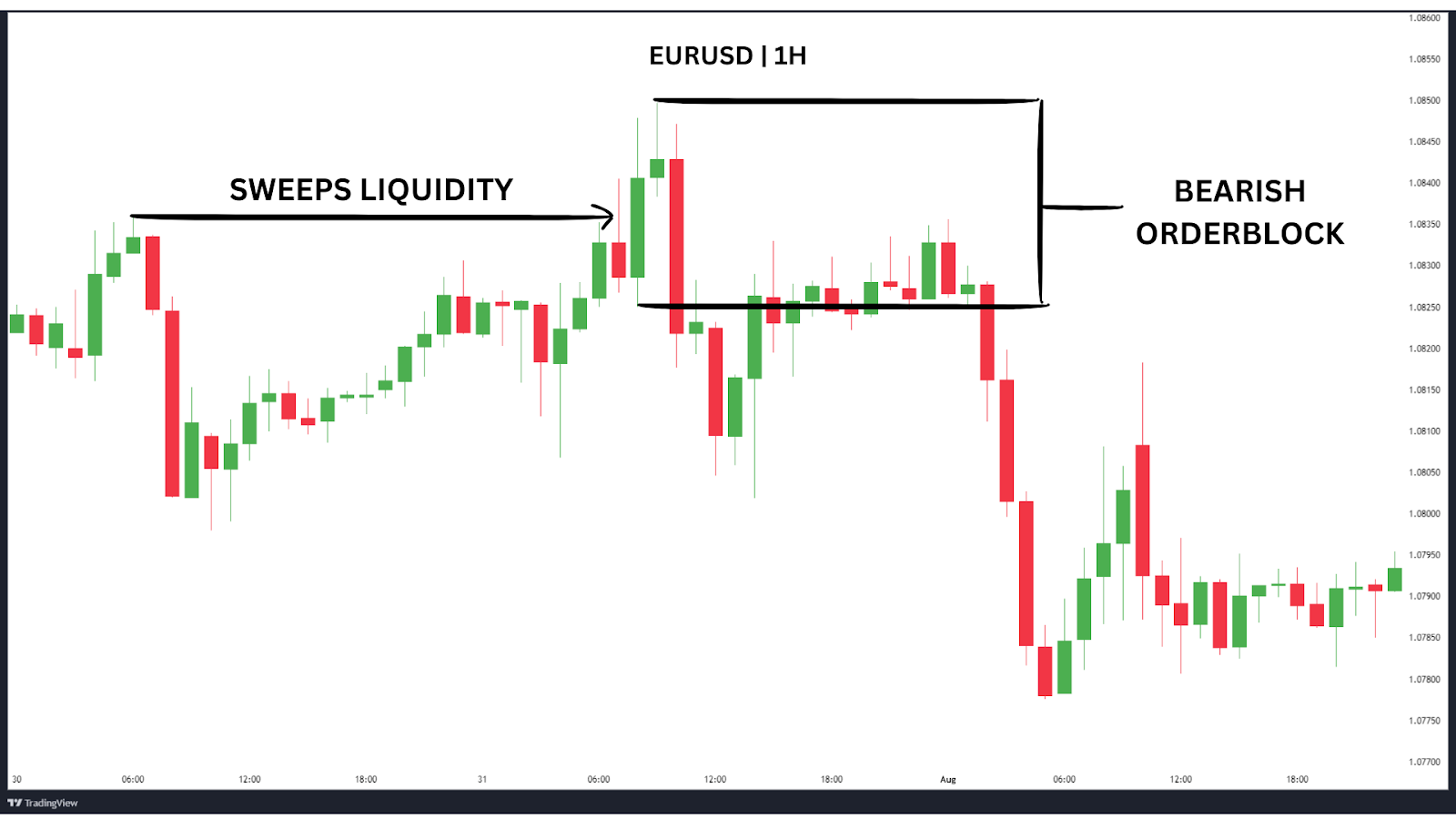

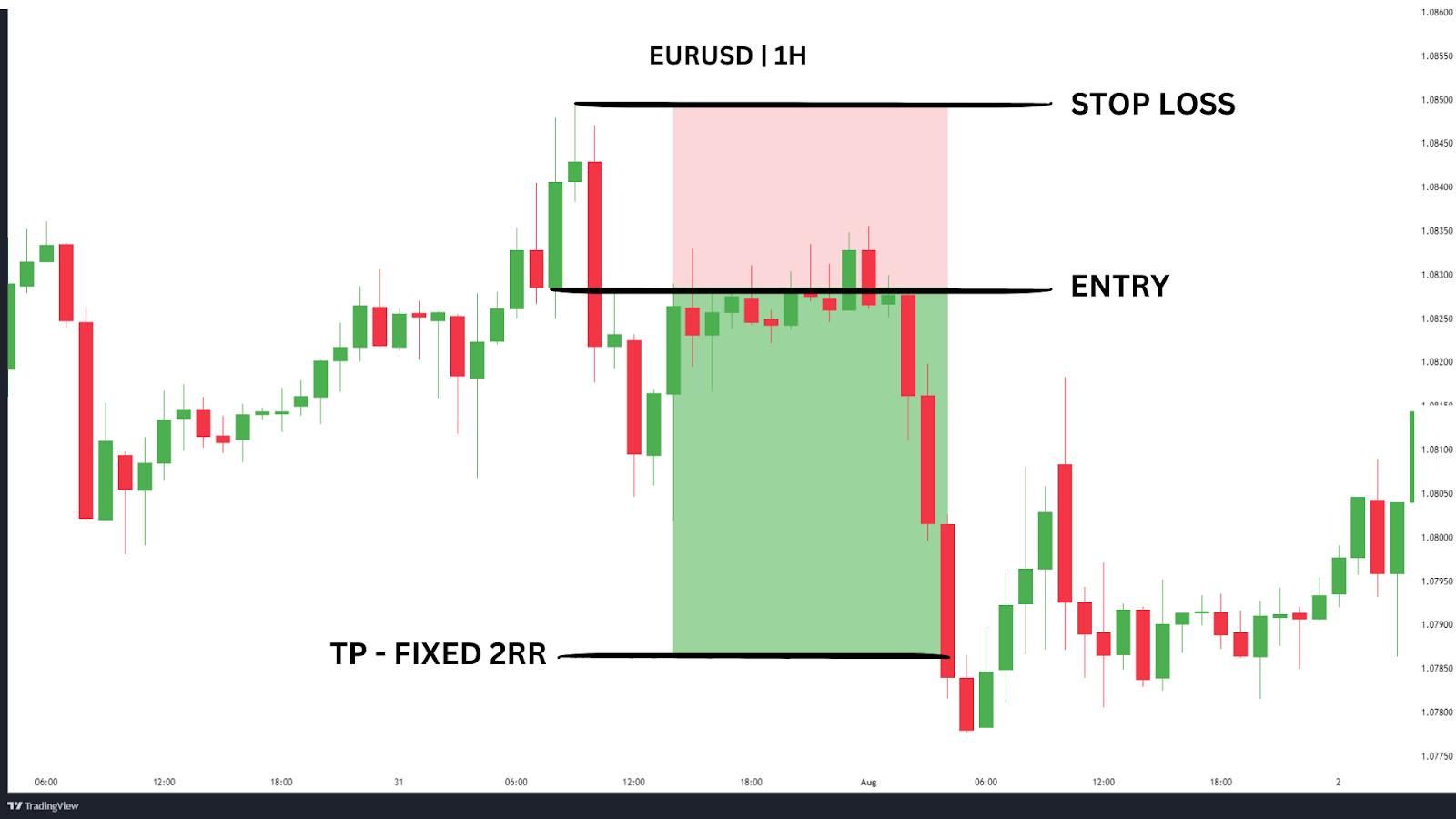

In this EUR/USD 1-hour example, a bearish order block forms after sweeping liquidity and closes with a sharp move downward.

A liquidity sweep happens when the price breaks above a previous high or below a previous low to trigger stop-loss orders from retail traders. These areas, where stop-losses accumulate, are referred to as liquidity pools.

Here’s a super simple breakdown of liquidity in this EUR/USD context.

- Previous high holds liquidity: Many retail traders place stop-losses above obvious highs.

- Price sweeps: The market moves above this high, collecting the stop-losses (liquidity).

- Sharp move down: After sweeping liquidity, the market reverses, forming a bearish order block.

You’d enter the trade on the open of the candle that starts the order block formation, while placing your stop loss above the high of the block.

For traders unfamiliar with Smart Money Concepts (SMC), we recommend targeting a fixed 2:1 reward-to-risk ratio for simplicity.

However, if you are more experienced with SMC, targeting liquidity pools, such as recent swing highs/lows or fair value gaps (FVGs), can offer additional opportunities.

Trading Strategy Summary

Entry Point: Enter a reversal trade at the opening price of the first candle in the Order Block.

Stop-Loss: Set your stop-loss just above the high (bearish) or below the low (bullish) of the order block.

Profit Target: Aim for the most recent swing high/low or a fixed 2:1 reward-to-risk ratio, whichever comes first.

| PROS: Provides a structured and precise entry point with clear risk management. |

| CONS: May result in missed opportunities if the market moves quickly or skips your entry point. |

Method Two: Combining Order Blocks with Fair Value Gaps (SMC Combo)

This strategy is a powerful combination of two Smart Money Concepts (SMC): Order Blocks and Fair Value Gaps (FVGs). When used together, they offer a highly efficient way to identify strong trade setups with a high Risk-Reward Ratio (RR).

Order Blocks and Fair Value Gaps complement each other by offering both a general area for potential reversals and a precise entry point. The Order Block signals where major institutional orders have caused a price reversal, while the Fair Value Gap pinpoints the untested price zone within that area.

This combination allows traders to enter a trade with greater confidence, knowing the specific level of institutional activity, and minimises risk by offering a clearer entry, reducing potential drawdown.

Together, they provide a structured approach for finding high-probability setups.

With this in mind, let’s dive into a bullish example on AUD/USD 5-minute timeframe and how we can achieve a 5.3 RR trade using this method.

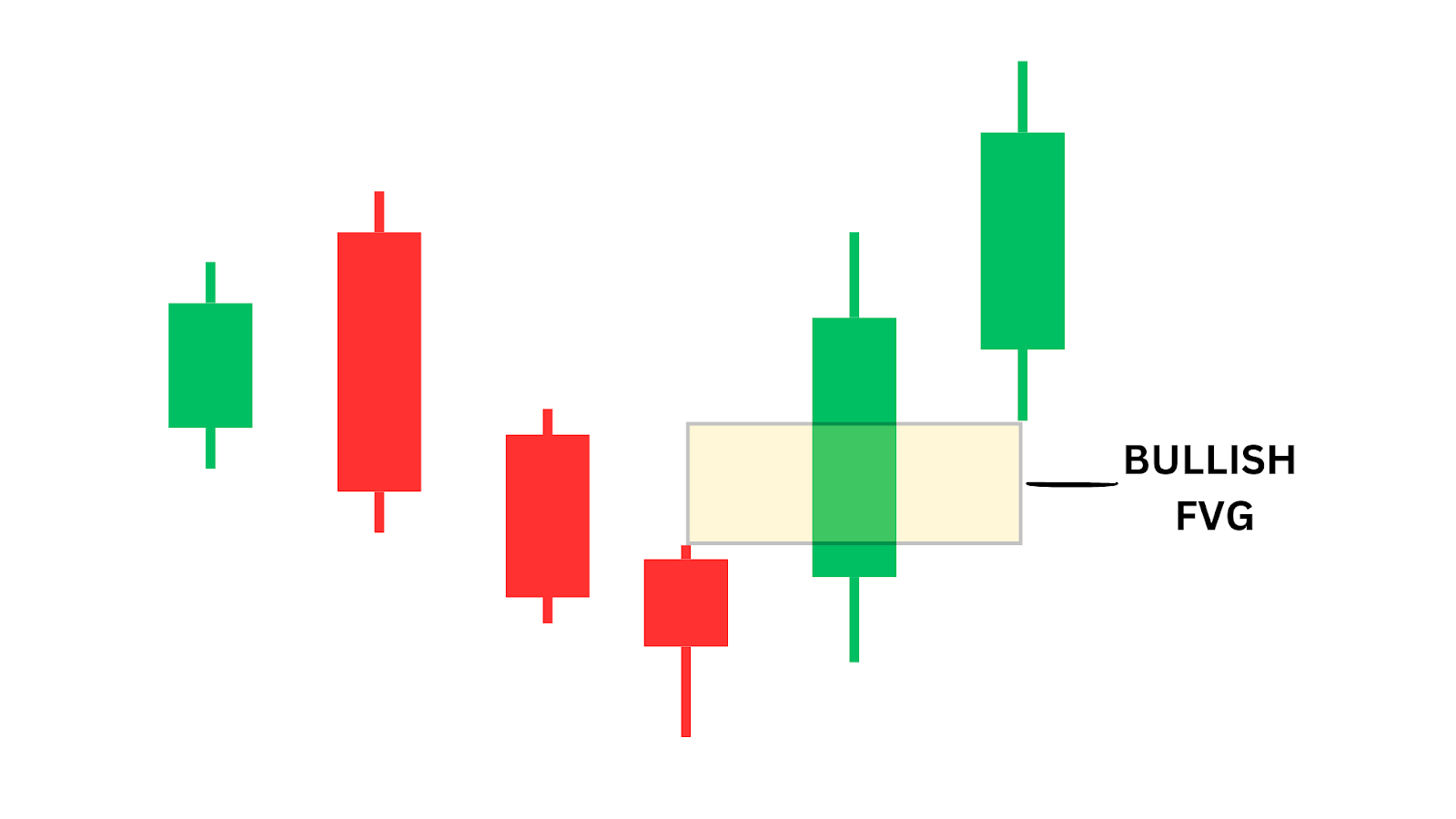

In the yellow box, we observe a Bullish Order Block forming on AUD/USD. In this case, we see that price initially sweeps liquidity, forming a low that the market reacts from.

- Liquidity Sweep: The low point of the move signals that liquidity below has been swept, as traders get stopped out.

- Order Block Confirmation: The order block is confirmed once a bullish candle closes above the first candle in the order block range. This is a crucial confirmation to ensure the order block is valid and supported by smart money.

After confirming the bullish order block, we notice a Fair Value Gap (FVG) forming in the middle of the order block. Although price tapped into this FVG once and reacted bullishly, a large portion remains unfilled. This unfilled section of the FVG becomes our entry zone.

We’ll place our stop-loss just below the order block’s low, which also aligns with the recent swing low. For our take profit, we’ll target the most recent major swing high.

Trading Strategy Summary

Entry Point: Wait for a confirmed Order Block to form, then identify an FVG within the block. When the price revisits the FVG but does not break it with a closed candle, enter a reversal trade.

Stop-Loss: Place your stop-loss below the order block low (for long trades) or above the high (for short trades).

Profit Target: Take profit at the most recent swing high/low.

| PROS: Combines two effective SMC strategies for high-probability setups, offers a strong reward-to-risk ratio, and provides a precise entry with FVG confirmation. |

| CONS: Requires patience for confirmation, which can result in missed trades, can be more complex for beginner traders to execute without enough practice. |

Method Three: Combining Fibonacci Retracements with Order Blocks

This strategy combines two powerful styles of trading, SMC with a well-known tool – Fibonacci retracement levels. This helps us to enhance the precision of our entries, especially in trending markets.

It works particularly well when the market’s higher time frame direction is clear, providing solid confluence for your trades.

In this example, we’re using the AUD/USD 4-Hour chart, where the macro environment remains bullish across higher time frames.

We first notice a weak pullback that sweeps previous pivot lows, followed by aggressive buying. This creates a bullish order block as price forms a new pivot high.

To align the order block with a Fibonacci retracement, we place the Fib tool from the swing low to the pivot high, setting it to show the 0.5 and 0.618 levels. If the trend is strong, price should ideally retrace no deeper than the 0.618 level.

However, to ensure we’re entered into the trade, we’ll place our limit order at the 0.5 retracement level, which aligns well with the top of the order block for added confirmation.

For stop losses, we’ll place them just below the low of the order block, ensuring our risk is well-contained. We set our take profit for a fixed 2:1 Reward-to-Risk (2RR), targeting the next pivot high as a potential exit point.

Trading Strategy Summary

Entry Point: Limit order at the 0.5 Fibonacci retracement level, aligned with the top of the order block.

Stop-Loss: Place your stop-loss just below the low of the order block.

Profit Target: Target a fixed 2:1 Reward-to-Risk ratio or the next pivot high.

| PROS: Provides precise entry points using both Fibonacci and Order Blocks for strong confluence.Ideal for trending markets with a clear directional bias. |

| CONS: May miss trades if the market doesn’t retrace enough to your entry level. Not well-suited for range-bound or choppy market conditions. |

What other SMC Concepts Work Well with Order Blocks?

Order blocks are a vital part of Smart Money Concepts (SMC), but they become even more powerful when combined with other strategies. Here are two key concepts that complement order blocks well:

Fair Value Gaps

Fair Value Gaps are areas on the chart where price moves rapidly, leaving gaps in liquidity. These gaps represent imbalances between buyers and sellers, making them prime spots for institutional traders to step in.

When a fair value gap aligns with an order block, it can create a high-probability trade setup. Traders can look for price retracements into the FVG for potential entries, knowing the market is likely to fill this gap before moving in the desired direction.

Change in Character (ChoCh)

A Change of Character (ChoCh) occurs when price action shifts direction, typically marking a potential reversal or the end of a trend. When combined with order blocks, a ChoCh can help confirm that a reversal is imminent.

For instance, if a bearish order block forms and a ChoCh occurs with it, this gives traders an extra layer of confirmation that the market is likely to move downward.

Closing Thoughts on Order Blocks

Order blocks are a powerful tool for retail traders looking to follow in the footsteps of institutional traders. By mastering this concept, you can gain a clearer understanding of price movements and improve your entries and exits in the market.

However, it’s essential to remember that no strategy is foolproof. Success in trading often depends on your ability to combine multiple tools, such as order blocks, fair value gaps, and market structure shifts, to create a well-rounded trading plan.

Advantages of Trading Order Blocks

- Increased Market Insight: Order blocks provide a glimpse into how major players like banks and institutions operate.

- Reliable Price Zones: Once identified, order blocks often act as reliable areas of support or resistance.

- Precision: Trading around these zones allows for more accurate entries and stop-loss placements.

Disadvantages of Trading Order Blocks

- Complexity: Identifying order blocks correctly can take time and experience, especially on lower time frames.

- False Signals: Not all order blocks will lead to profitable trades, and some may be invalidated by sharp market moves.

- Patience Required: Waiting for price to return to an order block for entry can require patience and discipline.

FAQ Section

What role do kill zones play in Order Block trading?

Kill zones refer to specific times of day when institutional traders are most active, such as the opening hours of major financial centres like London, New York, and Tokyo. These periods often see increased volatility and liquidity as smart money players move large amounts of capital. For SMC traders, kill zones are crucial because they provide the best opportunities for trading strategies like liquidity grabs, fair value gap retracements, and order block reactions. By focusing on these time windows, traders can capture faster, more predictable price swings, especially when scalping lower time frames like the 1-minute or 5-minute charts.

How do order blocks and liquidity pools work together in SMC trading?

Order blocks and liquidity pools are closely interconnected in Smart Money Concepts. Order blocks represent zones where large institutions place buy or sell orders, and liquidity pools are areas where stop-loss orders from retail traders accumulate, typically around obvious market levels like recent highs or lows. Institutional traders often trigger liquidity pools to fill their large orders within the order blocks. For example, they might push the price to take out retail stop losses at a liquidity pool, then reverse the price back in line with their positions at the order block. By combining these two concepts, traders can predict market reversals or continuations more effectively.

How can I use order blocks to improve my trading strategy?

Order blocks offer a reliable framework for predicting price reversals or continuations in the market. To use them effectively in your trading strategy, first identify the last bullish or bearish candle before a sharp move in the opposite direction. Once an order block forms, it acts as a zone of support or resistance, depending on its position. You can refine your strategy by entering trades when the price retraces to an order block, knowing that these zones are likely to hold because institutional players have entered the market there. This technique can improve the accuracy of your trades and help you better manage risk.

How do I spot a fair value gap (FVG) in Smart Money Concepts, and why is it important?

A fair value gap (FVG) occurs when there is a sudden imbalance between buyers and sellers, leading to a rapid price movement that leaves little or no overlap between the wicks of consecutive candles. To spot an FVG, look for sharp moves where price has ‘gapped’ – meaning it didn’t spend much time in a certain price range. FVGs are important because price tends to return to these levels to ‘fill’ the gap, offering prime trade entry opportunities. In SMC trading, FVGs are a signal that the market is out of balance, and traders can use them to identify high-probability trade setups when price retraces to these gaps.

What is the key advantage of using Smart Money Concepts (SMC) in trading?

Smart Money Concepts (SMC) give traders insights into how institutional investors like banks and hedge funds operate in the markets. The key advantage is that SMC allows retail traders to follow the ‘smart money’ instead of trading against it. By understanding where these big players place their orders – such as through order blocks or liquidity pools – traders can align their strategies with institutional moves. This reduces the chances of getting stopped out by market manipulation and improves the precision of entry and exit points, giving traders a significant edge in decision-making.