The Double Bottom pattern is one of the most powerful and reliable signals for spotting major bullish reversals. In this guide, we’ll break down exactly how to identify a double bottom, how to trade it step-by-step, and how to integrate it into your trading strategy with confidence.

What is a Double Bottom Chart Pattern?

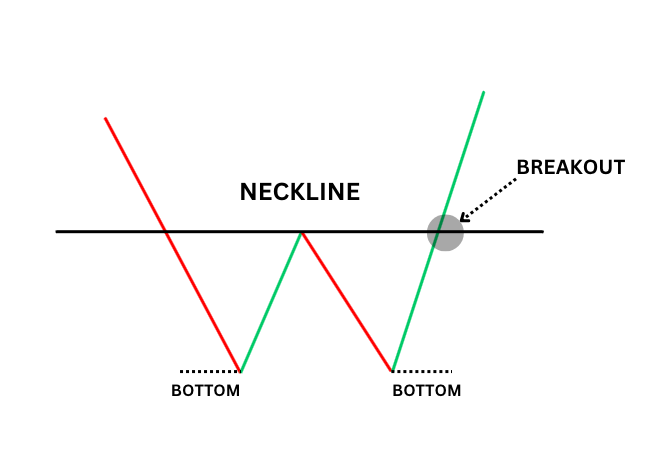

A Double Bottom is a bullish reversal pattern that forms after a sustained downtrend. It looks like the letter “W” on a chart.

This pattern signals that price has tested a key support level twice, failed to break below it both times, and is now showing signs that selling momentum is exhausted.

Here’s the basic sequence:

- Sellers attempt to push prices lower but fail at a key support.

- Price bounces up, then returns to retest the same support zone.

- When sellers fail again, buyers take control – leading to a bullish reversal.

The pattern is confirmed once price breaks and closes above the resistance between the two lows, known as the neckline.

After a confirmed breakout, the neckline often acts as new support, offering potential continuation to the upside.

Key Characteristics of the Double Bottom

- Formation: Two clear swing lows form near the same horizontal support level, separated by a peak (the neckline).

- Psychology: Sellers attempt to break support twice but fail, revealing exhaustion and allowing buyers to gain control.

- Confirmation: A confirmed double bottom requires a break and close above the neckline, validating the reversal.

Note:

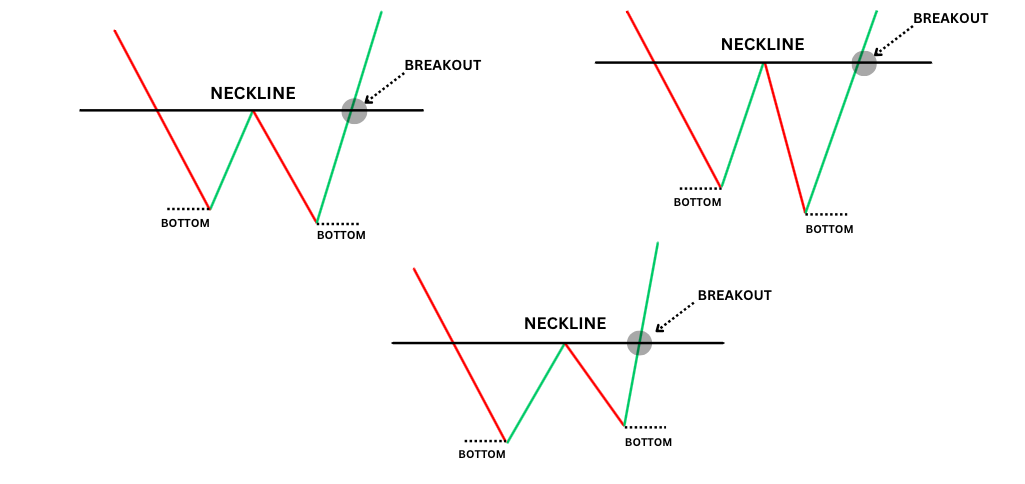

Not all double bottoms are perfectly symmetrical. Sometimes the second bottom is slightly higher or lower. What matters most is the structure and the strong rejection of lower prices, not perfect visual symmetry.

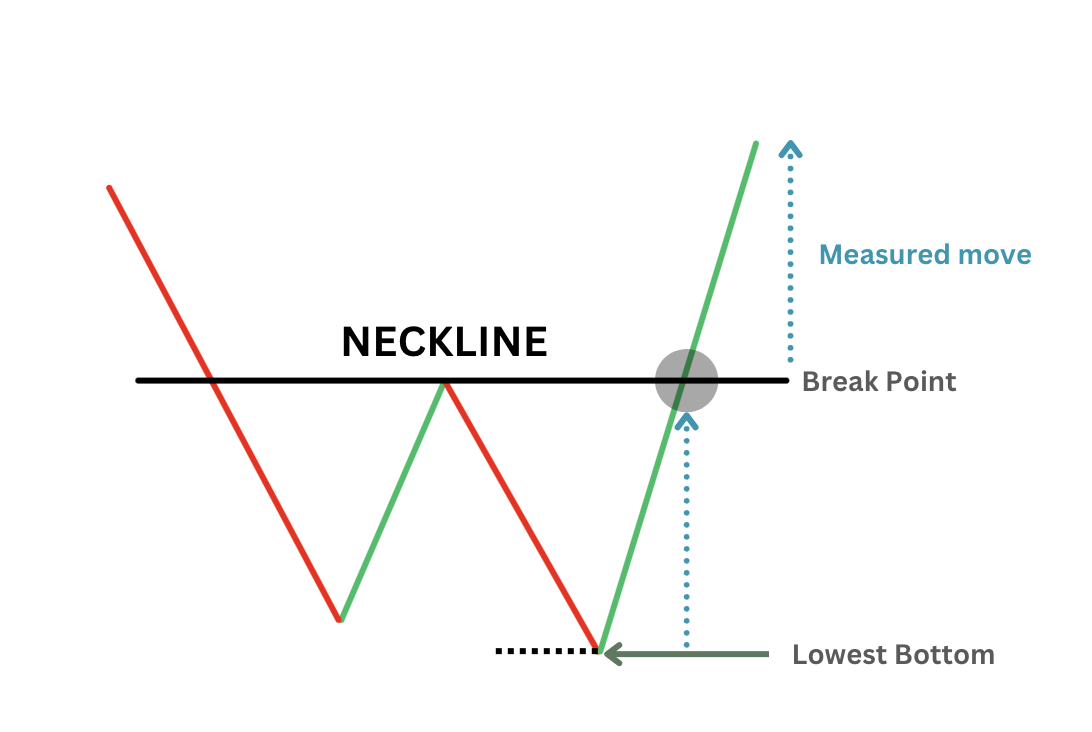

Understanding the Measured Move Target

The measured move target is the expected price movement an asset will make, once a chart pattern has been broken. In a double bottom’s case, the price move would be positioned to the upside.

How to calculate it:

- Measure the vertical distance from the lowest bottom to the neckline.

- Copy that distance upward from the neckline breakout.

Note that a measured move target provides a realistic profit-taking zone, but like all technical targets, serves more as a guideline rather than as a guarantee. Sometimes, a double bottom may not reach its target, other times, it may overshoot.

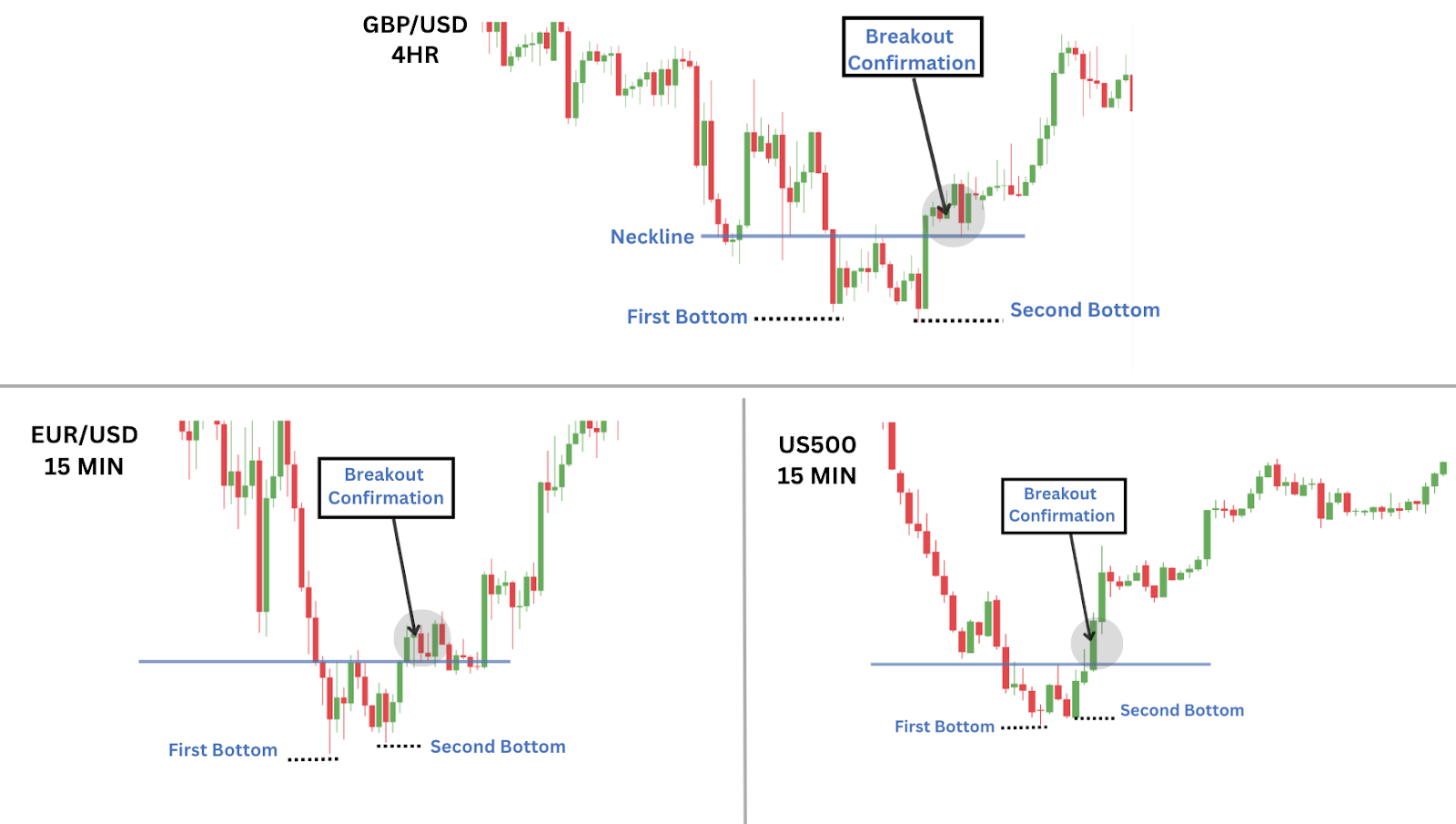

Double Bottom Examples

Double bottoms are recurring patterns that can appear on any timeframe, any asset class—from 1-minute to weekly charts— to traditional assets like stocks, to commodities, cryptos, and forex. This is an incredibly versatile pattern, that you can repeatedly spot across various charts and assets, making it a value add to your trading playbook.

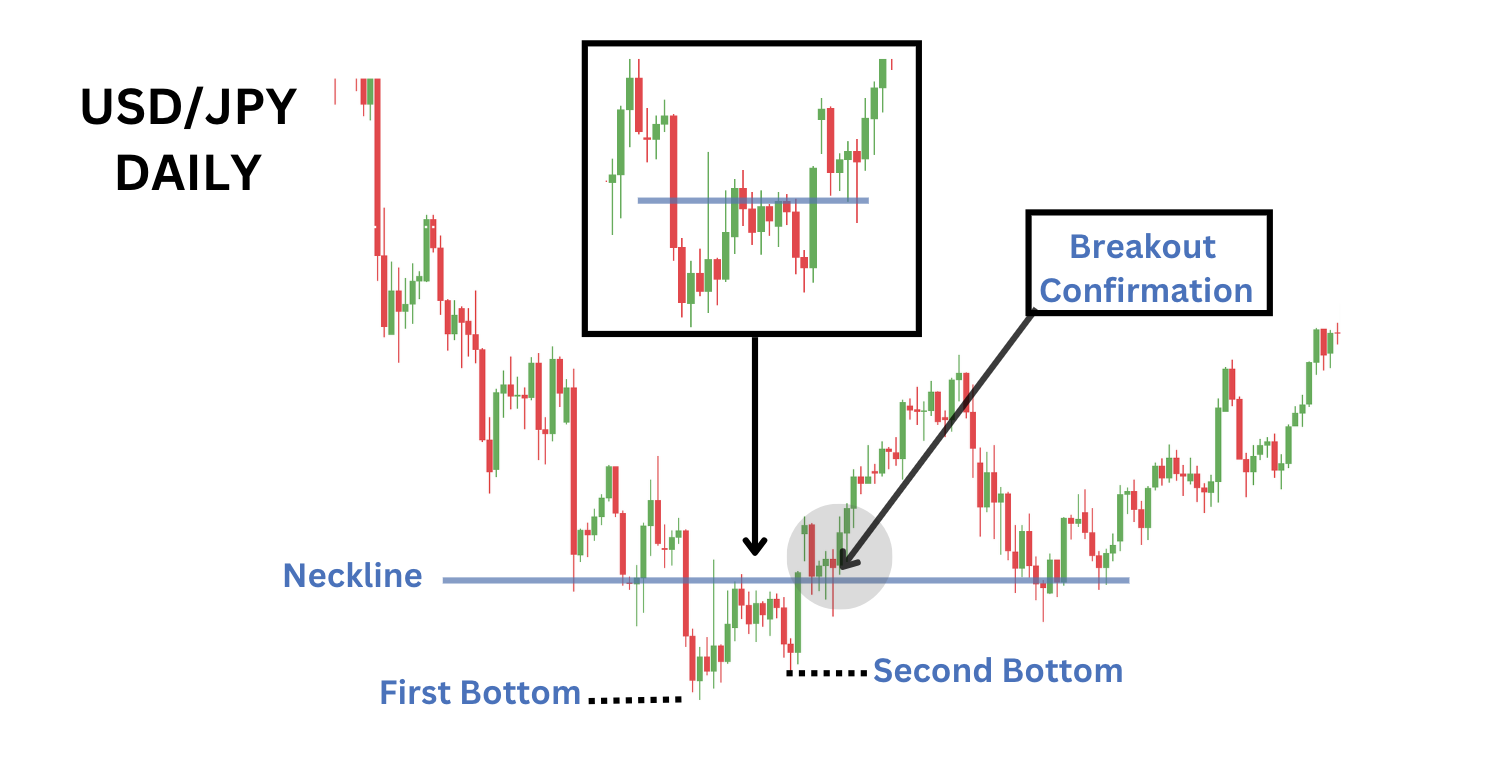

Case Study: Double Bottom on USD/JPY (Daily Chart)

Let’s examine a time when a double bottom caught a significant low.

After an extended downtrend on USD/JPY, the price forms two lows at around the same area. Finally, the price retraces to the previous high, creating that iconic ‘W’ shape and confirming the presence of a double bottom.

Following the breakout, the price retraces back to the neckline, and once again begins to rally to significant highs — confirming the idea of a bullish reversal.

How to Trade the Double Bottom Pattern

The simplest way to trade a double bottom is to enter a long position once the neckline has been broken towards the upside. However, you can also wait for a retest, or even trade it from the second leg up.

The point is, there is a variety of methods you can use to tackle the double bottom, each with their own unique setups. Here are three simple ways to get you started on trading this pattern.

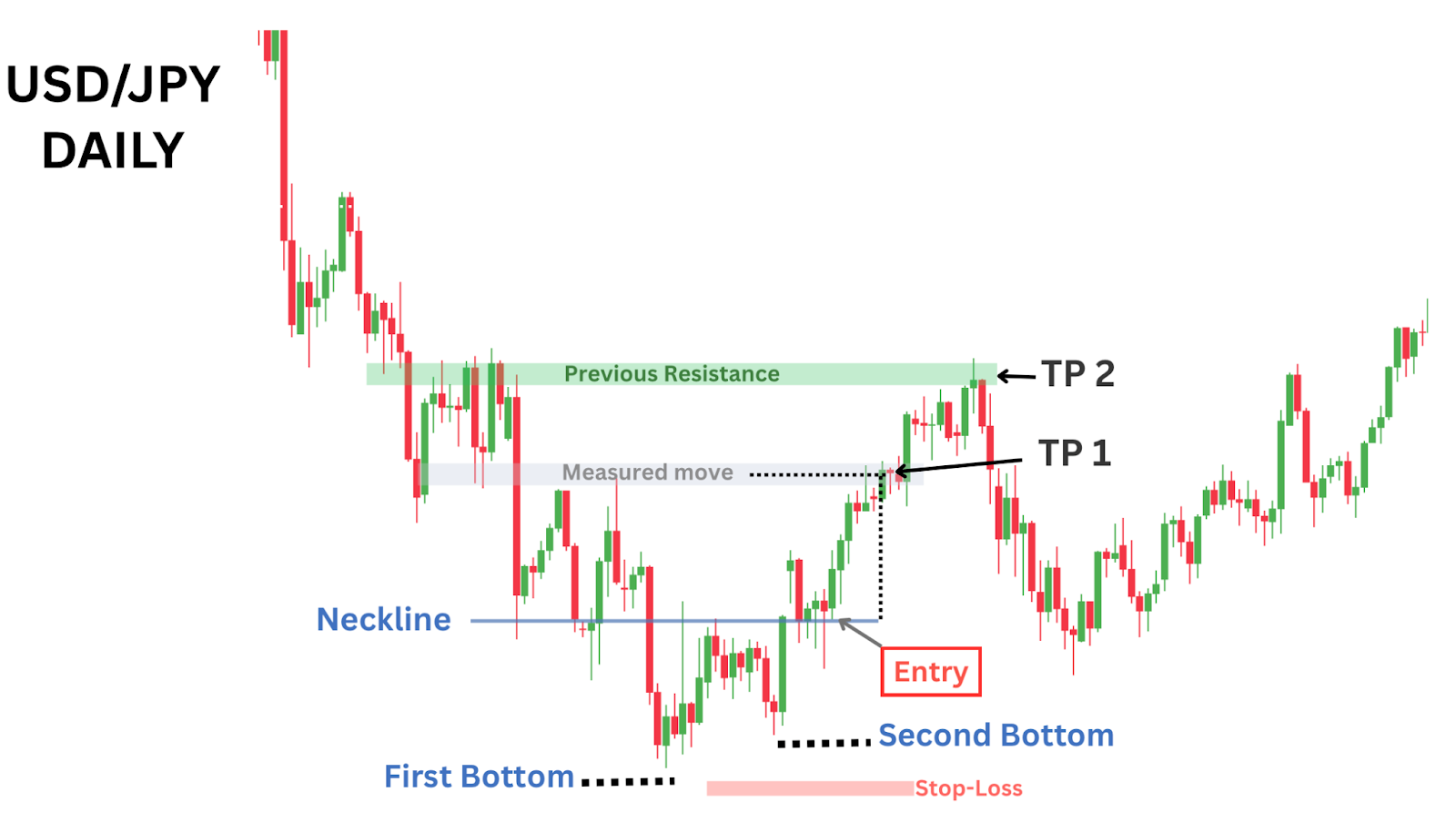

Method One: Break and Retest Entry (Low Risk Strategy)

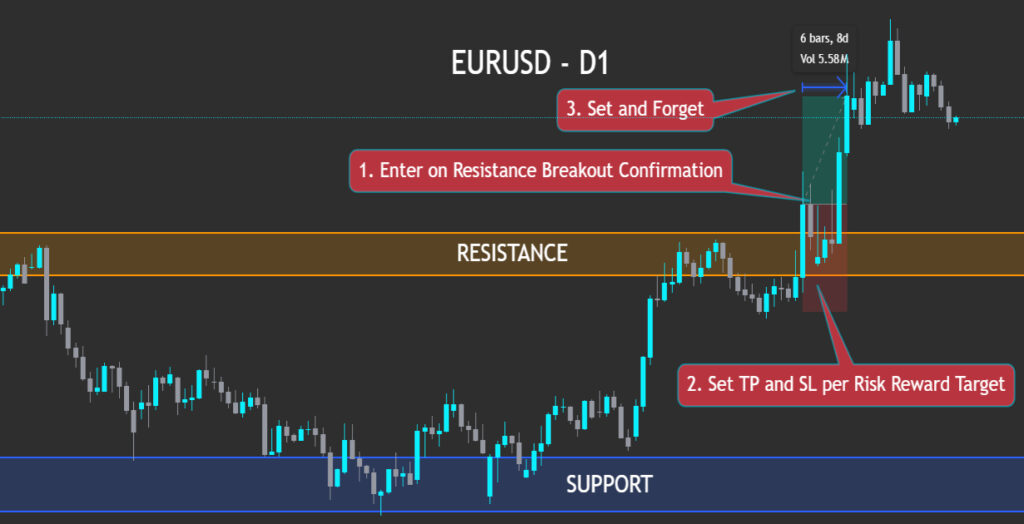

The most conservative approach to trading a double bottom is to wait for price to break and close above the neckline, then retest the neckline to confirm it as new support.

Instead of jumping in on the breakout, you wait for price to pull back to the neckline and show bullish rejection – locking in a better risk-to-reward profile and reducing the chances of getting caught in a failed breakout.

Setup:

- Formation: Price forms a double bottom and breaks above the neckline, confirming the reversal.

- Retest: Price pulls back to retest the neckline — former resistance now acting as support.

- Entry: On a bullish rejection candle or strong close from the neckline retest.

- Stop Loss: Placed just below the low of the retest candle.

- TP1: At the measured move target (bottom-to-neckline distance projected upward).

- TP2 (optional): At the next major resistance level or prior structure high.

Why This Works:

- Prioritises confirmation over early entries

- Higher success rate due to confirmation of the new support

- Cleaner structure with clearly defined invalidation

Drawback:

- You may miss the trade entirely if price doesn’t retest the neckline

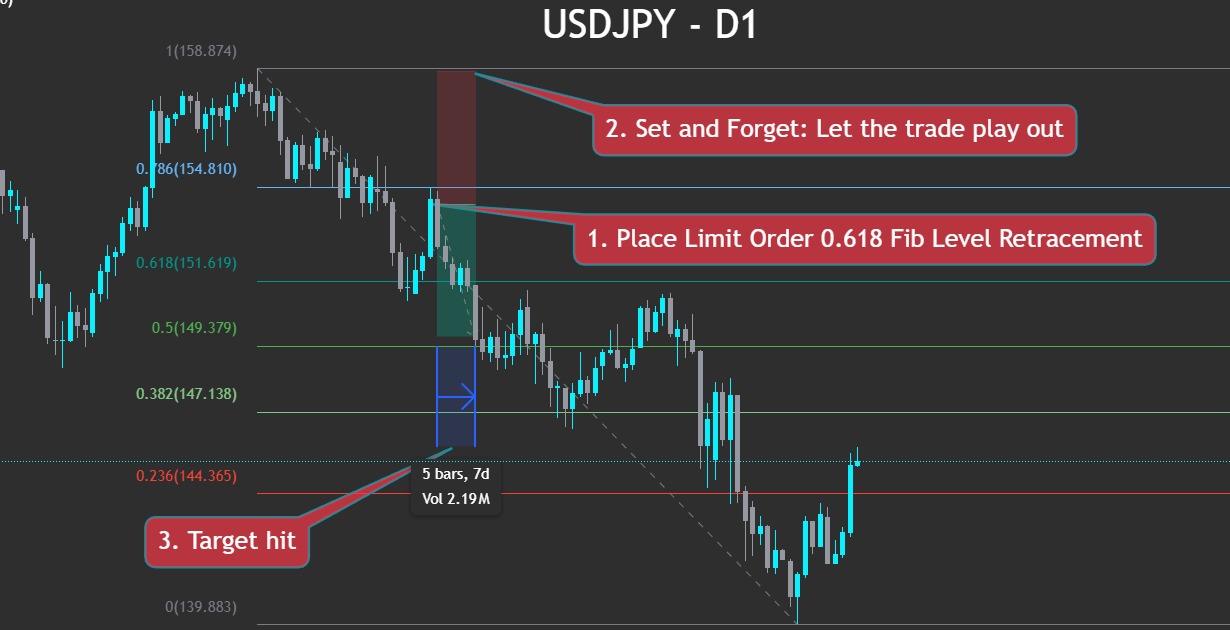

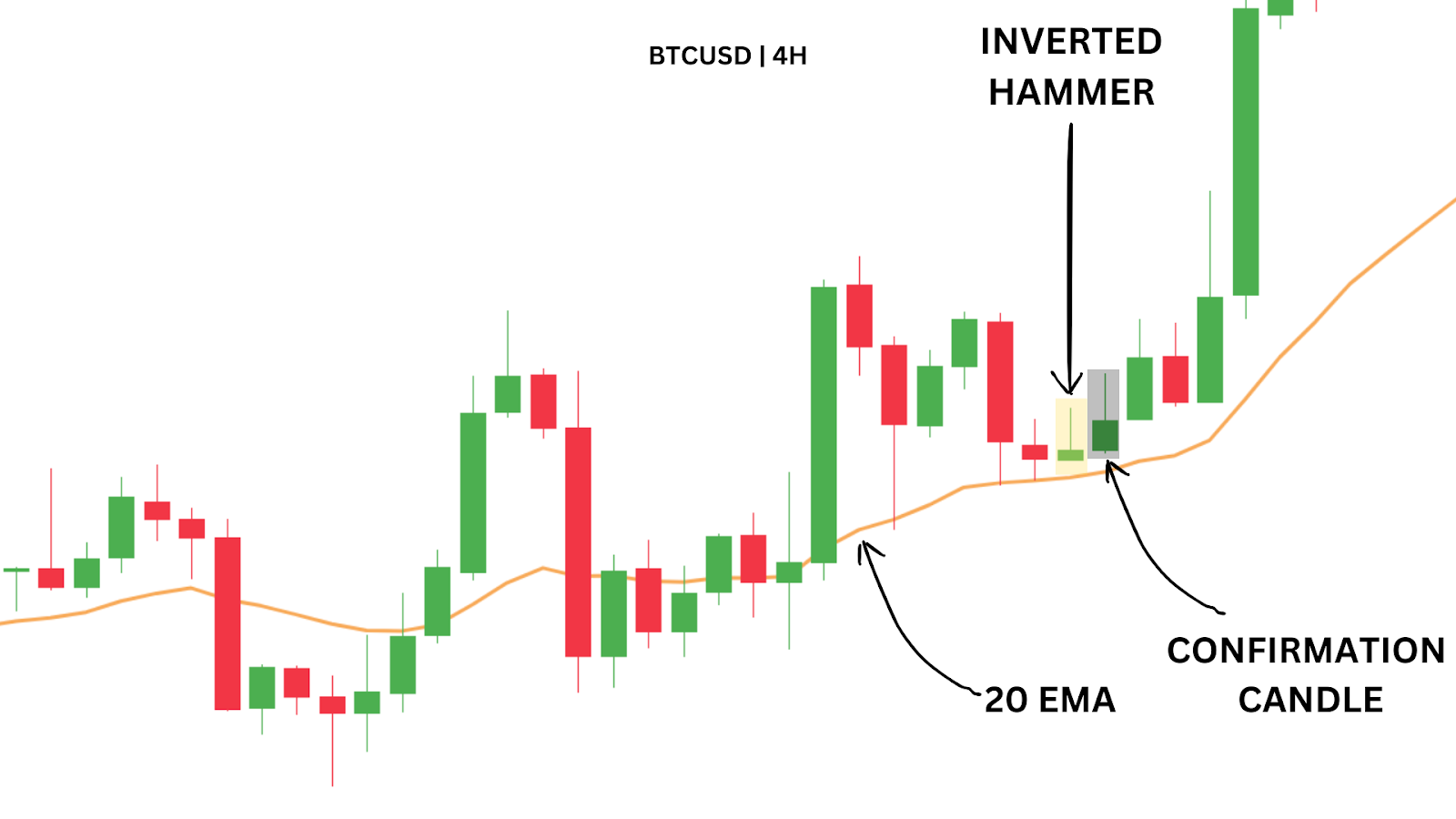

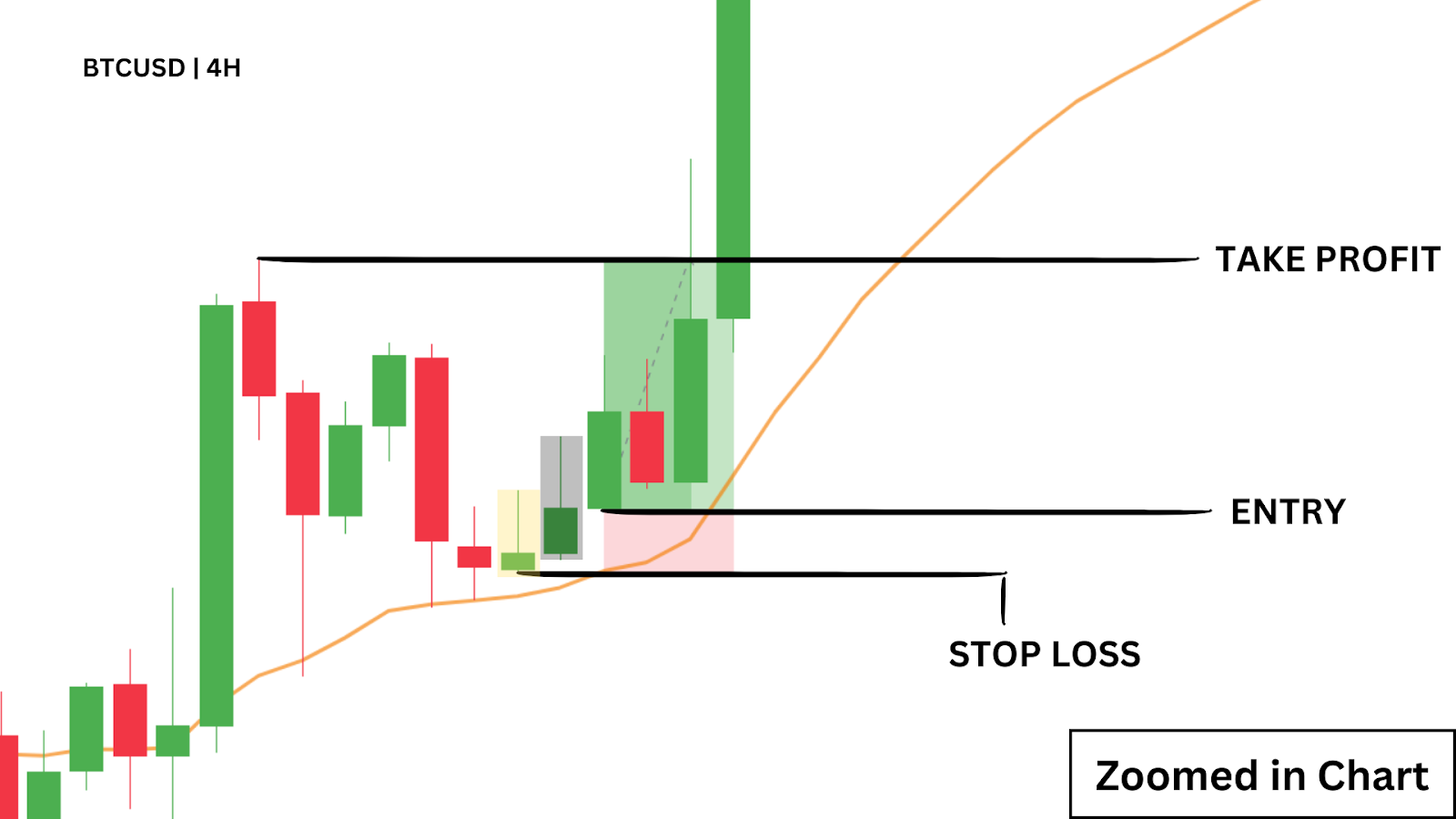

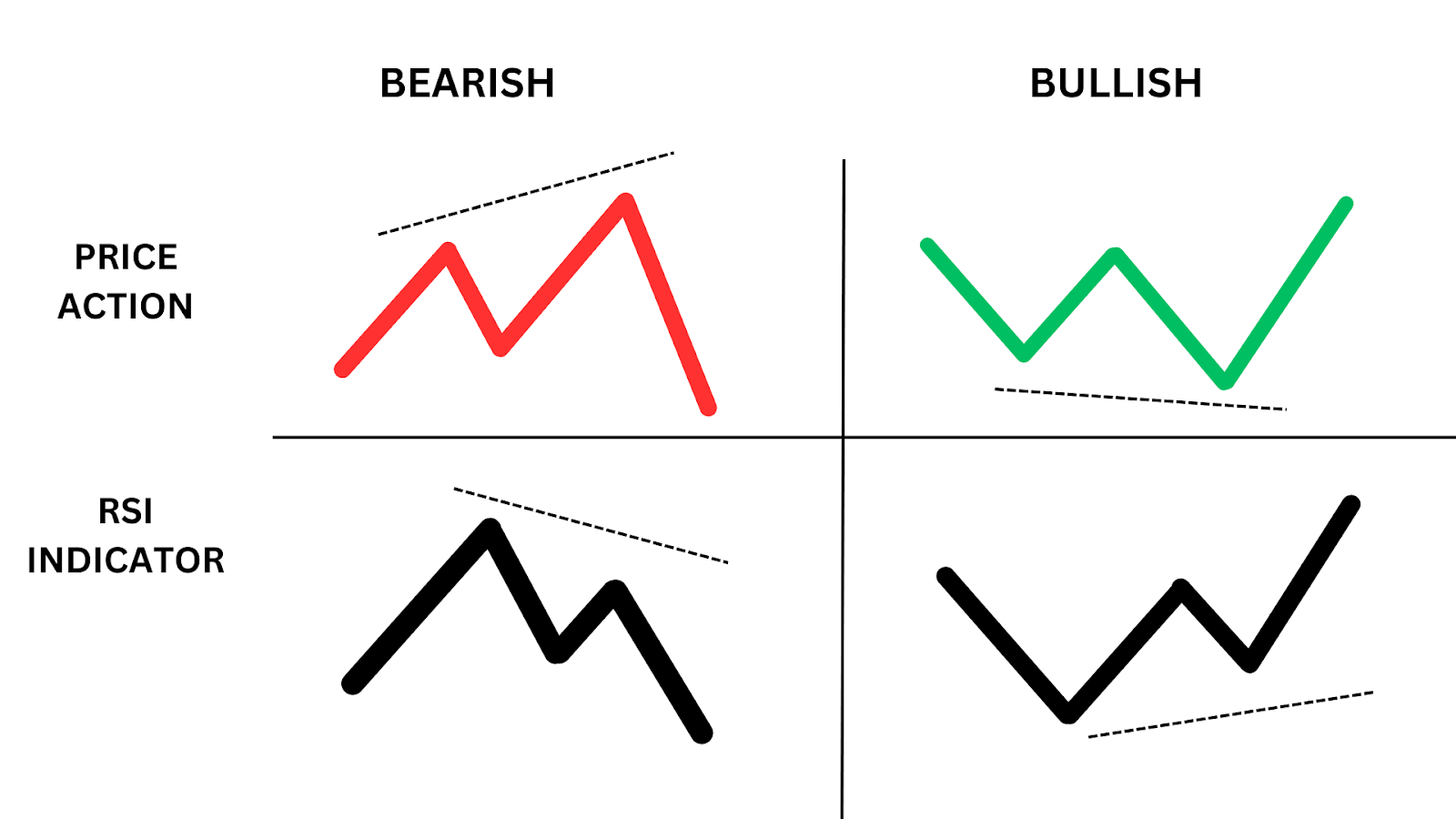

Method Two: Aggressive Second Bottom Entry (High Risk Strategy)

This strategy involves entering at the second bottom – before the neckline breakout – aiming to catch the reversal early.

It’s a higher risk approach, but it offers a better entry price and a tighter stop-loss, making it attractive for traders confident in reading early momentum shifts.

Setup:

- Formation: Price forms a double bottom at key support, with the second bottom holding at or near the same level.

- Momentum Shift (RSI Indicator): RSI prints a higher low, price forms an equal or lower low.

- Entry: On the bullish candle close after the second bottom forms and rejection is confirmed.

- Stop Loss: Just below the wick of the second bottom.

- TP1: At or just above the neckline.

- TP2: At the measured move target (bottom-to-neckline height projected upward).

- TP3 (optional): Prior high or next major resistance level.

Why This Works:

- The presence of a bullish divergence gives confidence for a reversal near the previous low

- The neckline serves as a high probability target, unless there are key resistances below

- Offers a strong risk-to-reward, going beyond the standard 1:1 RR a double bottom typically has

Drawback:

- The price can trail lower despite a bullish divergence, making this a risky entry

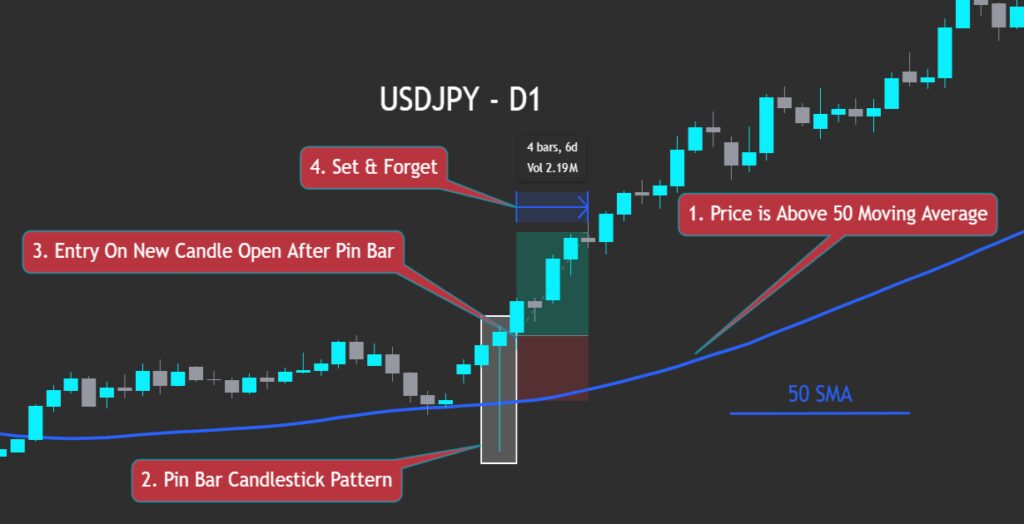

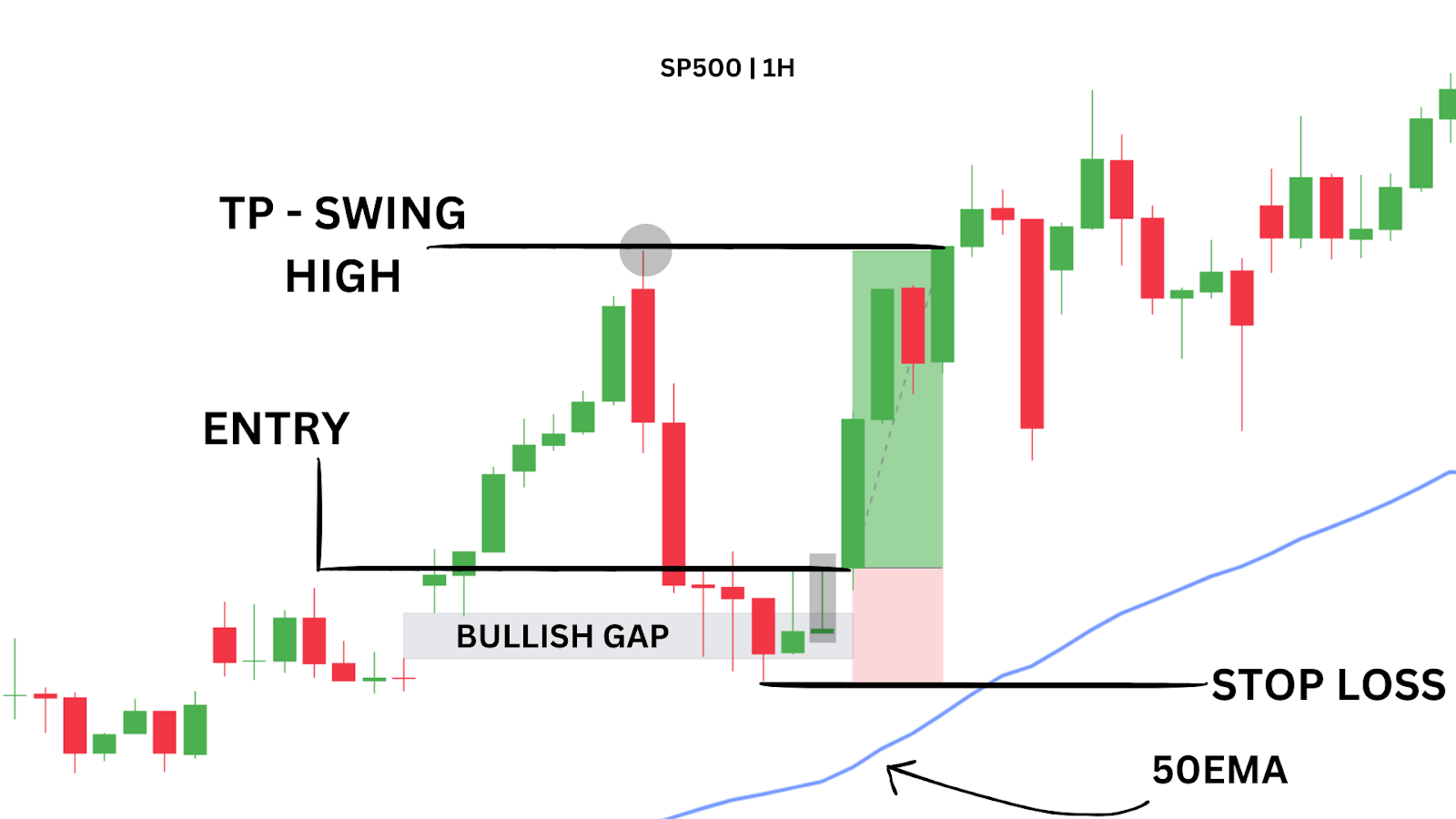

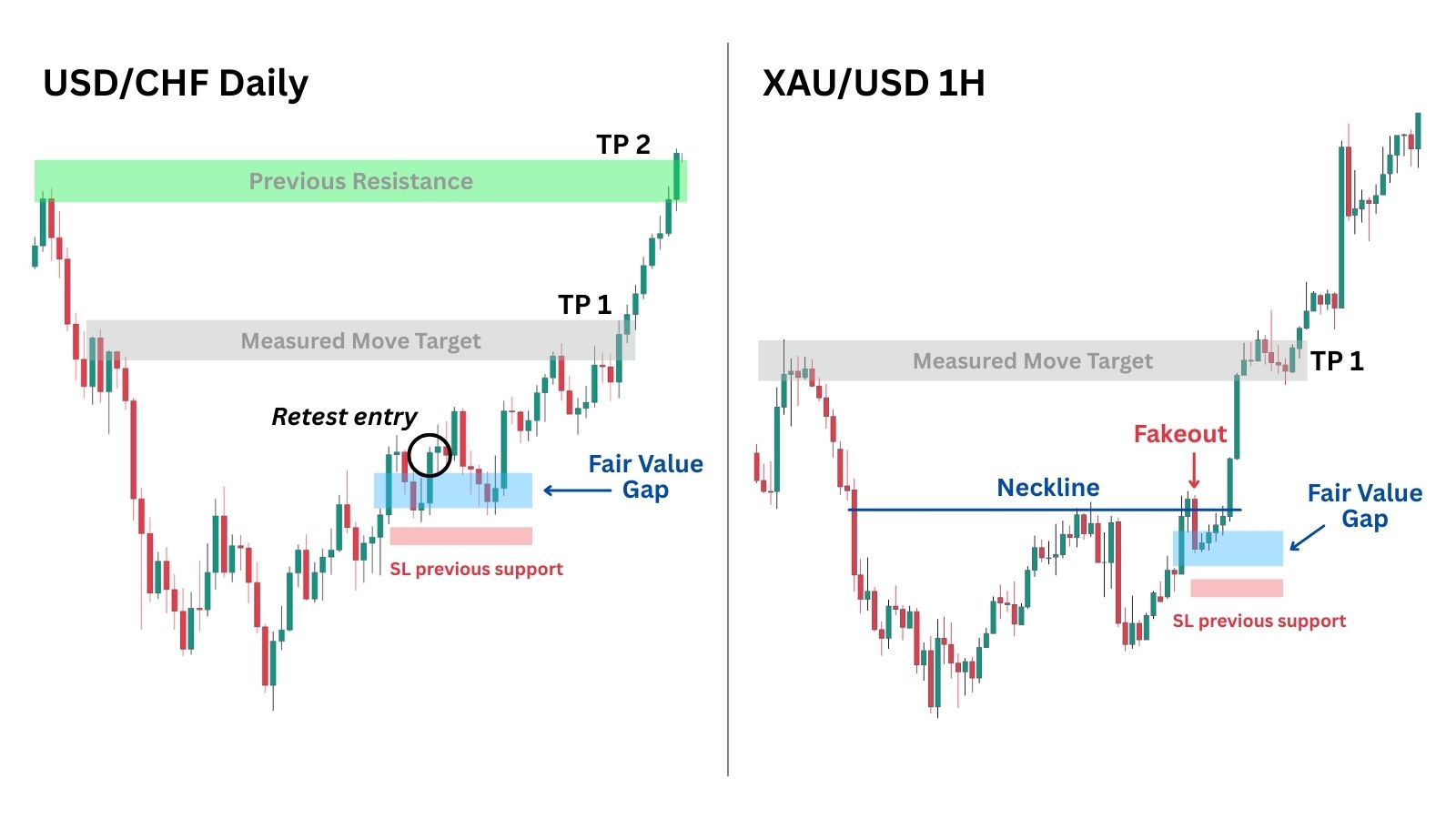

Method Three: Fair Value Gap Retest Strategy

This is somewhat of a more advanced strategy that combines with Smart Money Concepts techniques. Once a double bottom pattern breaks out, price sometimes moves so aggressively that it skips over certain levels, creating a Fair Value Gap (FVG).

What is a Fair Value Gap (FVG)?

A Fair Value Gap is a gap between candles where price moves so quickly that the first candle’s wicks do not overlap with the third candle’s wicks. This creates a gap within the second candle, and a temporary imbalance — a point in time where price moves so fast that not all buy orders were filled in an area. In many cases, price will return to fill this gap before continuing the breakout direction.

Why it Matters:

- FVGs act like magnets – price often revisits them to “rebalance” liquidity.

- They provide low-risk re-entry zones after a confirmed breakout.

- They symbolise strong momentum in the chart, which validates the breakout on a double bottom.

A fair value gap that occurs during the breakout of a double bottom pattern signals two things: the breakout has high momentum, and that price is likely to retrace to the FVG.

The FVG tends to also align with the neckline, but there are scenarios where the FVG occurs below or above the neckline. This guards against scenarios where the double bottom makes a false breakout, only to retrace slightly and rally again.

Setup:

- Formation: Confirmed double bottom with neckline breakout, and a Fair Value Gap.

- Entry: On bullish rejection candle as price taps into the FVG zone.

- Stop Loss: Below the FVG retest zone or previous low, providing a much better risk-to-reward.

- TP1: At the measured move target.

- TP2 (Optional): At the next major resistance level.

Why This Works:

- The Fair Value Gap confirms strong momentum — it’s not just a breakout, it’s backed by imbalance.

- The gap retest filters out weak entries, giving a clear spot to define risk.

- Targets align cleanly with measured moves and key resistance — strong R:R, no guesswork.

Drawback:

- Momentum can fade fast — price may slice through the gap without reacting, turning the setup into a trap.

Closing Thoughts on the Double Bottom Pattern

Double Bottom patterns remain one of the most reliable – and often misunderstood – chart patterns in technical analysis.

While its structure appears simple, the real skill lies in recognising where and when it forms, what the price action is signalling, and how to enhance the setup with additional confluences such as RSI divergence, volume confirmation, or Fair Value Gap retests.

Whether you’re scalping intraday moves or swinging major reversals, the Double Bottom offers clear structure, logical risk management, and repeatable setups across all markets and timeframes.

Remember:

Simplicity doesn’t make a setup weak. The best traders are the ones who can spot the “W” pattern early – before the broader market reacts.

Advantages of Trading the Double Bottom Pattern

| Widely recognised: | One of the most trusted reversal signals in technical analysis, familiar to traders at all levels. |

| Clear structure | The “W” shape is easy to spot and plan around, especially when paired with RSI or FVG. |

| Built-in risk management | Naturally defines a stop loss (below second bottom) and clear take-profit targets. |

| Works across markets | Applies to forex, indices, crypto, commodities, all asset classes and timeframes. |

| Scalable entries | Flexible for aggressive, conservative, or re-entry setups depending on your trading style. |

Disadvantages of Trading the Double Bottom Pattern

| Prone to fakeouts | Without confirmation (e.g. RSI divergence, volume), early entries may fail. |

| Can be slow to form | On higher timeframes, the full pattern may take time to complete. |

| Context is critical | A double bottom in a strong downtrend may be a trap without additional confluence. |

| Not always textbook | Uneven or imperfect bottoms can confuse traders who rely on perfect symmetry. |

FAQs

What’s the difference between a double bottom and a double top?

A double bottom is a bullish reversal pattern that forms after a downtrend. It signals that price has rejected the same support twice and may rally. Double top patterns are the opposite – a bearish reversal after an uptrend, forming with two peaks instead of two bottoms.

How do I know the pattern is valid?

You need three things:

- Two distinct lows near the same price level

- A neckline between them (highest point in the pattern)

- A breakout and close above the neckline

Bonus confirmation: RSI divergence, volume spike, or a neckline retest.

What’s the best timeframe for spotting double bottoms?

Double bottoms work across all timeframes – but:

- 1H–Daily: Better for clean structure and swing trades

- 1M–15M: Ideal for scalps, but requires tighter execution and strong confluence

Can I trade Double Bottoms without indicators?

Yes – structure is king. But using confluence from indicators like RSI, EMA, FVG, or volume can help filter out low-quality setups and improve entry timing.

Where should I place my stop loss and take profit?

- Stop Loss: Below the second bottom (or below the FVG zone if you’re trading a retest)

- TP1: Neckline

- TP2: Measured move projection

- TP3: Previous resistance or the next major structure high

Are all double bottoms the same?

No – some have equal lows, others don’t. Some break cleanly, others come back to retest. What matters is the psychology: sellers attempt to break support twice and fail, giving buyers the upper hand. Confirmation and context are key.