Hedge funds and retail traders may trade in the same market, but they do so under vastly different conditions. One is built on structure and strategy. The other is shaped by accessibility and adaptation.

Let’s dive in the key differences of how hedge funds and retail traders approach the markets.

Two Worlds, One Market: The Structural Divide in Forex

The foreign exchange (forex) market is the most liquid and accessible trading arena in the world, but access doesn’t mean equality. Hedge funds and retail traders exist in the same ecosystem but operate with entirely different systems, capital, goals, and tools.

Hedge funds are built for performance—with large capital, full-time teams, and advanced systems—while most retail traders go it alone, risking personal savings with limited tools, time, and training. That’s why 80–90% of retail traders lose money, according to multiple broker reports and European Securities and Markets Authorities (ESMA) studies, highlighting how stark the gap truly is.

This structural gap between access and integration has long disadvantaged retail traders.

However, in 2025, that gap is beginning to close. The rise of prop firms like FXIFY offers retail traders a bridge to institutional-style capital access, paired with performance-based scaling and embedded risk protocols that encourage professional habits.

Hedge Funds: Engineered for Precision

Hedge funds are designed to deliver consistent, risk-adjusted returns. Every trade is guided by capital preservation and long-term growth—not short-term gains. Most funds average 6–10% annually, prioritising steady compounding and controlled risk over big wins.

| Macroeconomic Frameworks Hedge funds begin with a top-down view—tracking rates, inflation, jobs, housing, and earnings to shape their currency bias and exposure. |

| Quantitative Models Many use proprietary algorithms, coded in Python or R, to forecast probabilities, time entries, and manage portfolio risk based on volatility and historical price behaviour. |

| Risk-Neutral Strategies Options-based funds often run delta- or gamma-neutral setups to reduce directional risk and stay steady through volatility. |

| Net Exposure Management Positions are sized in context of the whole portfolio. No single trade dominates risk, helping avoid overexposure. |

| Institutional Tools From 13F filings and COT reports to dark pool data and satellite feeds, hedge funds combine multiple sources for deeper insight and faster decisions. |

This structure helps them stay disciplined, adapt quickly, and sidestep the emotional traps that catch most retail traders.

Retail Traders: High Potential, Low Consistency

Retail traders are a diverse group—from hobbyists and side-hustlers to highly motivated individuals working toward full-time trading.

With the rise of prop firms, mobile platforms, and institutional-grade tools, retail traders have never been more empowered. Seasoned traders understand that risk management is key to their success, and often focus on trading a strategy (such as MACD RSI Strategy and SMC Fair Value Gaps), rather than an asset.

Despite that, 80% of retail traders still are unprofitable – meaning that the majority of them fall into the same patterns of bad practices.

Here’s why consistency is so hard to maintain for retail:

| Trading Style Heavy reliance on technical analysis, signals, and limited use of macro or fundamental data. |

| Time Commitment Trading often takes a back seat to jobs or personal responsibilities, leaving little time for analysis or refinement. |

| No Performance Framework Retail traders lack the structure of institutional environments—no benchmarks, reviews, or risk oversight to guide improvement. |

| Personal Risk Trades are funded with personal savings or income. This increases emotional pressure and limits their ability to scale or absorb drawdowns. |

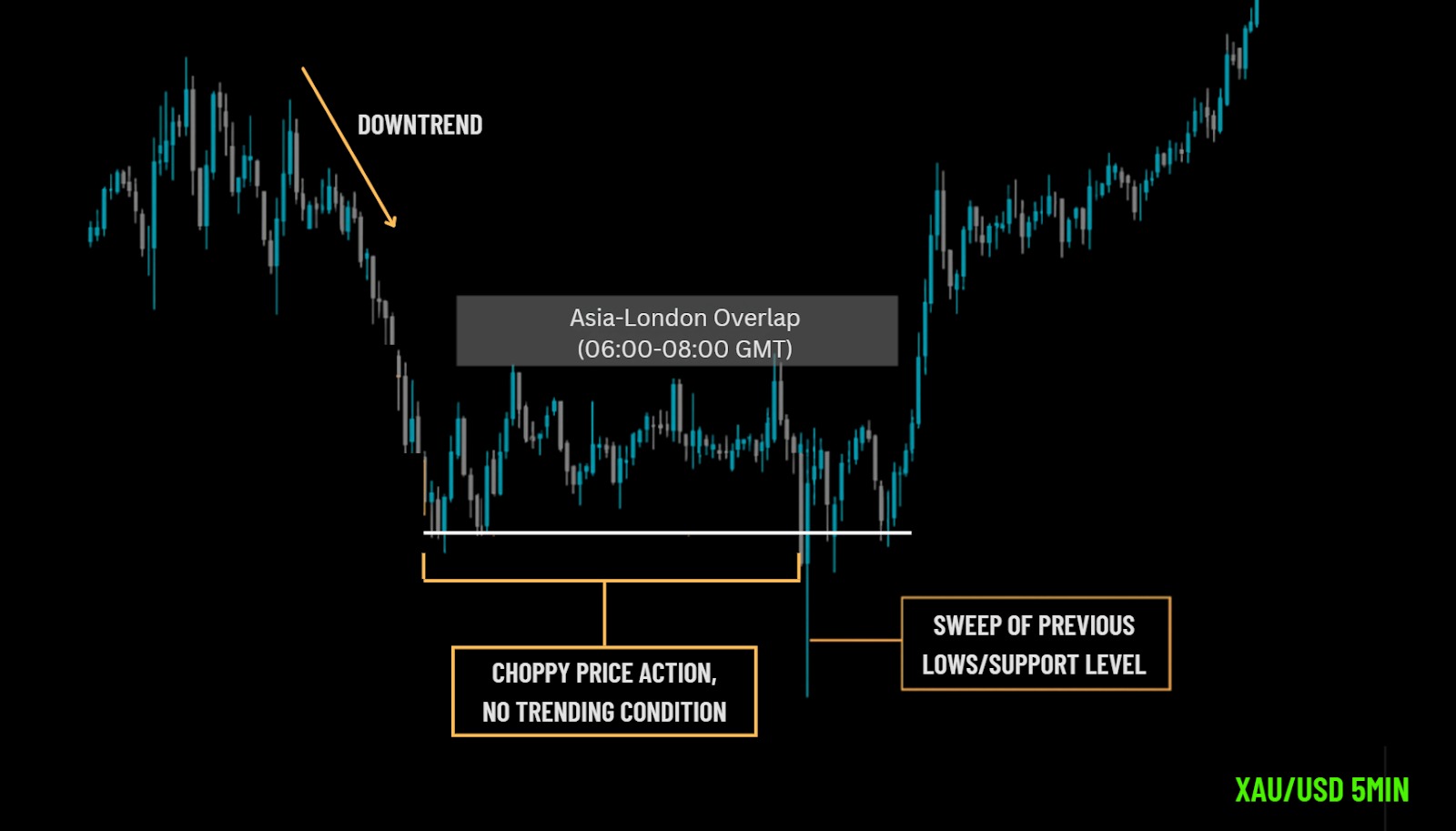

| Limited Market Impact Retail positions are too small to move markets or access preferential pricing, and stop losses are often swept in volatile or thin conditions. |

| Psychological Volatility Without behavioural systems in place, decisions are frequently impacted by emotion—overtrading, chasing trends, or reacting impulsively to news or social media. |

Retail traders tend to focus on profits rather than risk management. Because their position sizes are small, the perceived upside often feels insignificant—prompting them to overtrade, overleverage, or skip stops in search of “worthwhile” wins.

This mindset often leads to emotional trading, revenge entries, or abandoning plans when results feel too slow or small. Without a risk-first framework, consistency becomes difficult to sustain.

Institutional Workflow vs. Retail Emotional Trading Loop

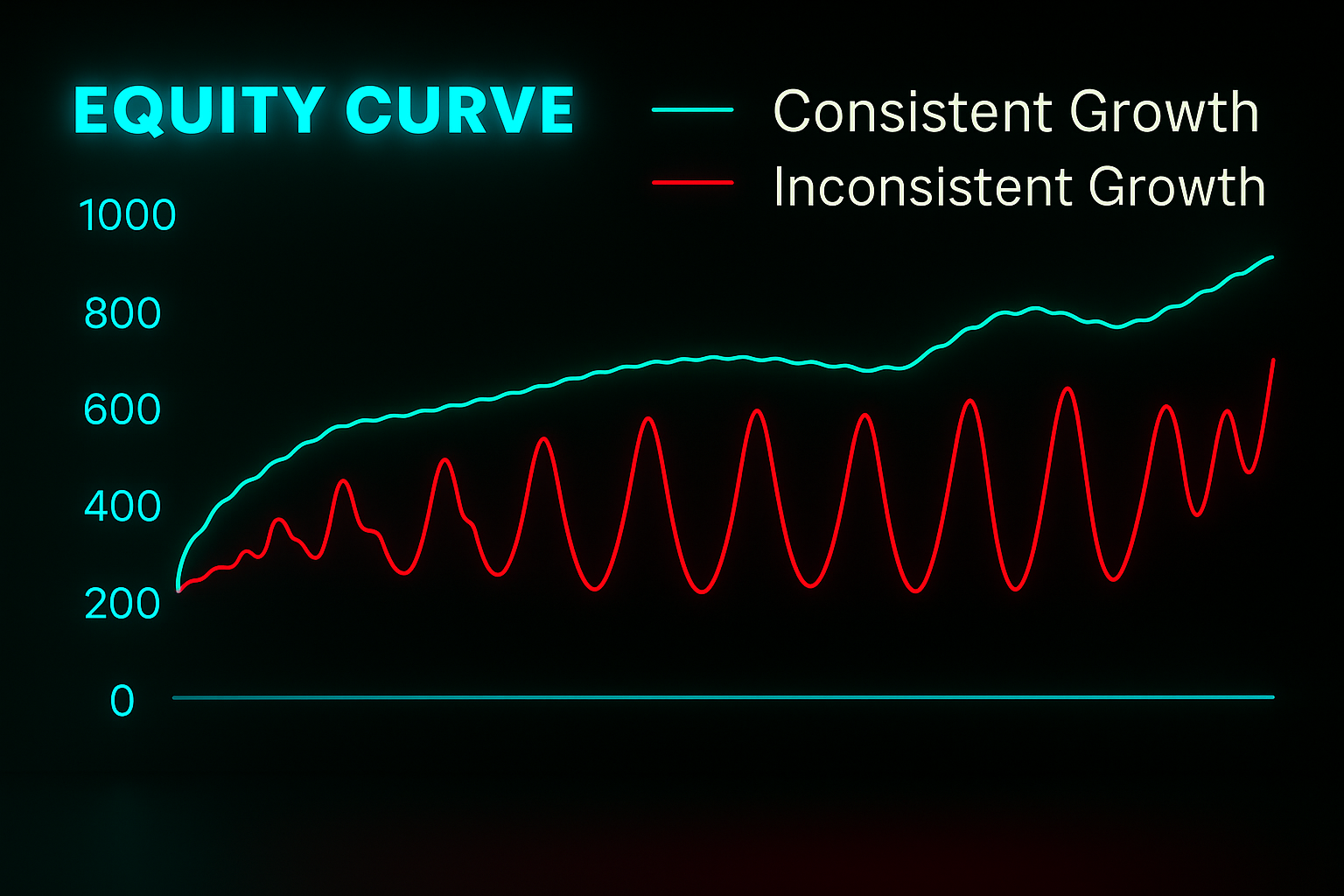

While seasoned traders exist, there’s a reason 80–90% of retail traders lose money. Many fall into a boom-and-bust cycle, giving back their profits to the market, as their discipline fades.

Institutions follow a defined workflow—strategy, execution, review—while most retail traders operate in a loop driven by emotion: react, enter, regret, repeat. The difference isn’t just experience. It’s structure.

However, this institutional discipline is also a double-edged sword.

While it enforces structure and accountability, it can limit flexibility, creativity, and adaptability—qualities that some skilled retail traders lean into. Bridging these two worlds means finding a structure that supports consistency, without stifling the edge that makes discretionary trading effective.

How Some Retail Traders Are Bridging the Gap

The gap between institutional and retail trading hasn’t vanished—but it is narrowing. More independent traders are shifting away from reactive setups and toward structured, repeatable systems. They’re adopting rules-based execution, journaling results, and applying risk frameworks once reserved for funds.

Prop trading programs have accelerated this shift by embedding discipline into the trading environment. Limits on daily loss, trailing drawdowns, and maximum drawdowns aren’t just protective—they’re formative. These rules push traders to think in terms of capital preservation, not just profit potential. Risk becomes calculated. Trade selection becomes deliberate.

The image below captures this mindset shift—contrasting intuition-led trading with a structured model grounded in data, position sizing, and

The New Trading Era: Funded, Focused, Disciplined

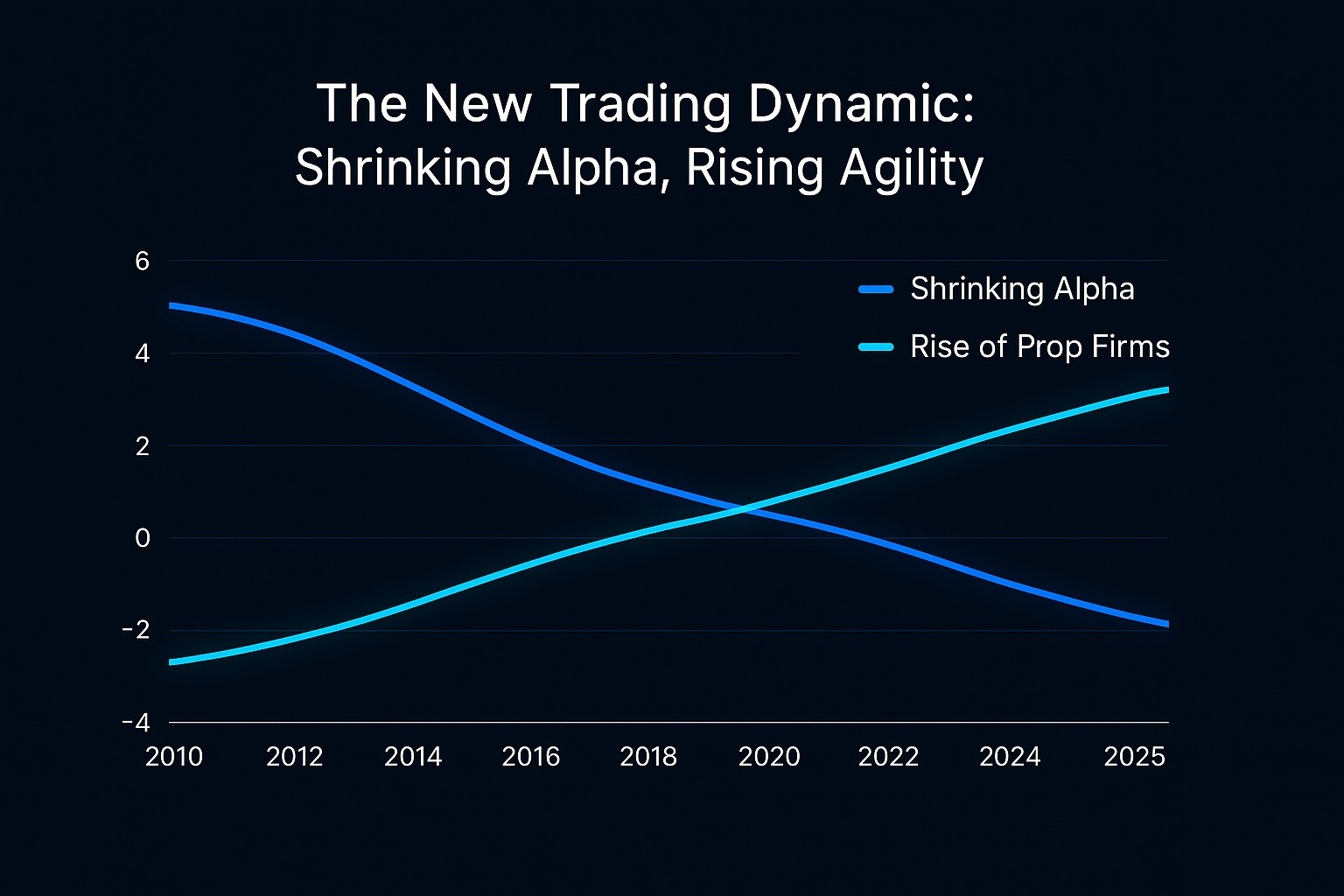

Just a decade ago, meaningful access to capital was reserved for hedge fund hires or bank trainees. Retail traders had the tools—but not the backing, nor the structure.

From 2010 to 2025, that changed. As markets became more efficient and institutional alpha narrowed, the rise of prop firms gave disciplined retail traders a real seat at the table. What began as a niche model has grown into a global ecosystem—one where traders aren’t judged by account size, but by how well they operate within a risk-defined process.

Today, professional-grade discipline is no longer limited to institutions. It’s accessible to anyone willing to adopt the same mindset.

Retail Prop Traders: Building Discipline Like a Pro

The era of intuition-first retail trading is giving way to a more systematic approach. Markets are faster. Information moves quicker. And capital is more conditional. In this environment, structure isn’t a preference—it’s a requirement.

What once defined institutional trading—macro frameworks, exposure controls, systematic review—is now within reach. The gap between solo trader and fund trader isn’t capital. It’s consistency.

Prop firms have opened the door. But stepping through it still requires what always defined successful trading: commitment, discipline, and the willingness to evolve.